I'm basically talking to myself...but maybe there's one person who kind of follows what I'm discussing...

Read More »EIB and Goldman Sachs Issue First Euro-Denominated Digital Bond on a Private Blockchain

The European Investment Bank (EIB) — in collaboration with Goldman Sachs Bank Europe, Santander and Société Générale — launched Project Venus, their second euro-denominated digitally native bond issue and first using private blockchain technology. The €100 million, two-year bond was issued, recorded and settled using private blockchain-based technology, and represents the inaugural issuance on Goldman Sachs’ tokenisation platform – GS DAPTM. Banque de France and the...

Read More »The State of the German Blockchain Ecosystem

Despite a global venture capital (VC) pullback, shrinking valuations and public market turmoil, Germany’s blockchain VC funding market remained stable this year, with companies in the space securing a total of US$218 million across 20 deals year-to-date (YTD), just US$37 million short of 2021’s US$255 million, a new report by CV VC, a Swiss VC and private equity firm specialized in cryptocurrency and blockchain solutions, shows. The German Blockchain Report, released...

Read More »Economic Progress and Economic Decay: North versus South

They read like Civil War battlefields: Chattanooga, Tennessee; Tuscaloosa, Alabama; Greer, South Carolina; West Point, Georgia; Montgomery, Alabama; Tupelo, Mississippi; Smyrna, Tennessee. They are the towns and small cities in the Deep South where America now builds its cars and trucks. Take Greer, for example (population of thirty-five thousand as of 2020). Located in the foothills of the bucolic Blue Ridge Mountains in the northwest corner of South Carolina, it is...

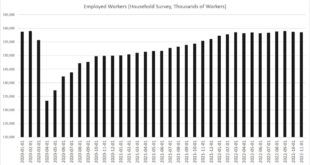

Read More »Total Employed Workers Fell Again in November as Savings and Incomes Fall

Total employed workers fell for the second month in a row in November, dropping nearly 400,000 workers below the pre-pandemic peak in February 2020. According to new employment data released by the Bureau of Labor Statistics on Friday, the current population survey shows employed workers fell to 158,470,000 in November, down 138,000 from October’s total of 158,608,000. This continues a nine-month trend in which the total number of employed persons has moved...

Read More »Payrolls like Jay Powell are boxed in by employment.

There's a battle going on with the labor market data, an unprecedented divergence in statistics. CES or the Establishment Survey suggests one thing about the economy while more and more evidence across the CPS aligns directly against it. The timing couldn't be more inconvenient, implications just massive given where we are. Will policymakers allow themselves to be imprisoned with the one, or have they given more consideration to the other already? Eurodollar University's Weekly Recap,...

Read More »Bern against federal plan to subsidise health insurance

A federal initiative aimed at subsidising health insurance premiums once they exceed 10% of disposable income met with resistance in Bern this week, reported RTS. Photo by Negative Space on Pexels.comThe idea, which was put forward by the Socialist Party, would require the federal government to foot two thirds of the bill for the subsidy with cantons left to find the remaining third. First the plan was rejected by the Federal Council on the grounds that some cantons...

Read More »Dollar Bears have the Upper Hand

Once again, the dollar was sold into a shallow bounce as the bears maintained the upper hand. There is a growing conviction that the peak in the Fed's tightening cycle is within view, despite more robust than expected jobs growth and an unexpectedly strong rise in average weekly earnings. After rallying through September, the US dollar's pullback was extended last week. Despite the oversold momentum indicators, dollar bounces have proved short and shallow. Falling...

Read More »Week Ahead: RBA and BOC Meetings Featured and China’s Inflation and Trade

The week ahead is more than an interlude before five G10 central banks meet on December 14-15. The data highlights include the US ISM services and producer prices, Chinese trade and inflation measures, Japanese wages, household consumption, and the current account. Also, the Reserve Bank of Australia and the Bank of Canada hold policy meetings. Central banks from India, Poland, Brazil, Peru, and Chile also meet.The dollar appreciated in Q1 and Q2 despite the economy...

Read More »The Fed Is Not “a Good Idea that Became Corrupt”: It Always Was Corrupt

There’s an idea rooted among some libertarians that the Federal Reserve was originally a sound institution but has grown corrupt. As a bankers’ bank, it was fine, they believe, but not as the monster it has grown to be. If we could only go back to the Fed’s founding charter, all would be well. I’m thinking of two well-known financial analysts who are unsurpassed in their analytical brilliance and knowledge of markets and who rightly regard the bureaucratic Federal...

Read More » SNB & CHF

SNB & CHF