CEO of Monetary Metals Keith Weiner gave a talk at the New Orleans Investment Conference on how to build and destroy a pension fund system in 22 easy steps. If you’d like to see an excellent case study of these steps in action, see the United Kingdom. This is a summary of Keith’s talk published with his permission. Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town (the falling interest rate). Then when it swings to the other side of the street, it destroys the other side of town (the rising interest rate), without repairing any of the infrastructure it previously destroyed. With that as background, let’s go through How to Build and Destroy a Pension Fund System in 22 Easy Steps: Step 1: Divine the

Topics:

Monetary Metals considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, blog, Featured, Interest rates, newsletter, rate hikes

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

CEO of Monetary Metals Keith Weiner gave a talk at the New Orleans Investment Conference on how to build and destroy a pension fund system in 22 easy steps. If you’d like to see an excellent case study of these steps in action, see the United Kingdom. This is a summary of Keith’s talk published with his permission.

Our interest rate system is like a wrecking ball. It swings to one side of the street and destroys one side of town (the falling interest rate). Then when it swings to the other side of the street, it destroys the other side of town (the rising interest rate), without repairing any of the infrastructure it previously destroyed.

With that as background, let’s go through How to Build and Destroy a Pension Fund System in 22 Easy Steps:

Step 1: Divine the Future Rate of ReturnAs a pension fund you must guess what the rate of return will be 20, 30, 40 and even 50 years from now. Super easy to do, no real issues here (tongue planted firmly in cheek). Step 2: Calculate the Amount of Capital to Deduct from PaychecksOnce you have your rate of return, you calculate how much to deduct from everybody’s paycheck in order to fund the pension. Given you already know the future rate of return on capital, this part is pretty easy too. Step 3: Make Promises to your PensionersDon’t forget this step! You have to promise the pensioners something for what you’re taking out of their paycheck every period. This is where you do that. Make sure everyone knows that they are guaranteed to get a certain amount once they retire. Since you can be absolutely sure of Steps 1 and 2, this part is rock solid. What about the volatile interest rate you say? Oh well that may pose a bit of a challenge, but nothing you can’t overcome! Let’s carry on. |

|

Step 4: Account for Interest Rates FallingYou are running into your first major issue. That challenge you mentioned in Step 3 is rearing its ugly head. Interest rates have been in steady decline for the past 40 years, with minor upward hiccups along the way, like the one we are in currently. Obviously if interest rates were stable this would not be an issue. But falling interest rates are a necessity in today’s centrally planned banked world and a falling interest rate means your return on capital is also falling. Step 5: Realize a Worse Rate of ReturnWith falling rates, the return on capital falls. So, all that capital you worked so hard to acquire is not enough. You calculated your rate of return based on a certain interest rate which is now a thing of the past. |

|

Step: 6 Realize you have a Capital ShortfallBecause your realized rate of return on capital is less than what you planned for to be able to pay your pensioners, you have a capital shortfall. And this isn’t a shortfall that is going away any time soon. You need to fix that gaping hole in your portfolio, and you need to fix it now. Remember, you have a promise to pay the pensioners who funded your system. Step 7: Start Your SearchSince it looks like that capital shortfall is here to stay, it is time to start hunting for capital anywhere you can find it. And that means you may have to go to great lengths to keep your portfolio looking solid and continue sending those pension checks in their promised amounts, on time. You essentially have two options, try to find more capital (because the rate of return on capital is lower) or try to find a higher return for your existing capital (which typically involves more risk). Let the search for capital begin. |

|

Step 8: Beg Pension Fund SponsorYou might start by asking the pension fund sponsor to help with your capital shortfall. “Can we please have more money?” is a great line, feel free to use it. In general, begging for more money does wonders for currying favor and helping people love and respect you. Step 9: Make it PoliticalDon’t forget the political cards in your hand! Sometimes this isn’t an option, but when it is, you should absolutely make it political. It’s an incontrovertible fact that the other political party got you into this mess, and with just a little more money from the correct political party, you should be able to get out of it, and drive a lot of votes too. |

|

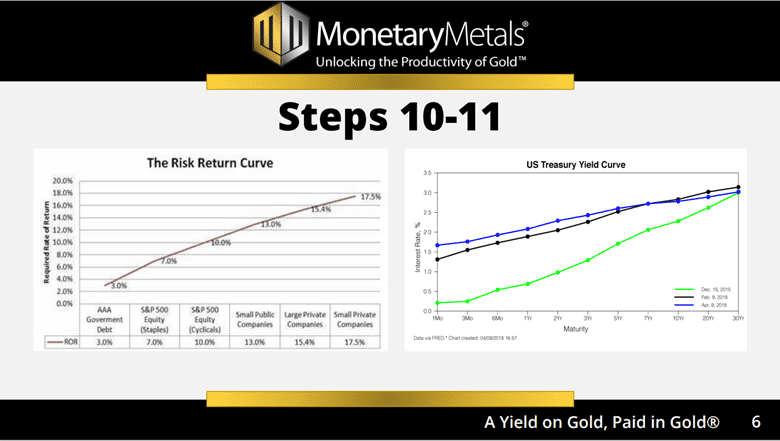

Step 10: Take a Walk on the Risky SideIf you weren’t able to get your capital in Steps 8 and 9, then you’re ready for Step 10. Thankfully, there’s always a way to get higher returns. It’s just that it comes with higher risks, but hey, who’s really checking? Besides, everybody’s doing it, which means it can’t be that risky. Step 11: Try the Far Side of the Yield CurveAs a pension fund you may already own Treasuries as a part of your portfolio. But do you own the type of Treasuries that offer the right yields to make up that capital deficit you have? Allow me to introduce you to the long end of the curve. The short end offers smaller returns, but the longer end offers higher rates. (Please keep in mind that with an inverted yield curve this could not be true.) |

|

Step 12: Not Enough?Still not enough? Ooops… central banks do not make being a pension fund easy! |

|

Step 13: LeverageHave no fear, leverage is here! Just borrow to increase the amount of assets you have. This has never gone wrong ever and is usually sound investing advice for pension funds to follow when they’re in a pinch. Archimedes would be proud. |

|

Step 14: Still Not EnoughYou’ve tried everything. And then you tried things you didn’t even know you could try! Maybe it’s finally time to go for something even more taboo? |

|

Step 15: The Forbidden FruitWhen all else fails, try the forbidden fruit—equities. Your pension fund is a fixed income fund, by definition, and perhaps even by mandate. But why not mix it up a little and buy equities instead? Most people would tell you not to do this, but most people haven’t seen the horrendous shape your portfolio is in. Step 16: Still Not Enough, AgainReally?!?! Where else can you go?! Step 17: Duration MismatchWell, here’s a little trick from our banking friends, borrow short, and lend long. That’s right, use short term funding, which is typically the cheapest, to buy longer term higher yielding assets. If it seems too good to be true, let’s just say looks can be deceiving and banks have been doing it for decades and they’re still standing, right? |

|

Step 18: Some of You are Here NowBLAM!!! Kablooey! Splat!!! Ouch, that hurts. This was the state of UK pension funds were in when they had their recent crisis. |

|

Step 19: Rising Interest RatesRising rates? What happened to that falling interest rate environment we’ve been following for the past 40 years? Well, this is one of those unfortunate little hiccups in the upward direction. And since you’re borrowing short to lend long, using leverage, and investing up into the risk/return curve, higher rates mean that…. Step 20: Funding Costs SkyrocketYour funding costs are going through the roof. That’s right. The cost to fund your…er…fund…is increasing at an exponential rate. This is the last thing you need. You’re already not sleeping at this point. It can’t get any worse, right? Step 21: Falling Asset PricesWrong. As your funding costs are increasing at an exponential rate, the value of your assets is plummeting. Now you must sell those assets to deleverage. Selling assets as prices are falling, to try and survive. This is the definition of a crisis. At this point, there’s only one step left to try… |

|

Step 22: Ask for a BailoutCry Uncle. Tap out. Throw in the towel. Give up. This whole pension fund business was too much for any sane individual to undertake when you are forced to face the machinations of central banks and their volatile interest rate system. It’s time to ask your local central banker for a bailout. Or QE. Or something. Anything to just stop the pain. |

Step 23: Is there a Solution?

I know we said it was 22 Easy Steps not 23. But how is one to get out of this mess they’ve made?

Everyone, not just pension funds, needs a stable rate of interest. But in an irredeemable currency system, run by unaccountable central banks, this is impossible.

But there is one interest rate that is stable…

Gold.

The interest rate in gold is stable and offers attractive yields to both investors and institutions alike.

A Yield on Gold, Paid in Gold® would have been a much better option for UK pension funds and UK investors looking to make sound investments that would help them plan for their financial future.

Monetary Metals is building the alternative system, denominated in gold, and paid in gold. Check us out and let us know what you think.

The Case for Gold Yield in Investment Portfolios

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

Tags: Blog,Featured,Interest rates,newsletter,rate hikes