Overview: Yesterday's greenback gains have been mostly reversed today. New efforts by China in its property market and anticipation of more stimulus helped rekindle the animal spirits today. Asia and Europe shrugged off yesterday's losses on Wall Street and the rally in bonds continued. The 8-12 bp decline in European benchmark 10-year yields comes even though the final composite PMI was better than expected fanning hopes of a short and shallow economic downturn....

Read More »Over 50,000 new Swiss companies were founded in 2022

Keystone / Ennio Leanza A total of 50,015 companies set up in Switzerland last year thanks to a late surge in the last quarter. The number of new firms entering the marketplace has remained stable. The total corresponds to a drop of 1% compared to 2021 and an increase of 7% compared to 2020, according to data from commercial registers compiled by Help.ch published on Tuesday. The performance in 2022 is 27% higher than ten years ago, when 39,371 companies were...

Read More »Ferdinando Galiani, an Italian Precursor to the Austrians

[From the Austrian Economics Newsletter, Spring 1987] The Austrian School of economics did not develop out of thin air. It built upon the work of a number of other economists and philosophers going back as far as Aristotle. Among the precursors of the Austrian School were a number of Spanish and Italian scholastic economists. Several early Italian economists influenced the development of continental European economic thought in the centuries before Carl Menger. Gian...

Read More »WARNING: Heading Towards A Monetary Breakdown – Jeffrey Snider #crypto #finance #ftx

WARNING: Heading Towards A Monetary Breakdown - Jeffrey Snider #crypto #finance #ftx Educate my audience about free market economics and the principles and benefits of individual liberty, limited government and sound money. These are America's founding principles, guaranteed by the U.S. Thanks For Watching Our Video ? Please, like, comment, subscribe, and ring the bell! EVERYTHING helps us grow!. Subscribe Here: ? Jeffrey Snider - The Dramatic Change In Consumer Behavior Sinks GDP...

Read More »Great News! Consumer Sentiment Is Awful!

I don’t know how many times I’ve seen blog posts or articles or Tweets about negative consumer sentiment over the last year. These articles rightly point out that the University of Michigan consumer sentiment survey is sitting near (or at a few months ago) 50 year lows. This fact is taken as a negative for the economy and therefore stocks. The only problem is that sentiment today tells you only how people view things today – and investing is about the future. If...

Read More »And with it, global inversions roar back.

Was the lessened pessimism of the second half of December an illusion? For the first full trading day of 2023, it sure seemed like it. Pummeled by China's awful numbers, LT bonds worldwide were bid. Then came another major CPI down big, and so, too, were rates. Inversions are back big. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com https://www.PortfolioShield.net...

Read More »Money-Supply Growth Turns Negative for First Time in 33 Years

Money supply growth fell again in November, and this time it turned negative for the first time in 33 years. November’s drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. During the thirteen months between April 2020 and April 2021, money supply growth in the United States often climbed above 35 percent year over year, well above even the “high” levels experienced from 2009 to 2013. Since then, the money...

Read More »The Dollar Jumps

Overview: Market participants have returned from the New Year celebrations apparently with robust risk appetites. Equities and bonds are rallying, and the dollar has surged higher. The markets seem to be looking past the surge in China’s Covid cases and anticipates a recovery, helping Chinese equities lead Asia Pacific bourses higher, where Japanese markets are still on holiday. Europe’s Stoxx 600 is 1.6% higher in late morning turnover. US equity futures are also...

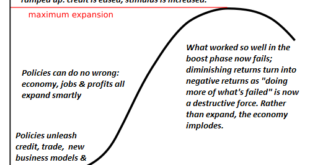

Read More »Misunderstanding War, Money and Prosperity

If the consensus of experts misunderstand money, credit and prosperity, how are we going to advance? Describing all the ways experts got it wrong is a thriving cottage industry. Expertise is itself contentious, as conventional expertise legitimized by credentials, prestigious institutional positions, scholarship, prizes, etc. can be wielded to promote the interests of the expert or whomever is funding the expert. Another segment of experts are self-proclaimed,...

Read More »“Markets and civil society are win-win institutions, government and politics are zero-sum.”

Interview with Jeff Deist, President Mises Institute, Auburn, USA Division, friction and polarization have been on the rise in the West for at least a decade, but the escalation we saw during the “covid years” was especially worrying. Over the last year, this “worry” has become a truly pressing concern, even a real emergency one might argue, as inflationary pressures and an actual war were added to the mix of political and social tensions. Going into 2023, there are...

Read More » SNB & CHF

SNB & CHF