Today we ask, what is wealth? As we start a new year many will be looking at their portfolios and wondering what 2023 will have in store for them. Similar to 2022, we suspect there will be a lot of unknowns. As with anything unforeseen, it’s a good idea to have some insurance. This is why there were record levels of gold buying last year, and we expect the same in the coming months; because people want to protect their wealth with the insurance that gold offers....

Read More »Swiss examine Covid test obligation for travellers from China

Travellers at Geneva airport in December © Keystone / Jean-christophe Bott While countries around the world impose curbs on travellers from China as Covid-19 cases there surge, the Swiss authorities are still weighing up possible measures. On Wednesday health experts from the 27 EU member states couldn’t agree on compulsory testing for travellers from China, but they strongly recommended it. The EU health experts also recommended, among other things, that medical...

Read More »Rome’s Runaway Inflation: Currency Devaluation in the Fourth and Fifth Centuries

By the beginning of the fourth century, the Roman Empire had become a completely different economic reality from what it had been at the beginning of the first century. The denarius argenteus, the empire’s monetary unit during the first two centuries, had virtually disappeared since the middle of the third century, having been replaced by the argenteus antoninianus and the argenteus aurelianianus, numerals of greater theoretical value, but of less and less real...

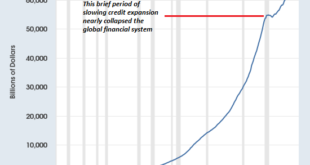

Read More »Collateral. Collateral. Collateral. Confirmed…by the Fed.

After some initial though needed background, we'll dive into what you need to know about the world's real monetary engine. No, not the Fed though the Fed once played a role in the beginning. Instead, various parts of repo tell us what's important, including triparty repo. What that is and why data from it shows collateral really is messed up, that's what we'll discuss today. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP...

Read More »2023: You Wanted Endless Stimulus, You Got Stagflation.

After more than $20 trillion in stimulus plans since 2020, the economy is going into stagnation with elevated inflation. Global governments announced more than $12 trillion in stimulus measures in 2020 alone, and central banks bloated their balance sheet by $8 trillion. The result was disappointing and with long-lasting negative effects. Weak recovery, record debt, and elevated inflation. Of course, governments all over the world blamed the Ukraine invasion on the...

Read More »The Market Appears to Shrug Off the Fed’s Warning

Overview: The US dollar is consolidating in a mixed fashion today. The FOMC minutes drew much attention but failed, at least initially, to spur a significant shift in expectations. The pricing in the Fed funds futures strip is still consistent with a cut later this year, which the minutes were clear, no officials anticipate. Today's US ADP jobs estimate, and November trade balance are being overshadowed by tomorrow's nonfarm payroll figures. The Fed's Harker,...

Read More »It’s a New Era

This dynamic–making problems much worse by forcing more of whatever worked in the previous era into a saturated, increasing unstable new era–receives little attention or understanding. Eras may last decades, and only those who’ve lived long enough to recall previous eras have experienced the transition from one era to the next. The era of financialization, globalization and low-cost, abundant oil/natural gas began over 40 years ago in 1981. The era of digital /...

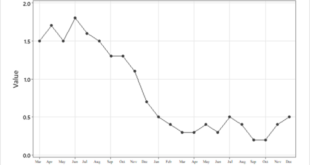

Read More »This is another big one. Repeated mistakes have already ended the Fed hawks.

The Federal Reserve continues to its hawkish display - just like it had in 2018. And just like back then, all the evidence keeps piling up that they're completely wrong. Another big one today to go with several crucial pieces over the last several days show why markets aren't even paying attention to these dead-hawks-flying. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com...

Read More »Switzerland’s Premier Crypto Conference Returns With a Two-Day Format in Zurich & Davos

Wrapped around the Annual Meeting of the World Economic Forum (WEF), the CryptoSummit.ch will kick off on Monday, 16th January 2023 at the Hyatt Circle Conference Centre at Zurich airport. The second day of the event is set to take place on Friday, 20th January 2023 in Davos. The theme of CryptoSummit.ch 2023 The theme of the CryptoSummit.ch 2023 is regaining trust in crypto and advancing technology. It is set to open with the keynote from Charles Hoskinson, the...

Read More »Central Bankers Are Poor Archers: The Problems and Failures of Inflation Targeting and Price Stability

The famous quote, “Insanity is doing the same thing over and over again and expecting different results,” is usually attributed to Albert Einstein. While intended as a parable for quantum insanity, such a quote could equally be a parable for inflation policy. With the Bank of England and the Federal Reserve seeking to maintain target rates of 2 percent, the UK inflation rate has only fallen to 10.7 percent from 11.1 percent. Considering inflation is still...

Read More » SNB & CHF

SNB & CHF