Introduction The success of a business organization depends, to quite an extent, on the planning of resources. This planning keeps the business way above others. Budgeting, therefore, becomes a critical aspect of accounting. However, please keep in mind that financial planning in business is steeped in challenges because of the economic turmoil. Do you run your own small business? If yes, then you count yourself among the 99% of small and medium businesses run in...

Read More »Swiss central bank posts record CHF132 billion loss for 2022

The Swiss National Bank (SNB) has posted an annual loss of CHF132 billion ($143 billion) for 2022, the biggest in its 115-year history. “The loss on foreign currency positions amounted to around CHF131 billion and the loss on Swiss franc positions was around CHF1 billion. A valuation gain of CHF400 million was recorded on gold holdings,” the SNB said in a statement on Monday. The 2022 loss means the SNB will not make its usual payout to the Swiss federal and cantonal...

Read More »Data centres account for 4 percent of Swiss electricity usage

Data centres are expanding rapidly in Switzerland, with such facilities already accounting for 4% of national energy – more than the farming sector. The SonntagsZeitung reports that Switzerland is now home to 86 data centres, and only Netherlands has a higher rate per capita in Europe. The paper cites a 2021 study by the Lucerne University of Applied Sciences and Arts estimating that the energy usage of Swiss data centres will double in the next five years,...

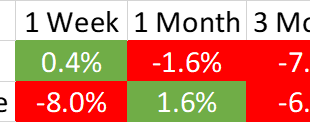

Read More »Weekly Market Pulse: The Consensus Will Be Wrong

What’s your outlook for this year? I’ve heard that question repeatedly over the last month and if you’re reading this hoping I’ll let you have a peak at my crystal ball, you’re going to be disappointed. Because I don’t have a crystal ball and neither, I hasten to add, does anyone else in this business. So, no, I don’t know what’s going to happen this year. I do know what the consensus view is, what the majority expects to happen, and that may be more useful. Because...

Read More »What the trigger for equities will be. It’s not really about the Fed.

The 'soft landing' is on the table at NYSE. December payroll data kept the hope alive. But is it really? Growing weight of evidence - not to mention totally different interpretation of same across many other markets - strongly implies it isn't. We discuss how or maybe when share prices realize the difference. Eurodollar University's Money & Macro Analysis Twitter: https://twitter.com/JeffSnider_AIP https://www.eurodollar.university https://www.marketsinsiderpro.com...

Read More »Falling US Yields Stymie the Dollar’s Recovery

We have been torn between our conviction that the dollar’s cyclical rally ended last September-October, and the near-term momentum indicators that warned that the dollar’s pullback was overdone. Aside from the Japanese yen, a consolidative phase dominated December, but the momentum indicators still seemed to suggest upside potential dollar. A proper correction appeared to have begun in the days leading up to the US jobs report. While we correctly anticipated a “buy...

Read More »Davos apartment rental prices spike ahead of WEF

Visitors travelling to the mountain town of Davos for this month’s World Economic Forum (WEF) could face pricey rates, according to Swiss media. The Schweiz am Wochenende newspaper writes on Saturday that a three-bed studio in the canton Graubünden town costs CHF2,600 ($2,800) per night during the WEF, runs from January 16-20. With service charges and cleaning, this comes to CHF15,000 for the five nights of the event, the paper writes. In February, the same...

Read More »The Offshore Global Dollar System | Jeff Snider

For access to econ community, consider https://www.patreon.com/moneymacro or consider buying me a 'coffee' at https://ko-fi.com/moneymacro LIKE CHATTING ECON WITH ME? △ Follow me on Twitter: https://twitter.com/joerischasfoort △ Follow me on LinkedIn: https://www.linkedin.com/in/joeri-schasfoort/ △ I have a private Discord server for Senior and Chief economist Patrons / members. Otherwise I sometimes hang out in two Discord servers: △ Unlearning Economics's server:...

Read More »US CPI Featured and Why the Fed may Still Hike by 50 bp

The most important economic report in the week ahead is the US December Consumer Price Index on January 12. To be sure, the Federal Reserve targets an alternative measure, the deflator of personal consumption expenditures. However, in this cycle, when households, businesses, investors, and policymakers are particularly sensitive to inflation, CPI, which is reported a couple of weeks before the PCE deflator, has stolen the thunder. In explaining the surprise...

Read More »Uber side-stepped Swiss rules, says whistleblower

A former top lobbyist for Uber says the firm wilfully ignored regulations when it began operating in Switzerland in 2013. Uber says it has since updated its working model. By choosing to act first and apologise later in implementing its gig-economy model, Uber “massively undermined” democracy in many countries, including Switzerland, former lobbyist Mark MacGann told Tamedia newspapers on Saturday. MacGann was Uber’s chief lobbyist in Europe between 2014 and 2016...

Read More » SNB & CHF

SNB & CHF