A company led by Swiss engineer Pascal Jaussi is building a space shuttle by combining technologies from all over the world. (SRF/swissinfo.ch) Jaussi, an engineer and Swiss Air Force military pilot, founded the company Swiss Space Systems in 2013 in Payerne, canton Vaud. Through the firm, he is pursuing his childhood dream of becoming an astronaut. The company’s goal is to make space accessible by developing, manufacturing and operating suborbital spaceplanes. The SOAR (Sub-Orbital...

Read More »MARO ANALYTICS – 12 04 15 THE PARTICIPATION RATE MYSTERY – SOLVED! -w/ Charles Hugh Smith

Charles Hugh Smith and Gordon T Long discuss the puzzle of the falling US Civilian Labor Participation Rate in which all the pundits express concern but few agree on what the root cause is. RELENTLESS TECHNOLOGY ADVANCEMENT - Gaining The Right Perspective Together they show that it is instructive to start with the larger picture going back to 1970 when massive historic computer technology advancements truly began to be adopted. Schumpeter's Creative Destruction was in full swing and...

Read More »Emerging Market Preview: Week Ahead

(from my colleague Dr. Win Thin) EM starts the week off in the familiar position of coming under pressure. The strong US jobs report has all but cemented a Fed lift-off this month, helping the dollar to claw back some of its post-ECB losses. Meanwhile, commodities continue to sink under the prospects of increased supply. Brent oil in particular is making new cycle lows after last week’s OPEC meeting saw the quota system basically scrapped. These factors all continue to conspire...

Read More »Why China’s Reserves Fell $87.2 bln in November

Economists expected China's reserves to fall by around $33 bln in November. Instead, they fell by a little more than $87 bln. This is the third largest decline it has recorded, and a little below the $94 bln drop reported in |August. China's reserves peaked in June 2014 near $3.993 trillion. At the end of November, they were just above $3.438 trillion, which is essentially where they stood in October 2014. What happened in November? There are two main considerations. The first is...

Read More »Dollar Continues to Recover

The exaggerated response to last week's ECB meeting continues to unwind. Draghi's dovish comments and the strength of US employment data have helped keep the divergence meme front and center. The euro traded quietly in Asia before breaking down to almost $1.0800 in the European morning. There seemed to be only two news developments that had a bearing. First, the results of the first round of the French elections saw the National Front capitalize on the refugee and terrorism to lead...

Read More »Silver Rocket Report 6 Dec, 2015

The prices of the metals moved mostly sideways this week. That is, until Friday. Then foom! (Foom is the sound of a rocket taking off.) From 6 to 10am (Arizona time, i.e. 8 to 12 NY time) the price of gold rose from $1,061 to $1,087. Not surprisingly, the silver price rose a greater percentage, from $14.14 to $14.59. The catalyst seems to be the Bureau of Labor Statics jobs report. There were a few more jobs created than expected, which means the economy is doing well and/or the Fed is...

Read More »After Gorging On News, Time To Digest

Last week lived up to the hype. It was indeed a momentous week. China joined the SDR, with a weight that puts it in third place behind the dollar and euro. The ECB did ease policy. It delivered a 10 bp cut in the deposit rate (now -30 bp), extended its asset purchase program for six months (to March 2017), broadened the range of assets that can be bought to include regional bonds, and declared intentions to reinvest maturing proceeds. The US employment data removed what was perceived as...

Read More »Observations from the Speculative Positioning in the Futures Market

1. Given the large moves in prices shortly after the CFTC reporting period ended on 1 December renders the latest Commitment of Traders report more dated than is usually the case. 2. The Thanksgiving holiday that closed US markets reduced participation in the currency futures. Of the 16 gross positions of the eight currency futures we track, none had a significant adjustment (more than 10k contracts). The 9.8k contract increase of speculative gross shorts euro futures (to 261.6k) was...

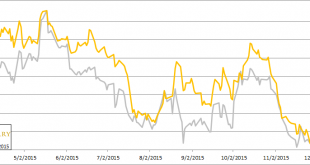

Read More »Once Unleashed, Corrective Forces Dominate

The market's disappointment with the ECB unleashed pent-up corrective forces in the foreign exchange market. This leg up in the dollar began in mid-October. Through the day before the ECB, the euro was the weakest of the major currencies, losing 7.5% against the dollar. The yen and sterling shed a little less than half as much. The Australian dollar was the only one of the majors to have gained against the dollar. And even then, its 0.12% appreciation had only been achieved here in...

Read More »Escaping prison through reading

For prisoners books have a therapeutic effect and lets them forget everything around them for a while. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel: http://www.youtube.com/swissinfovideos...

Read More » SNB & CHF

SNB & CHF