(Here is a draft of a monthly column I write for a Chinese paper) It is official. The Chinese yuan will be in the SDR. At a 10.4% share, it is a bit more than I expected, but less than the 14%-16% share that the IMF staff has intimated a few months ago. This is a significant event, even if there is no short-term market opportunity. The yuan’s exchange rate against the dollar has steadily declined over the month of November contrary to conspiracy theories that warned Chinese...

Read More »China, the SDR, and Toward a Less Euro-Centric World

(Here is a draft of a monthly column I write for a Chinese paper) It is official. The Chinese yuan will be in the SDR. At a 10.4% share, it is a bit more than I expected, but less than the 14%-16% share that the IMF staff has intimated a few months ago. This is a significant event, even if there is no short-term market opportunity. The yuan’s exchange rate against the dollar has steadily declined over the month of November contrary to conspiracy theories that warned Chinese...

Read More »Dollar Trades Heavier, Key Events Awaited

The US dollar is trading with a heavier bias today amid some last minute position squaring ahead of the key events of the week, which are stacked in the second half. The ECB meeting and US jobs data are the two most important events in a jam packed week for most participants. The recent pattern has been for new lows in the euro to be greeted with a bit of profit-taking. This pattern is holding. New lows were made yesterday just below $1.0560, and short-covering lifted it to nearly...

Read More »Searching for places to store nuclear waste

Nuclear waste experts are looking for possible sites for deep geological repositories for atomic waste and are using vibrator vehicles that generate weak seismic waves. (SRF/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »A Free Market in Interest Rates

Unless you’re living under a rock, you know that we have an administered interest rate. This means that the bureaucrats at the Federal Reserve decide what’s good for the little people. Then they impose it on us. In trying to return to freedom, many people wonder why couldn’t we let the market set the interest rate. After all, we don’t have a Corn Control Agency or a Lumber Board (pun intended). So why do we have a Federal Open Market Committee? It’s a very good question. Someone asked it...

Read More »Cool Video: CNBC Discussion about China and the SDR

I had the privilege of being on CNBC to discuss the significance of China being included in the IMF's Special Drawing Right. Here is the link to the discussion. The decision was announced shortly after the interview on CNBC. It was largely a foregone conclusion that China would join. Besides the confirmation, the new news was in the weighting. China's yuan got an almost 11% share of the new SDR that will be launched 1 October 2016. The room for the yuan comes comes mostly at the...

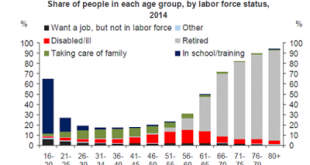

Read More »Great Graphic: Decline of US Participation Rate Explained

The decline in the labor force participation rate helps explain the substantial decline in the US unemployment rate over the past couple of years. That decline has helped bring the Federal Reserve to the point that a December rate hike is thought to be extremely likely barring a significant disappointment at the end of the week with the November jobs report. This Great Graphic was posted on Ritholtz's Big Picture Blog and was compiled by Deutsche Bank's Torsten Slok from BLS data. ...

Read More »Emerging Markets: Preview of the Week Ahead

(from my colleagues Dr. Win Thin and Ilan Solot) This is set to be one of the most important weeks of the year. EM is likely to take a backseat between the ECB monetary policy decision, the OPEC meeting and the US jobs report. That said, there are several potential sources of idiosyncratic risk to key an eye on. There could be more headline risks from the Russia-Turkey situation. Some think that the leader of Brazilian lower house may bring forward the impeachment process this week,...

Read More »Dollar Edges Higher Ahead of Month-End and Key Events

The US dollar remains firm against most of the major currencies to start what promises to be a critical week for investors. There are two main considerations. The first is the last minute position adjustments ahead the key events that begin with the IMF's SDR decision later today, running through the start-of the month data (especially PMIs), central bank meetings in Australia, Canada, and then the big one, the ECB. The US monthly jobs report and the OPEC meeting cap the weeks. The...

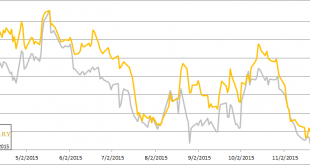

Read More »Light Thanksgiving Week Report 29 Nov, 2015

In this holiday-shortened week (Thanksgiving), the price of gold dropped $20 and silver 10 cents. Friday, when the price dropped the most, could not have had much liquidity as most Americans were out of work shopping or partying. Whatever they may have been buying, it sure wasn’t gold. We might be inclined to take the basis data this week with a grain of salt. Here’s the graph of the metals’ prices. The Prices of Gold and Silver We are interested in the changing equilibrium created when...

Read More » SNB & CHF

SNB & CHF