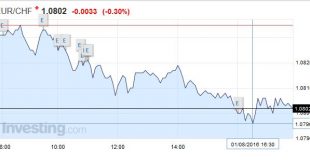

Swiss Franc Click to enlarge. FX Rates The US dollar is trading with a small upside bias in narrow trading ranges. The main news has consisted of PMI reports, while investors continue to digest last week’s developments. In particular the BOJ’s underwhelming response to poor economic data and a missed opportunity to reinforce the fiscal stimulus, and the dismal US GDP. The dollar has been pinned today in the lower...

Read More »Great Graphic: Real Broad Trade-Weighted Dollar

Summary: The real broad trade-weighted dollar index rose in July for the third month. It peaked in January above trendline drawn through the Reagan and Clinton dollar rallies. Expect the trendline to be violated again before the end of the year. This Great Graphic, created on Bloomberg, depicts the Federal Reserve’s real broad trade-weighted index of the dollar. Real means that it is adjusted for inflation...

Read More »No Big Thoughts, but Several Smaller Observations

Summary: Notable that as the CRB Index moves lower, MSCI emerging market equities have done well. European banks are retreating after the stress test results. Tokyo elected its first women governor as this seem to be in part a sign of protest against Abe. August has begun off with clear price action. The US dollar is stronger against nearly all the major currencies. Bond yields are higher. Equities and...

Read More »The Helicopter Mortgage

Medical vs. Financial Engineering I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later. What would have happened if I had suffered the same accident in 1975? The...

Read More »Switzerland has world’s priciest Big Macs. So eat Swiss chocolate instead.

The Economist invented the Big Mac index in 1986 as a tongue-in-cheek guide to currency valuations. Because the well-known burger is the same throughout much of the world, the magazine thought it could be used as a measure of how over or undervalued a currency was. An overpriced burger suggests an overvalued currency and a cheap one an undervalued currency. As it did last year, Switzerland topped the chart this year...

Read More »The Dollar Is Going to 1/10,000 Ounce – One Day

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. An image from the future: the US dollar, which one of these days is going to sink. Alas, there is many a slip ‘twixt the cup and the lip… Image via pinterest.com The Long Term vs. Trading Ideas The price of gold was up about thirty bucks this week. The price of silver was up almost seventy cents. Last week, a reader...

Read More »Visions of Tomorrow from the Permanently High Plateau

Mad as a Hatter Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to. They may not die of old age… but they do occasionally die. Photo credit: Brett Cole...

Read More »KOF Economic Barometer: Prospects for the Swiss Economy Remain Favourable

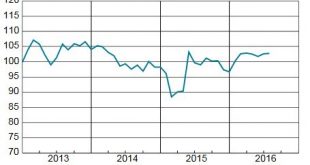

The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the outcome of the vote in the United Kingdom and...

Read More »Greenspan explains negative Swiss Yields

Jeff Gundlach is not the only person who is feeling “maximum negative” on Treasuries. In an interview, none other than the “Maestro” Alan Greenspan, the man whose “great moderation” policy made the current global bond bubble possible, said that he is worried bond prices have risen too high. Asked if he finds what is happened in the bond market right now “in any way, shape, or form concerning for financial...

Read More »Emerging Markets: Preview of the Week Ahead

EM ended last week on a firm note, helped by the weaker than expected US Q2 GDP report as well as the small bounce in oil. With the RBA and BOE expected to ease this week, the global liquidity backdrop remains favorable for EM and “risk.” US jobs report Friday will be very important for EM going forward. We get our first glimpse of the Chinese economy for July with the PMI readings this week. EM CPI data this...

Read More » SNB & CHF

SNB & CHF