UBS Group AG beat analysts’ second-quarter profit estimates and said it’s on track to cut costs by 2.1 billion Swiss francs ($2.2 billion) through 2017, with Chief Executive Officer Sergio Ermotti struggling with a slump at the wealth management and securities-trading units. © Denis Linine | Dreamstime.com Net income slipped to 1.03 billion francs from 1.2 billion francs a year ago, the Zurich-based bank said in a...

Read More »FX Daily, July 29: Kuroda Hesitates, Yen Advances, Focus Turns to Europe and North America

Prospects for the Swiss Economy Remain Favourable The KOF Economic Barometer has only changed little and reached a value of 102.7 in July. In June, and therefore before the referendum in the United Kingdom about its membership in the EU, the KOF Economic Barometer stood at a value of 102.6 (revised from 102.4). Thus the Barometer has been standing above the historical average since February this year. Despite the...

Read More »Credit Suisse’s turnaround is working, but vulnerable

Just a month ago, Credit Suisse CEO Tidjane Thiam and Deutsche Bank CEO John Cryan risked, as one hedge fund manager put it, becoming the dead men walking of European banking as they struggled to shore up their firms’ profitability. © Simon Zenger | Dreamstime.com Thursday’s results from Credit Suisse suggest Thiam may escape that fate while Cryan’s effort to revamp the German lender stalls. After a first-quarter...

Read More »FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

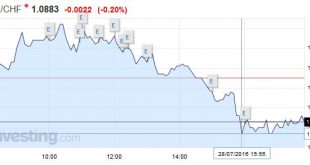

Swiss Franc The Swiss Franc is having a very volatile week. With the European stress tests approaching and with a bad U.S. durable goods release, the EUR/CHF is on the descent again. Data on net immigration to Switzerland has been published. The number of people who are leaving Switzerland is on the rise and the net immigration number has fallen. This is positive for the euro and negative for CHF. This decrease in...

Read More »Fasten Your Seat Belts: Tomorrow Promises to be Tumultuous

Summary: Japan reports on labor, consumption, inflation and industrial output before the BOJ meeting. ECB reports inflation and Q2 GDP and the results of the stress test on banks. US reports first look at Q2 GDP. Tomorrow could be among the most challenging sessions of the third quarter. The focus is primarily on Japan and Europe, but the US reports its first estimate of Q2 GDP. After a six-month soft...

Read More »Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today’s uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of “helicopter money” is about to be unveiled in Japan by the world’s most experimental central bank. However, as Nomura’s Richard Koo warns, central banks may get much more than they bargained for, because helicopter money “probably marks the end of the road for believers in the omnipotence of monetary policy who have...

Read More »Claudio Grass Interviews Ronald Stoeferle: Central Banks In A Lose-Lose Situation

A Fragile System Claudio Grass, Global Gold: Ronald, it is a pleasure to have the opportunity to speak with you. We’ve known each other for a very long time, both on a personal and professional level. Because of our central banks, we find our economies today operating on artificial stimulus and negative interest rates. How would you summarize the consequences of this policy? Mr. Stoeferle: I have always considered...

Read More »FOMC says What it Had To, No More or Less

[clear] [follow_author user=dorgang position=right text="Introduction by"] Summary: Fed upgraded its assessment of the economy. Added that the downside risks to the economy have diminished. Only George dissents. The Federal Reserve met market expectations fully. It upgraded its assessment of the economy, recognized...

Read More »FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

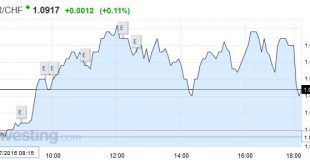

Swiss Franc The Euro kept on climbing, after yesterday’s rapid rise. Click to enlarge. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. Switzerland UBS Consumption Indicator Japan As uncertainty over Japan’s fiscal stimulus roiled the yen and domestic...

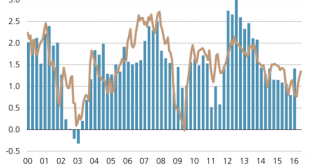

Read More »UBS Consumption Indicator: Summer tourism inspires confidence

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. In June, the UBS consumption indicator rose from 1.24 to 1.34 points. This was mainly due to a better performance in the tourism industry as well as a slight improvement in sentiment in the retail trade....

Read More » SNB & CHF

SNB & CHF