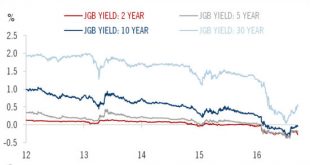

While possibly helping to alleviate margin pressure on banks, raising inflation expectations remains a difficult task The Bank of Japan (BoJ) today shifted its monetary stimulus framework towards yield-curve control and away from rigid targeting of asset purchases. In essence, the BoJ will purchase sufficient Japanese government bonds (JGBs) to ensure that 10-year JGB yields are capped at about zero. The BOJ also announced that it aims to overshoot its 2% inflation target, committing itself...

Read More »Core retail sales weak in August, but U.S. consumption still healthy

Macroview In spite of poor August retail report, we remain reasonably sanguine on US consumer spending growth over the near term. Today’s US retail sales report for August was surprisingly downbeat, with core retail sales recording their second monthly decline in a row. Core retail sales in the US fell by 0.1% month over month (m-o-m) in August, worse than consensus expectations. Moreover, June and July numbers were revised down by a cumulative 0.2%. The result was that between Q2 and...

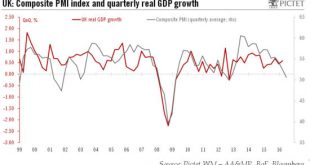

Read More »Bank of England on hold, sterling stable for now

While recent data has been encouraging, we still expect the UK economy to weaken in 2017. Short-term support for sterling may be undermined by Brexit talks and twin deficits. At its 15 September meeting, the Bank of England (BoE) left its main policy rate unchanged at 0.25% and maintained its Asset Purchase Facility (APF) target at GBP435 bn. The BoE’s assessment of economic conditions was broadly similar to its August projections despite some “slight upside” in the data. Nevertheless, the...

Read More »SNB sees weaker medium-term inflation

Macroview SNB likely to keep negative deposit rate until end of ECB’s asset buying programme, and focus on forex intervention to control upward pressure on franc. The Swiss National Bank (SNB) decided on September 15 to maintain its interest rate on sight deposits unchanged at -0.75%.In its quarterly monetary policy assessment, the SNB highlighted once again the Swiss franc’s overvaluation and reiterated its willingness to intervene on the foreign exchange market if needed.The central bank...

Read More »Improved Chinese data may be foretaste of GDP surprise

Growth momentum regained traction in August after a poor July. Although GDP figures for the third quarter may surprise on the upside, the longer-term trend still shows Chinese growth slowing. Major economic indicators for August point to broad-based stabilisation of China's growth momentum after a weak start to the second half. The more upbeat macro picture is supported by improvements in the PMI reading and import data, and leads us to believe the likelihood of an upside surprise for...

Read More »Private equity, an antidote to prospect of weak returns?

Published: 13th September 2016Download issue:The summer months were good for risk assets, though things may get bumpier in the months ahead. But alongside this study in chiaroscuro, the September issue of Perspectives offers a brighter picture of investment opportunities.Pictet chief strategist Christophe Donay admits that “prospects for portfolio returns look far weaker than they did in the past” as the extraordinary measures introduced by central banks to combat low growth and inflation...

Read More »Strong Swiss growth lessens chance SNB will act

Macroview Stronger-than-forecast growth means the central bank is unlikely to alter monetary policy this month Swiss real GDP growth data surprised on the upside in Q2, expanding by 0.6% q-o-q (and 2.5% q-o-q annualised). In addition, growth in the three previous quarters was revised significantly higher. As a result, our GDP growth forecast for growth in Switzerland rises mechanically from 0.9% to 1.5% for 2016.GDP breakdown by expenditure component was less upbeat than the headline number...

Read More »Signs of recovery in Chinese trade data

Improved export and import data, together with fiscal measures, mean that the Chinese economy remains on track to achieve 6.5% growth this year According to data released last week, China’s exports in August fell 2.8% year over year, which was better than Bloomberg consensus forecasts of a 4% drop and the 4.4% fall seen in July. Exports improved across the board, with exports strongest to developed economies. China’s headline export growth in year-over-year terms has been negative since...

Read More »Chinese capital outflow pressure is moderating

Macroview The pace of capital outflows from China has slowed significantly since the central bank intervened in the market earlier this year. Capital outflow pressures remain, but are likely to stabilise at a moderate level going forward.We estimate capital outflows of about USD41 bn in August, roughly the same as in the previous month. This is a much more moderate level of outflows than previously. We estimate that, in all, outflows amounted to USD1.3 tn between Q2 2014 and Q2 2016, with...

Read More »Fundamental undervaluation supports the Swedish krona

Improving growth and inflation prospects could help the krona against the euro going forward. The krona is also undervalued against the US dollar, based on fundamentals. At its 7 September meeting, Sweden’s Riksbank decided to keep the repo rate unchanged at -0.5% and to continue to purchase government bonds until the end of the year. The Riksbank acknowledged that the Swedish economy was relatively strong and that inflation was beginning to rise.However, the central bank made clear its...

Read More » Perspectives Pictet

Perspectives Pictet