MA course at the University of Bern. Time: Wed 10-12. KSL course site. Course assistant: Christian Wipf. The course introduces Master students to modern macroeconomic theory. Building on the analysis of the consumption-saving tradeoff and on concepts from general equilibrium theory, the course covers workhorse general equilibrium models of modern macroeconomics, including the representative agent framework, the overlapping generations model, and possibly the Lucas tree model. Lectures...

Read More »The Bank of England’s “Future of Finance Report”

Huw van Steenis’ summarizes his report as follows (my emphasis): A new economy is emerging driven by changes in technology, demographics and the environment. The UK is also undergoing several major transitions that finance has to respond to. What this means for finance Finance is likely to undergo intense change over the coming decade. The shift to digitally-enabled services and firms is already profound and appears to be accelerating. The shift from banks to market-based finance is...

Read More »FedNow and Fedwire

The Federal Reserve Banks will develop a round-the-clock real-time payment and settlement service, FedNow. The objective is to support faster payments in the United States. From the FAQs (my emphasis): … there are some faster payment services offered by banks and fintech companies in the United States, their functionality can be limited. In particular, due to the lack of a universal infrastructure to conduct faster payments, most of these services rely on “closed-loop” approaches, meaning...

Read More »Nordhaus on Climate Change

In his Nobel lecture (reprinted in the June issue of the American Economic Review), William Nordhaus concludes that we should focus on four goals: First, people around the world need to understand and accept … Those who understand the issue must speak up and debate contrarians who spread false and tendentious reasoning. … Second, nations must establish policies that raise the price of CO2 and other greenhouse-gas emissions. … Moreover, we need to ensure that actions are global and not...

Read More »Views on Libra

Different aspects of the Libra proposal that various authors have emphasized: Jameson Lopp on OneZero: A “database of programmable resources;” Move; “[p]erhaps the network as a whole can switch to proof of stake, but in order for the stablecoin peg/basket to be maintained, some set of entities must keep a bridge open to the traditional financial system. This will be a persistent point of centralized control via the Libra Association”; not a blockchain, the “data structure of the ledger...

Read More »Jordan Peterson’s “12 Rules for Life”

In 12 Rules for Life, Jordan Peterson argues for the kind of values instilled by a socially conservative parental home: Aim for paradise, but concentrate on today. Meaning is key, not happiness. Assume responsibility. Listen carefully, speak clearly, and tell the truth. And stand straight, even in the face of adversity. Here they are, Peterson’s 12 rules: Stand up straight with your shoulders back Treat yourself like you would someone you are responsible for helping Make friends with...

Read More »Where the Phillips Curve is Alive

In an NBER working paper, James Stock and Mark Watson argue that the correlation between cyclically sensitive inflation (CSI) and bandpass filtered activity measures is high and has not declined over the last decades, contrary to standard measures of the slope of the Phillips curve. … we construct a new price index designed to maximize the cyclical variation in the price index. This index, which we call Cyclically Sensitive Inflation (CSI), estimates the weights on the component prices...

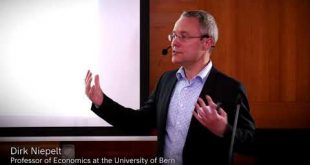

Read More »Dirk Niepelt: Public Versus Private Digital Money: Macroeconomic (ir)relevance. FoM, part 13.

Public Versus Private Digital Money: Macroeconomic (ir)relevance. Dirk Niepelt is Director of the Study Center Gerzensee and Professor at the University of Bern. A research fellow at the Center for Economic Policy Research (CEPR, London), CESifo (Munich) research network member and member of the macroeconomic committee of the Verein für Socialpolitik, he served on the board of the Swiss Society of Economics and Statistics and was a visiting professor at the Institute for International...

Read More »Dirk Niepelt: Public Versus Private Digital Money: Macroeconomic (ir)relevance. FoM, part 13.

Public Versus Private Digital Money: Macroeconomic (ir)relevance. Dirk Niepelt is Director of the Study Center Gerzensee and Professor at the University of Bern. A research fellow at the Center for Economic Policy Research (CEPR, London), CESifo (Munich) research network member and member of the macroeconomic committee of the Verein für Socialpolitik, he served on the board of the Swiss Society of Economics and Statistics and was a visiting professor at the Institute for International...

Read More »“Libra oder lieber nicht? (Libra, or Better Not?),” NZZ, 2019

NZZ, 10 July 2019, with Corinne Zellweger-Gutknecht. PDF. Libra is supposed to be backed; the returns on the securities backing it are going to be distributed among the Libra partners; and Libra’s price is supposed to be managed by a network of market makers. We don’t know much more. Will market makers have the incentive to deliver? See also the longer article in Jusletter.

Read More » Dirk Niepelt

Dirk Niepelt