On Marginal Revolution, Alex Tabarrok reported (in December 2019) that [m]en and women are different. A seemingly obvious fact to most of humanity but a long-time subject of controversy within psychology. New large-scale results using better empirical methods are resolving the debate, however, in favor of the person in the street. The basic story is that at the broadest level (OCEAN) differences are relatively small but that is because there are large offsetting differences between men...

Read More »Ownership of Central Banks

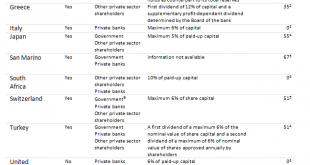

On Bank Underground, David Bholat and Karla Martinez Gutierrez described (in October 2019) the ownership structures of central banks across the world. From their post: Figure 4: Institutional detail on central banks not fully owned by governments

Read More »Interest Rates Since 1310

Figure III in Paul Schmelzing (2019), Eight Centuries of Global Real Interest Rates, R-G, and the ‘Suprasecular’ Decline, 1311–2018. SSRN.

Read More »With Whom Paypal Shares Payment Information

List of third parties (other than PayPal customers) with whom personal information may be shared, according to Paypal, October 2019.

Read More »On the Declining Political Support for Economic Unions

In an NBER working paper, Gino Gancia, Giacomo Ponzetto, and Jaume Ventura propose a theory of declining public support for economic unions: Broad gains from trade in differentiated goods make way for distributive conflict due to specific factors: … this is partly due to the growth of trade between countries that are increasingly dissimilar. … political support for international unions can grow with their breadth and depth as long as member countries are sufficiently similar....

Read More »Treasury Direct

A common argument against retail central bank digital currency (CBDC) is that CBDC would undermine financial stability by allowing the general public to swiftly move funds from banks to a government account. But in several countries such swift transfers are possible already today—in the US through Treasury Direct. (The argument also has conceptual flaws, see the paper On the Equivalence of Public and Private Money with Markus Brunnermeier.)

Read More »US Money Markets

For over a year the federal funds rate has increased relative to the rate the Fed pays on excess reserves. In mid September 2019, the federal funds rate increased abruptly, triggering the Fed to inject fresh funds. In parallel, the repo market rates spiked dramatically. On the Cato Institute’s blog, George Selgin argues that structurally elevated demand collided with reduced supply. He mentions explicit and implicit regulation; Treasury General Account (TGA) balances; the NY Fed’s foreign...

Read More »More Endorsements for “Macroeconomic Analysis”

“This is an excellent textbook for macroeconomics at the master’s or beginning PhD level. The topics and the material used to cover them are well chosen; the treatment gives a solid and unified background for positive and normative analysis. It strikes a good balance between being conceptually clear and logically consistent, and at the same time quite accessible.” —Fernando Alvarez, Saieh Family Professor of Economics, University of Chicago Forthcoming, MIT Press. MIT Press book page. My...

Read More »India’s Unified Payments Interface

In the FT, Benjamin Parkin reports about the transformation of India’s payments landscape. Behind the boom is an innovation launched by the Indian government in 2016: the unglamorous sounding Unified Payments Interface, or UPI, which allows immediate mobile payments directly between bank accounts. Conceived as a public utility, the service is transforming India’s cash-dependent economy into fertile soil for mobile-money apps. … Both the volume and value of transactions had more than...

Read More »Harvard’s Admissions Policy

A paper by Peter Arcidiacono, Josh Kinsler, and Tyler Ransom offers some glimpses. The lawsuit Students For Fair Admissions v. Harvard University provided an unprecedented look at how an elite school makes admissions decisions. Using publicly released reports, we examine the preferences Harvard gives for recruited athletes, legacies, those on the dean’s interest list, and children of faculty and staff (ALDCs). Among white admits, over 43% are ALDC. Among admits who are African American,...

Read More » Dirk Niepelt

Dirk Niepelt