MA course at the University of Bern. Time: Wed 10-12. KSL course site. Course assistant: Armando Näf. The course introduces Master students to modern macroeconomic theory. Building on the analysis of the consumption-saving tradeoff and on concepts from general equilibrium theory, the course covers workhorse general equilibrium models of modern macroeconomics, including the representative agent framework, the overlapping generations model, and possibly the Lucas tree model. Lectures...

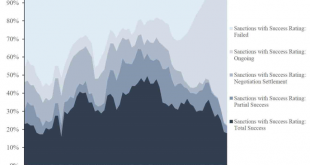

Read More »Sanctions and their Success Rates

The new Global Sanctions Database covers bilateral, multilateral, and plurilateral sanctions from 1950 to 2016.

Read More »“Unabhängigkeit der Nationalbank (Independence of the SNB),” FuW, 2020

Finanz und Wirtschaft, July 25, 2020. PDF. The Swiss National Bank—yes, the Swiss one—feels it must remind politicians of its independence. Parliamentarians from left to right (!) voice demands. To shrink the SNB’s balance sheet? No, for more central bank profits to be distributed sooner rather than later. I discuss misconceptions, possible motivations, and a constructive response. «The best way to defend the independence of a central bank is never to exercise it.»

Read More »“Monetäre Staatsfinanzierung mit Folgen (Monetary Financing of Government),” Die Volkswirtschaft, 2020

Die Volkswirtschaft, 24 July 2020. PDF. Clarifying the connections between outright monetary financing, QE, the distribution of seignorage profits, the relationship between fiscal and monetary policy, and central bank independence. Abstract: Wenn Parlamentarier höhere Gewinnausschüttungen der Nationalbank fordern, Kritiker im Euroraum mehr «Quantitative Easing» oder Helikoptergeld verlangen und andere Stimmen monetäre Staatsfinanzierung monieren, dann steht die Beziehung zwischen...

Read More »“Austerity,” EJ, forthcoming

Economic Journal, forthcoming, with Harris Dellas. PDF. We study the optimal debt and investment decisions of a sovereign with private information. The separating equilibrium is characterized by a cap on the current account. A sovereign repays debt amount due that exceeds default costs in order to signal creditworthiness and smooth consumption. Accepting funding conditional on investment/reforms relaxes borrowing constraints, even when investment does not create collateral, but it...

Read More »Roadmap Towards Enhanced Cross-border Payments

A new report by the Committee on Payments and Market Infrastructures lists 7 types of frictions and 19 focus areas to address these frictions.

Read More »Financial Innovation, Central Banks, CBDC

In its annual economic report, the BIS further warms to the idea that CBDC is a key part of central banks’ response to financial innovation. Central banks play a pivotal role in maintaining the safety and integrity of the payment system. They provide the solid foundation by acting as guardians of the stability of money and payments. The pandemic and resulting strain on economic activity around the world have confirmed the importance of central banks in payments. Digital innovation is...

Read More »Money and Memory

On Alphaville, Claire Jones and Izabella Kaminska discuss privacy issues related to CBDC. In the background, Kocherlakota’s “Money is Memory” is lurking.

Read More »“Macroeconomic Analysis,” VoxEU, 2020

VoxEU, June 22, 2020. HTML. Is macroeconomics useful? Of course. To make the point, academics must regain the interpretative high ground from market commentators. While it helps when policymakers understand fundamental macroeconomic concepts, it is equally important for the general public to grasp them. More, and how this relates to the new textbook, on VoxEU.

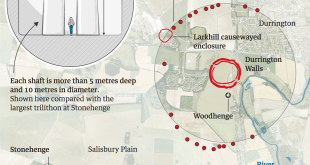

Read More »Durrington Shafts

Stonehenge is tiny. Dalya Alberge reports in the Guardian.

Read More » Dirk Niepelt

Dirk Niepelt