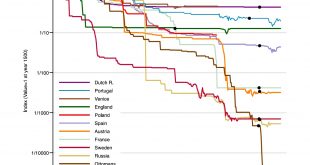

K. Kıvanç Karaman, ¸Sevket Pamuk, Seçil Yıldırım-Karaman (2020), Money and monetary stability in Europe, 1300–1914, Journal of Monetary Economics (115). At one extreme, the Dutch Republic depreciated its monetary unit by about 2.3 times, at the other, the Ottomans depreciated by about 25,000 times. These two numbers correspond to average annual depreciation rates of 0.2 and 2.5% respectively, with the other states falling in-between. … depreciations tended to be episodic. In...

Read More »Central Banks Have Accepted a Future Retail CBDC

Recent indications: BIS: Central banks and BIS publish first central bank digital currency (CBDC) report laying out key requirements (9 October 2020) ECB: A Digital Euro (updated regularly) Bank of Russia: Bank of Russia announces public discussions on digital ruble (13 October 2020) Related recent developments: Digital Dollar Project: The Digital Dollar Project Publishes Nine Pilot Scenarios to Test Elements of a US CBDC (October 2020) Monetative e.V.: Digitales Zentralbankgeld aus...

Read More »Paul Milgrom and Robert Wilson

A Fine Theorem offers a very nice description of their work.

Read More »Markus’ Academy

Event directory with links to videos and summaries.

Read More »“Dynamic Tax Externalities and the U.S. Fiscal Transformation,” JME, 2020

Journal of Monetary Economics, with Martin Gonzalez-Eiras. PDF. (Appendix: PDF.) We propose a theory of tax centralization in politico-economic equilibrium. Taxation has dynamic general equilibrium implications which are internalized at the federal, but not at the regional level. The political support for taxation therefore differs across levels of government. Complementarities on the spending side decouple the equilibrium composition of spending and taxation and create a role for...

Read More »SUERF Webinar Baffi Bocconi Libra 2 0 20200831

This SUERF Baffi Bocconi e-lecture hosted Katrin Assenmacher, ECB, and Dirk Niepelt, University of Bern, to discuss Libra 2.0 from a monetary policy and financial stability perspective and to set Libra 2.0 in relation to the concept of Central Bank Digital Currencies (CBDC). After the two presentations the speakers answered live to questions posed in the chat. Moderator: Donato Masciandaro, Bocconi University. Idea and scientific design: Ernest Gnan, OeNB and SUERF.

Read More »Economic Aspects of the Energy Transition

In an NBER working paper, Geoffrey Heal discusses some aspects of the energy transition to come. On infrastructure investments: the likely net investment required to go carbon-free is now as little as $0.179 trillion renewable power from wind and solar PV plants is now less expensive than power from gas, coal or nuclear plants … If it were not for the intermittency of renewables, we would save money by converting to clean power. the social benefits from stopping the CO2 emissions...

Read More »High-Skilled Immigration and Employment at Multinationals

Britta Glennon reports in an NBER working paper that the two go together. Skilled immigration restrictions may have secondary consequences that have been largely overlooked in the immigration debate: multinational firms faced with visa constraints have an offshoring option, namely, hiring the labor they need at their foreign affiliates. If multinationals use this option, then restrictive migration policies are unlikely to have the desired effects of increasing employment of natives,...

Read More »Assar Lindbeck (1930–2020)

Colleague, co-author, visionary. Assar remains a role model. He was curious, open minded, and incorruptible. He didn’t need to prove himself or that he was correct (politically and otherwise), all he wanted was to contribute and learn. He was a generalist, both in economics and beyond. He exposed nonsense and shaped policy. He will be sadly missed. In memory of Assar Lindbeck.

Read More »First Regulated Stablecoin Retail Transaction—at Digitec?

C. Septhon reports in Modern Consensus: The Sygnum Digital Swiss Franc (DCHF), which is pegged on a 1:1 basis with the fiat currency, was used to complete a payment for an Apple iPad at Digitec Galaxus, Switzerland’s largest online retailer. Coinify, a digital currency platform provider, enabled the sale to take place. Sygnum is different from Tether etc. because it is a regulated bank. Accordingly, DCHF corresponds to a monitored currency board.

Read More » Dirk Niepelt

Dirk Niepelt