NZZ, February 1, 2021. PDF. (Title changed by NZZ.) Do negative interest rates render government debt costless? No. What about r<g? I discuss Olivier Blanchard’s presidential address and the conclusions that columnists have drawn. For background: See this post.

Read More »Neil MacGregor’s “Germany: Memories of a Nation”

Goodreads rating 4.55. Surprising, sympathetic.

Read More »Money vs. Savings: Gluts, Current Accounts, Triffin, Capital Flow Correlations

On bankunderground, Michael Kumhof, Phurichai Rungcharoenkitkul, and Andrej Sokol question that foreign savings is an important driver of US current account deficits: Consider how US imports can be paid for in the real world: first, by transferring existing domestic or foreign bank balances to foreigners, which involves no new financing. Second, by borrowing from domestic banks and transferring the resulting bank balances to foreign households, which involves domestic but not foreign...

Read More »“The Pandemic Endgame,” VoxEU, 2021

VoxEU, January 11, 2021, with Martin Gonzalez-Eiras. HTML. Based on the CEPR discussion paper, we draw conclusions for the pandemic endgame. We explain why Israel will likely impose a harsher lockdown than other countries, especially poor ones. And why we should expect “inverse lockdowns”—measures to stimulate social interaction.

Read More »Make Your Bed

Some modest new year’s resolutions inspired by the commencement speech of US Navy Admiral William H. McRave.

Read More »Manley Hall’s “Fundamentals of the Esoteric Sciences”

Goodreads rating 4.39. Concise, to the point, insightful.

Read More »Peter Matthiessen’s “The Snow Leopard”

Goodreads rating 4.11. Tranquility.

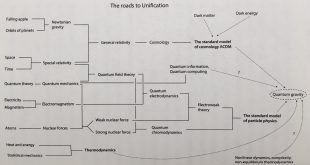

Read More »Jim Al-Khalili’s “The World According to Physics”

Goodreads rating 4.17. Stronger on relativity than on quantum mechanics and thermodynamics.

Read More »Reading List on ‘Free’ or ‘Not-so-free’ Public Debt

Olivier Blanchard, Public Debt and Low Interest Rates, AER 2019, 109(4). Robert Barro, r Minus g, NBER wp 28002, October 2020. Dmitriy Sergeyev and Neil Mehrotra, Debt Sustainability in a Low Interest World, CEPR dp 15282, September 2020. Stan Olijslagers, Nander de Vette, and Sweder van Wijnbergen, Debt Sustainability when r−g<0: No Free Lunch after All, CEPR dp 15478, November 2020. Ricardo Reis, The Constraint on Public Debt when r<g But g<m, Mimeo, December 2020.

Read More »John Cochrane about CBDC and Me

Writing about CBDC, John Cochrane makes it clear that he is in favor. He links to my work and writes Dirk Niepelt has written a lot about CBDC theory, including reserves for all in 2015, a recent Vox-EU summary and papers, here with Markus Brunnermeier a JME paper “CBDC coupled with central bank pass-through funding need not imply a credit crunch nor undermine financial stability,” a follow up including “The model implies annual implicit subsidies to U.S. banks of up to 0.8 percent...

Read More » Dirk Niepelt

Dirk Niepelt