Swiss Franc The Euro has risen by 0.45% to 1.0587 EUR/CHF and USD/CHF, March 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In HG Wells’ “War of the Worlds,” the common cold repelled a Martian invasion. Now, a novel coronavirus is disrupting everything and everywhere. Global equities continue to get hammered, though the apparent relative resilience of Japan may have spurred some buying of Japanese equities....

Read More »Swiss Balance of Payments and International Investment Position: Q4 2019 and review of the year 2019

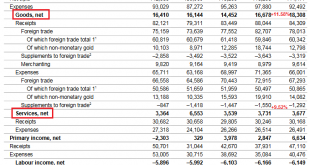

Key developments in 2019 The current account surplus for 2019 was CHF 86 billion, CHF 29 billion more than the previous year. This increase was principally due to growth in primary income (labour and investment income). In the year under review, receipts exceeded expenses by CHF 14 billion, whereas in the two previous years, expenses had significantly exceeded receipts. The main contributors to this development had been finance and holding companies, which had...

Read More »Further billions may be needed to save Swiss companies

Many high street stores have been told to close their doors. (Keystone / Jean-christophe Bott) A CHF42 billion coronavirus financial aid package may not be enough to save firms from extinction, warn business leaders and economists. The state could be saddled with a bill three times higher if the crisis drags on until the end of the year. Earlier this week, the government increased its emergency funding from CHF10 billion to CHF42 billion ($42.6 billion). Some CHF14...

Read More »Swiss hospitals take French coronavirus patients

The Swiss healthcare system will be tested over the coming weeks, experts warn. (© Keystone / Gaetan Bally) Three Swiss hospitals have agreed to provide intensive care treatment for six seriously ill coronavirus patients from the neighbouring Alsace region of France. However, experts fear that Switzerland’s health infrastructure will soon be stretched by the rising number of pandemic victims. Two hospitals in Basel and one in Jura, in northwestern Switzerland, said...

Read More »The System Will Not Return to “Normal,” and That’s Good; We Can Do Better

Essential home lockdown reading. The pandemic is revealing to all what many of us have known for a long time: the status quo was designed to fail and so its failure was not just predictable but inevitable. We’ve propped up a dysfunctional, wasteful and unsustainable system by pouring trillions of dollars in borrowed money down a multitude of ratholes to avoid a reckoning and a re-set. And very predictably, that’s the “solution” to the unraveling triggered by the...

Read More »Drivers for the Week Ahead

Risk sentiment is likely to remain under pressure this week as the impact of the coronavirus continues to spread; demand for dollars remains strong As of this writing, the Senate-led aid bill has stalled; the US economic outlook is getting more dire; Canada is experiencing similar headwinds This is a big data week for the UK; eurozone March flash PMIs will be reported Tuesday; oil prices continue to slide Japan has a heavy data week; RBNZ will start QE; China offers...

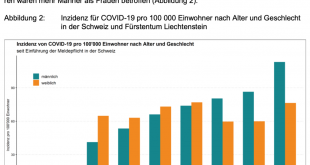

Read More »COVID-19 – Auslegeordnung

In den vergangenen Tagen habe ich mich immer wieder gefragt, “wo besteht eigentlich das Problem?” Zu oft habe ich das Gefühl, dass viele Experten, Medien und Politiker mit den Zahlen ein Durcheinander haben und so mehr zur Verwirrung als zur Klärung beitragen. Deshalb hier der Versuch einer strukturierten Aufschlüsselung. Eine Bitte an alle Leser: Ich suche Quellen (Webseiten, Videos [mit Minutenangabe], Interviews, etc.), welche meine Fragen entweder beantworten...

Read More »Mit Aktien wird man nicht reich und vermögend ??

Ja, richtig gelesen. Mit Aktien wird man nicht reich und vermögend. Was ich damit meine, möchte ich in diesem Beitrag erläutern. Keine Sorge, ich werde weiterhin in Aktien investieren, aber auch meine Motivation für Aktien Investments nochmal genauer erläutern. Wenn Aktien nicht reich machen Aktien sind ein Investmentkonstrukt, man investiert sein verdientes Geld in Unternehmen. Das investierte Geld kann somit langfristig für einen arbeiten und der Topf kann durch...

Read More »SNB belässt Leitzins unverändert und stärkt die Banken

Die SNB steht bereit, bei Bedarf zusätzliche Massnahmen zur Sicherung der Liquidität zu treffen. (Bild: Shutterstock.com/Distinctive Shots) Die Schweizerische Nationalbank (SNB) belässt ihren Leitzins sowie den Zins auf Sichtguthaben bei -0,75%, wie sie am Donnerstag im Rahmen der geldpolitischen Lagebeurteilung mitteilte. Sie interveniert verstärkt am Devisenmarkt, um zur Stabilisierung der Lage beizutragen. Dabei betrachtet sie die gesamte Währungssituation....

Read More »Coronavirus: estimating the death toll in Switzerland

© Pongmoji | Dreamstime.com COVID-19 has hit the world fast and we are racing to understand it, while struggling to come to terms with its deadly impact. When trying to estimate the impact, it is tempting to take the current number of deaths and divide it by the number of reported cases. However, the resulting percentage is meaningless. Here’s why: Jumping the gun If we divide the current number of deaths in South Korea with the current number of cases so far we get...

Read More » SNB & CHF

SNB & CHF