The US Dollar Index has lost 10 percent from its March highs and many press comments have started to speculate about the likely collapse of the US dollar as world reserve currency due to this weakness. These wild speculations need to be debunked. The US dollar year-to-date (August 2020) has strengthened relative to 96 out of 146 currencies in the Bloomberg universe. In fact, the US Fed Trade-Weighted Broad Dollar Index has strengthened by 2.3 percent in the same...

Read More »FX Daily, September 14: UK Presses Ahead, China Strikes Out at German Pork Producers, and Moody’s Weighs on Turkey

Swiss Franc The Euro has fallen by 0.07% to 1.0762 EUR/CHF and USD/CHF, September 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A flurry of deals, including the still-evolving Oracle-TikTok tie-up, helped lift equity markets in the Asia Pacific region. South Korea’s Kospi, and Indonesia, which had been battered last week, led the advance. The MSCI Asia Pacific Index rose for the third consecutive...

Read More »Hayek’s Plan for Private Money

The most famous Austrian economist is 1974 Nobel laureate Friedrich Hayek. Because of his moderate views excusing state interventions in various circumstances, hardcore Rothbardians tend to regard Hayek as less than pure in many areas. However, one area where Hayek is certainly more radical (though perhaps not correct!) than even Murray Rothbard is monetary institutions, as detailed in his fascinating (1978) pamphlet The Denationalisation of Money. When it comes to...

Read More »Swiss Tourism Industry demands new Covid-19 Quarantine Regime

Swiss Tourism IndustryWith only three months to go before the start of the winter season, the de facto holiday ban for guests from certain high risk countries is causing huge concern for the Swiss tourism industry. Keystone / Jean-christophe Bott - Click to enlarge Foreign visitors from Covid-19 high risk countries should be able to travel to Switzerland with negative corona tests and not have to go into quarantine, say tourism officials. Under Swiss regulations,...

Read More »The Four D’s That Define the Future

When the money runs out or loses its purchasing power, all sorts of complexity that were previously viewed as essential crumble to dust.Four D’s will define 2020-2025: derealization, denormalization, decomplexification and decoherence. That’s a lot of D’s. Let’s take them one at a time. I use the word derealization to describe the inner disconnect between what we experience and what the propaganda / marketing complex we live in tells us we should be experiencing....

Read More »Credit Suisse makes digital push as it closes down branches

Switzerland’s second largest bank is replacing bricks and mortar with digital. Credit Suisse Credit Suisse is taking on so-called challenger banks with a new digital service for customers, including a debit card with no foreign transaction fees. The bank is closing down branches across Switzerland and is converting others into a “digital bar” concept. Switzerland’s second largest bank unveiled its new CSX banking app on Thursday with specific features aimed towards...

Read More »Fribourg hospital under pressure after Covid-19 outbreak

The town of Siviriez – source Wikipedia According to RTS, a branch of the HFR hospital in the Swiss canton of Fribourg has reached full capacity after a rise in Covid-19 patients following an outbreak in a local nursing home. The rise in hospital admissions follows an outbreak of Covid-19 in a nursing home in the region. Nine new patients have been admitted to the hospital since Wednesday. HFR Riaz, near the town of Bulle, is one of five HFR sites making up the...

Read More »No wave of coronavirus bankruptcies so far, study finds

Many employees were put on short time work during the lockdown as companies were hit by the pandemic. Keystone / Magali Girardin Government credits and employment support measures have helped stave off a wave of bankruptcies, but they could rise over the longer term, says a survey. Between January and August 2020, which includes the lockdown period, 2,800 firms in Switzerland declared bankruptcy. This is actually 621 fewer than in the same period last year, says the...

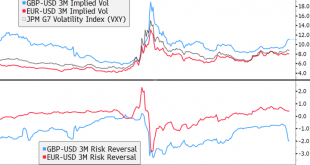

Read More »Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25% ECB is expected to keep policy steady; there were some eurozone IP readings; UK published its so-called Internal Market Bill Japan may go to the polls...

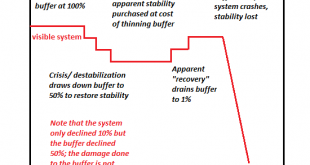

Read More »This Is How It Ends: All That Is Solid Melts Into Air

While the Federal Reserve and the Billionaire Class push the stock market to new highs to promote a false facade of prosperity, everyday life will fall apart. How will the status quo collapse? An open conflict–a civil war, an insurrection, a coup–appeals to our affection for drama, but the more likely reality is a decidedly undramatic dissolution in which all the elements of our way of life we reckoned were solid and permanent simply melt into air, to borrow Marx’s...

Read More » SNB & CHF

SNB & CHF