Simply buying bitcoin does not require a law change but legislation needs to keep up with a host of blockchain developments in finance and the way companies operate. © Keystone / Christian Beutler Bitcoin used to be something of a dirty word, associated with crime and money laundering. Switzerland has now amended its legal code to welcome cryptocurrencies and blockchain technology into the mainstream. Parliamentarians in the Senate rapidly passed a wide-ranging set...

Read More »Flashdance (Irene Cara Cover) Liz Ryan and Keith Weiner

Flashdance With Liz & Keith

Read More »In The End (Linkin Park Cover) Jennifer Cristiano, Bob Mittleman, Keith Weiner

Flashdance (Irene Cara Cover) Liz Ryan and Keith Weiner

Flashdance With Liz & Keith

Read More »In The End (Linkin Park Cover) Jennifer Cristiano, Bob Mittleman, Keith Weiner

Switzerland adds 10 more nations to its compulsory quarantine list

© Denis Linine | Dreamstime.com On 7 September 2020, Switzerland added to its list of quarantine countries. People entering Switzerland from 55 nations must now quarantine for 10 days. On 7 September 2020, 10 nations were added to the list. These include Croatia, French Polynesia, Guyana, Lebanon, Libya, Paraguay, San Marino, Trinidad and Tobago, Ukraine, United Arab Emirates. From 7 September 2020, anyone who has spent time in these countries over the 14 days prior...

Read More »Lyn Alden/Jeff Snider (QE, Deflation, Inflation, Dollar, Eurodollar System, Future US Economy)

The Rebel Capitalist show helps YOU learn more about Macro, Investing, Entrepreneurship AND Personal Freedom. ✅ Want to take your investing to the next level? Check out my new online investing forum!! I've partnered with Lyn Alden and Chris MacIntosh to bring you the best investment tool on the internet...Rebel Capitalist Pro. Check out our special offer at https://www.GeorgeGammon.com/pro For more content that'll help you build wealth and thrive in a world of out of control central...

Read More »Swiss-UK financial services pact antidote to EU intransigence

Switzerland and Britain are talking of closer cooperation as two major economies that are not part of the EU. © Keystone / Peter Schneider Switzerland and Britain are thrashing out a post-Brexit financial services treaty that is being billed as a global standard for common sense. It also takes aim at perceived EU inflexibility that has seen the Swiss stock market frozen out of European markets. The proposed treaty to “deepen cooperation” on a whole range of financial...

Read More »Intolerance and Authoritarianism Accelerate Disunity and Collapse

Scapegoating dissenters only hastens the disunity and disarray that accelerates the final collapse. Authoritarianism is imposed on us, but its sibling intolerance is our own doing. Intolerance and authoritarianism are two sides of the same coin: as intolerance becomes the norm, the intolerant start demanding that the state enforce their intolerance by suppressing their enemies via increasingly heavy-handed authoritarian measures. Intolerance and authoritarianism...

Read More »Re-recession Not Required

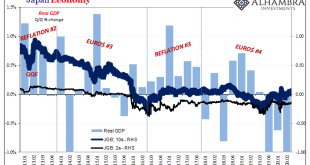

If we are going to see negative nominal Treasury rates, what would guide yields toward such a plunge? It seems like a recession is the ticket, the only way would have to be a major economic downturn. Since we’ve already experienced one in 2020, a big one no less, and are already on our way back up to recovery (some say), then have we seen the lows in rates? Not for nothing, every couple years when we do those (record low yields) that’s what “they” always say and yet...

Read More » SNB & CHF

SNB & CHF