Modern culture is biased against those that are rich even while depending upon the wealth that successful entrepreneurs have created. Original Article: "Progressives Want to Eliminate Wealthy Entrepreneurs but Need the Wealth They Create" [embedded content] Tags: Featured,newsletter

Read More »June 2023 Monthly

June is a pivotal month. The US debt-ceiling political drama cast a pall over sentiment even if it did not prevent the dollar from rallying or the S&P 500 and NASDAQ from setting new highs for the year. It is as if the two political parties in the US are playing a game of chicken and daring the other side to capitulate. Both sides are incentivized to take to the brink to convince their constituents that they secured the best deal possible. No side seems to...

Read More »Where Is That Darn Recession?

Mark takes a look at all the wrong predictions of recession in recent years, including those of Austrian School economists. While the MSM and Fed officials try to downplay the coming of a recession, many of the statistics and facts that Austrian consider important are indicating a looming recession, if not a full-blown economic crisis. Check out Anatomy of the Crash: The Financial Crisis of 2020, edited by Tho Bishop: Mises.org/AnatomyOfTheCrash Be sure to...

Read More »Can We Protect Ourselves from Inflation?

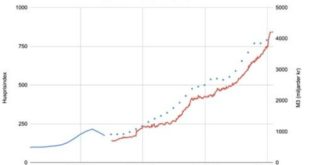

Rulers found out early on that they could debase gold and silver coins for their own gain. As a consequence, the money supply increased, whereas money’s purchasing power fell. This pseudoalchemy is the true definition of inflation and has been a policy for more than a thousand years. What’s more, an increase in the money supply leads to rising prices. This symptom of inflation is often mistaken as inflation itself. The correct term, though, is price inflation....

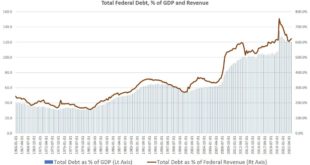

Read More »As Interest Rates Rise, the Era of “Deficits Don’t Matter” Is Over

Back in 2002, then-Vice President Dick Cheney claimed "Reagan proved deficits don't matter" and went on to push for tax cuts combined with more federal spending. Indeed, the Bush administration would go on to push immense amounts of new spending, supporting a huge Medicare expansion and blowing hundreds of millions of dollars on costly and pointless occupations in Iraq and Afghanistan. The national debt grew by 70 percent during Bush's eight years, but no one in...

Read More »Overcoming Government Intervention in the Economy

Once again, the economic system is trying to adjust to political and monetary interventions. The year 2023 marks the end of a historical period characterized by zero-cost credit. The monetary expansion that began in the early 2000s led to the great financial crisis of 2008 and the emerging markets boom. Exaggerated demand expectations and easy access to capital caused an overexpansion of production capacity and the subsequent industrial restructuring between 2015 and...

Read More »Rothbard’s Button Doesn’t Exist, but It Needs to Be Invented

In 1948, Ludwig Erhardt rescued a German economy that was in shambles simply by invoking free markets and currency reform. Our economy needs its Rothbard moment. Original Article: "Rothbard’s Button Doesn’t Exist, but It Needs to Be Invented" [embedded content] Tags: Featured,newsletter

Read More »Fear-Mongering Over the Debt Ceiling

Heritage Fellow Peter St. Onge joins Bob to set the record straight on several popular talking points about the debt ceiling. Bob on selling Gov't resources to reduce the National Debt: Mises.org/HAP397a [embedded content] [embedded content] Tags: Featured,newsletter

Read More »An Austrian Perspective vs the Financial Mainstream

This episode of Good Money with Tho Bishop features guest Ryan Griggs of Griggs Capital Strategies. During the show, Ryan discusses his work with Bob Murphy on an Austrian understanding of inverted yield curves as a signal for recessions and how it differs from the mainstream analysis. He also discusses Nelson Nash's infinite banking strategy as a means for capital accumulation, in contrast to traditional investment approaches. Ryan and Bob Murphy on the Austrian...

Read More »Don’t Get on the Nationalist Bus

America and the Art of the Possible: Restoring National Vitality in an Age of Decayby Christopher BuskirkEncounter Books, 2023; xxv + 162 pp. Christopher Buskirk is the publisher and editor of the magazine American Greatness, and the title of that magazine, like that of the book, shows his principal concern. How can the American people regain the sense of optimism and purpose which we once had but have now lost? Buskirk says that in the public sphere, civilizational...

Read More » SNB & CHF

SNB & CHF