While politicians, media mavens, and the academic elite spread fear about artificial intelligence, AI is helping make life better for ordinary consumers. Original Article: "Prices, Food, Employment: AI and Robotics Are for Regular Folks, Not Just the Elite" [embedded content] Tags: Featured,newsletter

Read More »Taxing Capital Leads to Capital Consumption

The Misesian tradition provides essential insights into the nature of capital. From Frédéric Bastiat to Murray N. Rothbard, Austrian capital theory excels. Bastiat illustrated gains from capital by giving us the anecdote of the neighbor who wanted to borrow a timber planer. Rothbard gave us the examples of royalties in the extractive industry to illustrate capital consumption. The list goes on. Often, capital’s exceptional output is because it behaves as both...

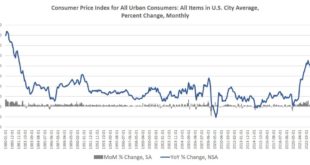

Read More »Price Inflation Growth Slowed Slightly in April. Now Wall Street Will Demand More Easy Money.

The federal government’s Bureau of Labor Statistics (BLS) released new price inflation data Wednesday, and according to the report, price inflation during April decelerated slightly, coming in at the lowest year-over-year increase in twenty-four months. According to the BLS, Consumer Price Index (CPI) inflation rose 4.9 percent year over year in April before seasonal adjustment. That’s down from March’s year-over-year increase of 5.0 percent, and April is the...

Read More »Limited Follow-Through Dollar Buying After Yesterday’s Gains

Overview: The dollar sprang higher yesterday but follow-through buying today has been limited. The little more than 0.5% gain in the Dollar Index was among the largest since mid-March. And yet, the debt ceiling anxiety and weak US bank shares persist. Today's talks at the White House have been postponed until early next week. Both sides are incentivized to bring it to the brink to demonstrate to their constituencies that they got the best deal possible. Both the...

Read More »Should Local Municipalities Default on Their Debts? Seems Like a Good Idea

While most free market advocates are fixated on the national debt, they also should be looking at municipal debt over which taxpayers have no say. Maybe default is the answer. Original Article: "Should Local Municipalities Default on Their Debts? Seems Like a Good Idea" [embedded content] Tags: Featured,newsletter

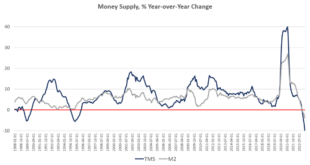

Read More »The Money Supply Has Plummeted in the Biggest Drop Since the Great Depression

Money supply growth fell again in March, plummeting further into negative territory after turning negative in November 2022 for the first time in twenty-eight years. March's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply repeatedly contract for five months in a row. The last time the...

Read More »Finance Discovers Sting: “How Fragile We Are”

An ongoing debate concerns the plunge in the four-week Treasury note yield in relation to the three-month Treasury yield. At least one tweeter claims it’s all about the coming debt ceiling showdown with the difference in rates (3.145 percent versus 5.070 percent) reflecting the risk of having liquidity tied up within three months as the debt ceiling exercise is run through DC sausage making. On the other side is Eurodollar University’s Jeffrey Snider who tweeted in...

Read More »The Ukraine War Isn’t about Democracy. It’s about States Seeking More Power.

The fight between Russia and NATO is not about "democracy versus authoritarianism." Rather both the US and Russian states are doubling down because they are doing what states do: seeking power. Original Article: "The Ukraine War Isn't about Democracy. It's about States Seeking More Power." [embedded content] Tags:...

Read More »Villagers of Brienz/Brinzauls are facing an imminent rockslide

It is an emotional time for the people of Brienz/Brinzauls in Switzerland living in the shadow of a crumbling mountain, who have been told by the authorities to immediately evacuate their homes. #swissalps #rockslide #evacuation --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe...

Read More »Progressives Want to Eliminate Wealthy Entrepreneurs but Need the Wealth They Create

Being perceived as anti–working class is a cardinal sin in American politics. Working-class people are seen as the unappreciated engine of American growth. Hillary Clinton discovered this lesson when she was criticized for calling Donald Trump supporters a “basket of deplorables.” But interestingly, expressing contempt for the upper class is quite tolerable. Rich people are frequently ridiculed by comedians and depicted as snobs in popular culture. Shows like...

Read More » SNB & CHF

SNB & CHF