On January 6, we wrote the Surest Way to Overthrow Capitalism. We said: “In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.” Today’s article is part I that promised article. Let’s consider how to know the right rate, first. It should not be controversial to say that if the government sets a price cap, say on a loaf of bread, that this harms bakers. So the bakers will seek every possible way out of it. First, they may try shrinking the loaf. But, gotcha! The government regulator anticipated that, and there is a heap of rules dictating the minimum size of

Topics:

Keith Weiner considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Basic Reports, capital consumption, capital destruction, central planner, Featured, newsletter, right interest rate, right price

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

On January 6, we wrote the Surest Way to Overthrow Capitalism. We said:

“In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.”

Today’s article is part I that promised article.

Let’s consider how to know the right rate, first. It should not be controversial to say that if the government sets a price cap, say on a loaf of bread, that this harms bakers. So the bakers will seek every possible way out of it. First, they may try shrinking the loaf. But, gotcha! The government regulator anticipated that, and there is a heap of rules dictating the minimum size of a loaf, weight, length, width, depth, density, etc. Next, the bakery industry changes the name. They don’t sell loaves of bread any more, they call them bread cakes. And so on.

There is always a little arms race going on, wherever there are government controls. One recent example is Uber. This company actually illustrates two different workarounds. One, is labor law. Labor law sets not only a minimum price for labor, but also adds many other restrictions that make companies less flexible, and therefore less able to deliver what customers want. So Uber drivers are not employees. Oh no, they are independent contractors.

Two, is taxi regulation. Uber is not a taxi. It is a ride-sharing service. Under regulation, definitions determine the difference between life and death. So everyone is forced to play a game of hair-splitting.

But what does not happen: consumers can buy as much bread as they want, below production cost. Something has to give. And if nothing else can give, then bakeries are ruined and you arrive at Venezuela. The average adult there lost 11kg (24 lbs) in 2017.

What does not happen is: bakeries pay workers $15 to produce $12 worth of bread.

Why not? What is it about production cost that makes bakers unable to go below it, even if they were willing? What is it that makes employers unable to pay workers more than the revenues generated from the work? And make no mistake about this point. Our socialist friends may try to turn it into a character attack (especially on the minimum wage), alleging evil motives for the baker, who is greedy and exploiting workers.

Of course it has nothing to do with motives. Reality does not permit you to consume more than you produce. If you spend $1.01 to produce a loaf of bread that you sell for $1.00, then you lose a penny on every loaf. This is true, regardless of whether a price-fixing law caps bread at $1.00, or whether a minimum wage low hikes your cost to $1.01.

You only have so many pennies. And eventually, you will run out.

Production consumes resources. It consumes the obvious resources that everyone can see. For example, baking a loaf of bread consumes flour, water, labor, etc.

It also consumes the not-so-obvious resources that most people do not see. Such as wear and tear of the mixing equipment and ovens, depreciation of the building, etc. It consumes capital.

To illustrate this, let’s look at Able Bakery. Able publishes financial statements showing only the first category, the flour, labor, and other ingredients. But they do not address capital at all, the ovens and mixers, the building, etc.

Able’s financial statements do not paint an accurate picture of the business.

Suppose Able reports a small profit. It does not count the (potentially large) costs of wearing out equipment and the building. So, the true picture of the bakery business may actually be that it loses money. We don’t know for sure (but we suspect from the small profit and potentially large cost that is excluded).

Even if a business uses peanut shells to do its buying and selling, it’s easy to count how many shells it had in the morning and how many it has at the end of the day. If the number goes up, then it created wealth. So long as there is no capital used for production.

However, in most businesses, there are non-obvious (i.e. non-cash) expenses. These are not obvious because they occur slowly. The baker can fire up the oven every day for years. He can open and close the over door thousands of times. But with each cycle of heat and cool, rotation of the hinges, and impact of the closing door on the seals, the oven degrades imperceptibly. Eventually, it is worn out and stops working. Wear and tear must be included in the financial statements. That should be obvious (and it is, to anyone in business or accounting).

This is necessary, but not sufficient. Businesses also need a consistent currency. Changes during the life of the equipment may cause inaccuracy in measuring wear and tear. We’ll look at two examples. The first is when the unit of account falls, what most people call inflation. The second is when the interest rate falls.

Charlie Bakery buys an oven for $10,000. At the time, the ingredients and labor to produce a loaf of bread are $0.90 and the retail sales price is $1.00. One could say that the oven is purchased for 10,000 breads (though a bread loaf is not a constant unit of value).

Ten years later, the oven is toast. By that time, a loaf of bread costs $9.00 to make, and it sells for $10.00. However, on the books, the depreciation of the oven is a straight line of the original $10,000, over ten years. This is $1,000 a year. By the tenth year, the wear on the oven appears to be 100 breads. This is a pleasant illusion, shattered when Charlie buys a new one and finds that it is now $100,000. The annual wear is really 1,000 breads.

Oops. Charlie’s depreciation appears on its books, 90% less than it should be. Profits are overstated by $9,000. Depreciation should have been $10,000 a year if a new oven is $100,000 and it lasts 10 years. If Charlie has 20 ovens, then profits are overstated by $180,000 a year.

Suppose that Charlie’s financials showed a profit of $150,000. Then the truth is that they suffered a loss of $30,000. They should go back over the last ten years, and restate everything.

What had appeared to be a profitable business, turns out to have been generating losses all along. This is a problem, as the company may be paying bonuses and dividends, while it is slowly eating itself.

This is just from the problem of a falling currency. The problem of falling interest is worse. With each drop in the interest rate, oven manufacturers, and bakers too, have a growing incentive to borrow more to buy more equipment to make more products. The oven company borrows to buy more metal brakes. Management are willing to operate at a lower margin, because their cost of borrowing is lower (and they don’t reckon that when the rate drops again, the next oven company will borrow more at even lower rates, and put the squeeze on them). Charlie Bakery borrows to buy more ovens, to bake more loaves of bread. Is this the creation of wealth? Or is it wealth consumption?

The problem that inflation distorts Charlie’s books is simple by comparison. One can recognize the loss of value of the currency (especially if the currency is measured in terms of gold).

But in this case, where the central planners have lowered, not the purchasing power of the currency, but the interest rate, how do we see the problem? The currency’s purchasing power is actually rising. And producers may be making greater profits (especially at first). So where should we look?

We might look at the return on assets. If a business is obliged to buy lots more ovens, to generate similar profits, then that’s an indication. We could also measure the ratio of debt to profit. Not only is there an increase in borrowing to get the same profit, which is bad enough, but the business has increased its risk too.

And one other point bears emphasis here. If a business is obliged to take on debt, where debt had not been necessary before, then that may be a sign that it has consumed its capital. Its capital is becoming negative. That is, investors are letting the company use their capital, in exchange for a diminishing return. Or even a negative return (which has occurred in Switzerland and Germany).

Let’s look at it from another angle. Suppose that buying a new oven will add $7,500 in profit per year for ten years. What is the net present value of the oven? One uses the interest rate to discount future earnings. If the interest rate is 10%, then the oven is worth about $48,500 today. But if the rate drops to 5%, then the net present value of the oven jumps to over $60,000.

So when the rate decreases, new equipment generates increased cash flow (revenues net of interest expense). And there is a synergistic effect. Each dollar of that cash flow is worth more. No wonder why businesses load up on debt to increase production… and no wonder why falling rates drives falling prices!

We have not yet proven that only a free market can know the right rate. However, we have shown that when the central planner alters either the value of the currency unit or the interest rate—show us any theory of central banking that does not involve altering the value and the interest rate—that unrecognized losses of capital occur. They are unrecognized because they are hard to calculate, even if one is looking especially for them, and of course mainstream theory does not encourage one to look.

Take GDP, for example, an economic statistic that is the perfect product of the conventional view. Even free-marketers use it.

But GDP is blind to the capital lost by the Able Bakers of the world. This blindness is not a bug, it’s a feature. GDP is also blind to the capital lost by the Charlie Bakers.

Conventional economics is based on not seeing capital consumption. Instead, it offers up purchasing power as a sop (especially since 1981, when rates have been falling).

To reiterate, cash flow is not the full picture of profit and loss. One must consider the capital account. The decision to invest capital, as well as the measured return generated thereon, are distorted by central planner induced changed in the unit of account and the interest rate. And macroeconomic statistics, by design, are blind to the consumption of capital.

This leads us to the key question: what measurements are the central planners supposed to use to determine the right value of the fiat currency? Or the right interest rate? Or the right wage? Or the right price of bread, or ovens? The central planners have macroeconomic statistics like GDP, which have inherent design flaws. The central planner cannot tell creation of capital from destruction. He can see GDP, tax revenues, and employment. All of which may rise with an increase in capital consumption. Both Able and Charlie are employing people, to generate their faux profits.

We conclude part I, with the question: have we proven our case for premise #2, that “only a free market can know the right rate”?

In part II, we will look at the other premise “there is no way a central planner could set the right rate, even if he knew”.

Supply and Demand Fundamentals

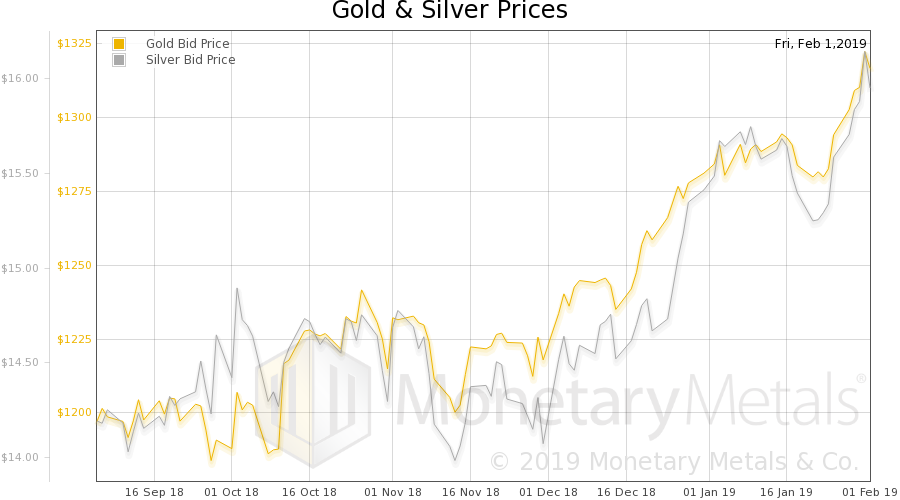

The prices of the metals were up, $14 for gold and ¢14 cents in silver. We have received many comments over the years, asking about our nonstandard language when discussing price. Why do we always say “the price of gold went up” and not “gold went up”? The latter would be easier to type, and it’s shorter. We normally prefer brevity, as it also makes text it easier to reader, and clearer.

But in this case, “gold went up” would do the opposite. It would mislead the reader. It would convey the sense that (1) the dollar is an economic constant and (2) gold became more valuable. Both are false.

And this provides a segue into one of the themes we have seen circulating in the gold community since the President Trump commented that the Fed was raising interest rates too fast, on December 25. The theme is that the Fed is losing credibility.

This theme rises from time to time, like a phoenix from the ashes. We recall it during the go-go years of Quantitative Easing. And again when QE ended. And again when the Fed’s so-called Quantitative Tightening began in fall 2017.

And now, again, that the president seemingly directed the Fed to alter monetary policy. Plus, it should be mentioned, by Dec 24 the stock market (and oil and credit—but not gold) was looking like it was on a bumpy road.

So the logic goes, if the Fed stops hiking rates now, what room will it have to do something to help avert/mitigate the next crisis? It’s kind of like wearing your winter outerwear while sitting in a nice warm restaurant. When you walk out into the night, you will suddenly feel miserable and cold.

Well, it needs to be said: the Fed does not avert or mitigate crises—it causes them. If they don’t lose credibility for causing crises, then what risk to their credibility now? And, if they don’t lose credibility for claiming to avert and mitigate the crises they cause, then why should people suddenly see the Fed in a different light today?

We have said in the past, and we say it again today. You’ll know the Fed is losing credibility when people stop thinking that gold goes up. When they stop thinking of the dollar as the firm reference point, against which up and down are measured.

The first people to arrive at this new paradigm will be the gold community. And conversely, so long as the gold community still thinks of gold going up—still asks Monetary Metals why we insist on the distinction of the gold price going up—then you know that the Fed’s credibility is the same as it ever was.

It’s a constant in the financial world, just like the dollar. A rock that has always been, and will always endure.

Gold and Silver PriceLet’s look at the only true picture of the supply and demand fundamentals of gold and silver. But, first, here is the chart of the prices of gold and silver. |

Gold and Silver Price(see more posts on gold price, silver price, ) |

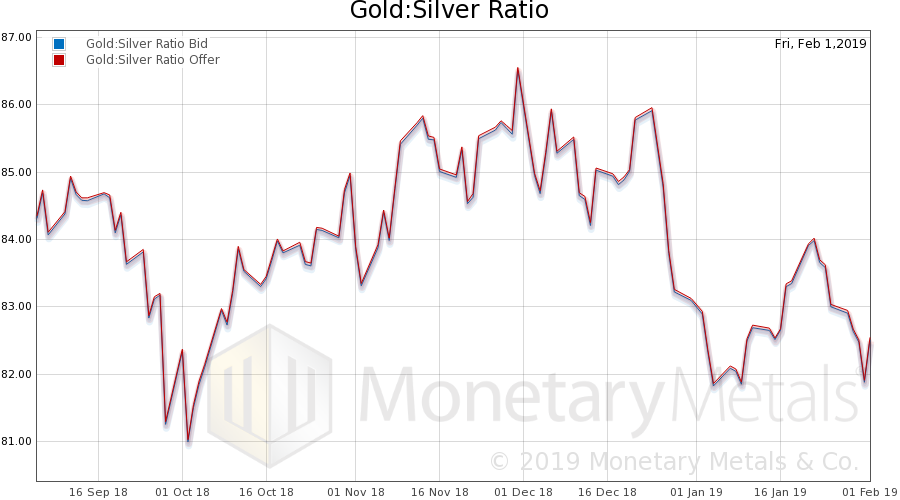

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio (see here for an explanation of bid and offer prices for the ratio). It was falling this week, then rose to end the week up a hair. |

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

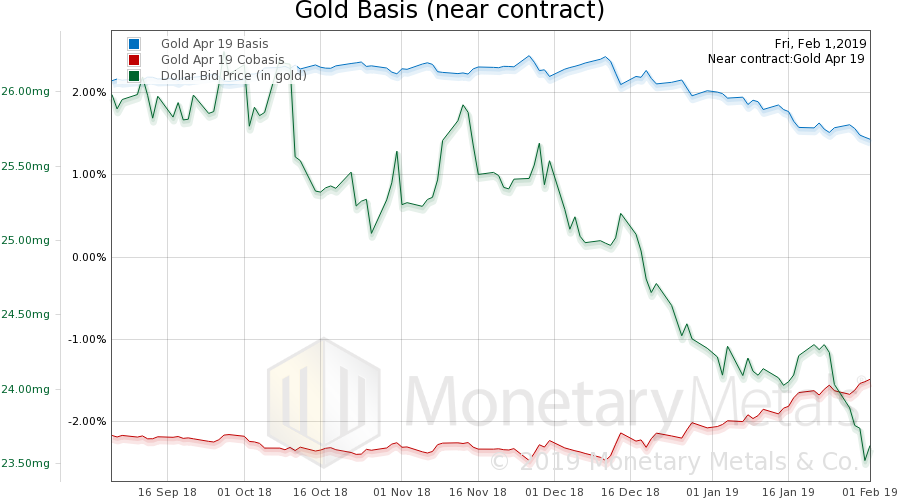

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph showing gold basis, cobasis and the price of the dollar in terms of gold price. As the price of the dollar falls (which we insist is the right way to think of it, not gold going up but the dollar going down), we see gold becoming slightly scarcer. And so it should be no surprise that the Monetary Metals Gold Fundamental Price rose this week, +$41 to $1,391. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

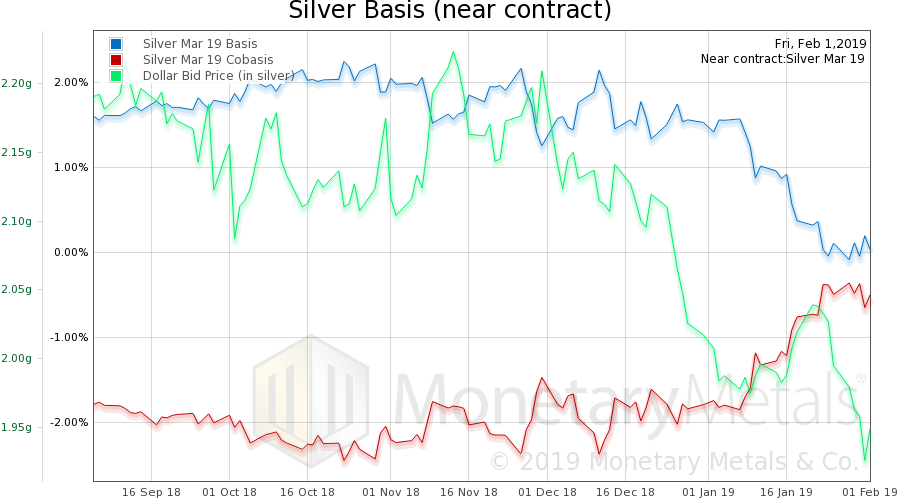

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. The price of silver was up this week, and the scarcity (i.e. cobasis, the red line) held but did not rise further. The Monetary Metals Silver Fundamental Price rose 28 cents, to $16.62. © 2019 Monetary Metals |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Tags: Basic Reports,capital consumption,capital destruction,central planner,Featured,newsletter,right interest rate,right price