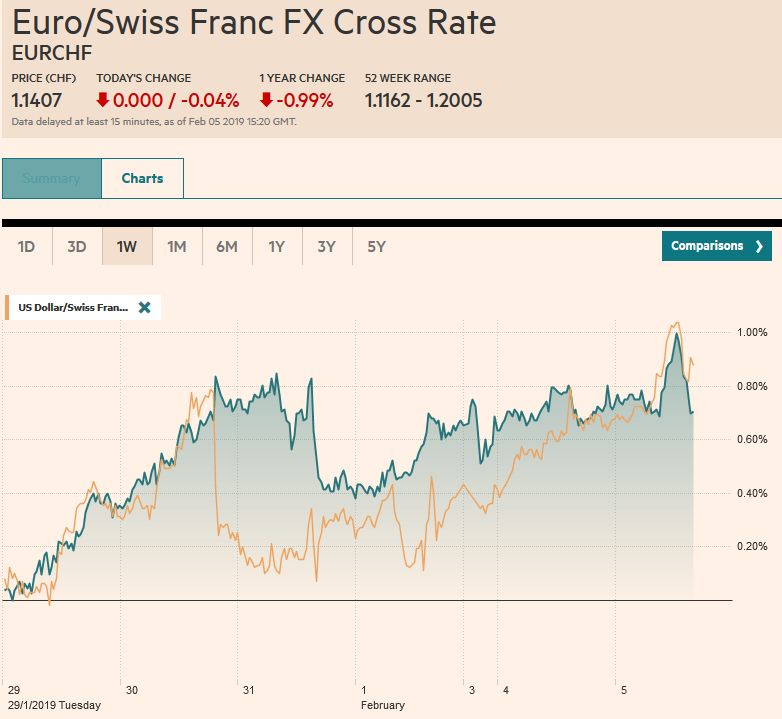

Swiss Franc The Euro has fallen by 0.04% at 1.1407 EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is little firmer against most of the major currencies. Despite some disappointing data (retail sales, trade, PMI), the Australian dollar has recovered from initial losses below %excerpt%.7200 on the back of the central bank’s reluctance to adopt an easing bias. A small upward revision in the eurozone’s flash service and composite PMIs help steady the euro after it neared .14. Most Asian markets remain closed for the Lunar New Year, but the Topix (though not the Nikkei) Australia, Hong Kong, and India edged higher. European

Topics:

Marc Chandler considers the following as important: $CAD. $EUR, 4) FX Trends, AUD, EUR/CHF, Featured, FX Daily, GBP, JPY, MXN, newsletter, Oil, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.04% at 1.1407 |

EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

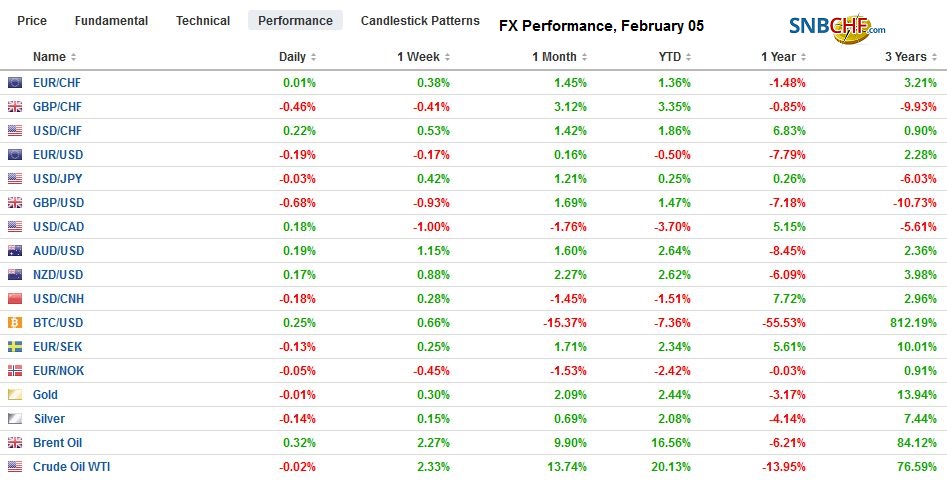

FX RatesOverview: The US dollar is little firmer against most of the major currencies. Despite some disappointing data (retail sales, trade, PMI), the Australian dollar has recovered from initial losses below $0.7200 on the back of the central bank’s reluctance to adopt an easing bias. A small upward revision in the eurozone’s flash service and composite PMIs help steady the euro after it neared $1.14. Most Asian markets remain closed for the Lunar New Year, but the Topix (though not the Nikkei) Australia, Hong Kong, and India edged higher. European shares are firm, with the Dow Jones Stoxx 600 extending its gains for the sixth consecutive session, led by energy and financials. Yesterday’s the S&P 500 extended its gains for the fourth session. Benchmark 10-year yields are mostly a little firmer, though Portugal (the favorite of many) and Italy are bucking the trend. |

FX Performance, February 05 |

Asia Pacific

There is one main story from the region today, and it is Australia. The Reserve Bank met and did not gratify some market calls that it adopt a less hawkish stance. The RBA is sensitive to the link between housing and consumption, but not sufficiently, apparently, to elicit a policy response. The link was evident in the disappointing retail sales. They were expected to be flat in December and instead fell 0.4% after the November series was revised to 0.5% from 0.4%. The January composite PMI was revised to 51.3 from 51.5 (flash). It averaged 53.6 in 2018. Australia also reported a sharp widening in the trade deficit from a revised A$2.26 bln shortfall in November to A$3.68 bln in December. The somber economic readings might not explain why the market jumped. Australia’s equity rally was led by financials, where investors responded well to the government’s report into the banking system did not call for radical change, such a structural reform or even tighter lending practices.

The Japanese economy contracted in Q3 and appears to have recovered in Q4, but uninspiringly so. Today the January composite PMI was reported. It fell to 50.9, nearly matching last year’s lows from September (50.7). It averaged 52.3 in Q4 18 and 51.5 in Q3. Japan’s Q4 GDP will be published next week. After a 0.6% contraction in Q3, it is expected to have expanded by 0.3%.

The Australian dollar is posting a big outside day, trading well beyond yesterday’s lows and highs. It initially was pushed below $0.7200 and found support ahead of the 20-day moving average (~$0.7190) before recovering to $0.7265. Yesterday’s high was near $0.7255. From a technical perspective, a close above there would be constructive. Last week’s high was just shy of $0.7300, and that is the next immediate target. That said, fundamental considerations are not as supportive as the technical considerations, and we would be more inclined to take advantage of the Aussie’s bounce to hedge or lighten up. Meanwhile, the dollar is confined to narrow ranges against the yen around JPY110. There is a $630 mln option struck there that expires today. Yesterday’s high was about JPY110.15. Above there, resistance is likely to be seen near JPY110.30.

Europe

European PMIs were mixed but the reaction in the market is the same. Both the euro and sterling are trading lower. The Eurozone service and composite PMIs were revised higher from the flash readings. The service sector PMI rose to 51.2 from 50.8 of the flash reading to match the December report. The composite rose to 51.0 from 50.7 and 51.1 in December. To the extent that the service sector is driven by domestic considerations and the manufacturing is more about world demand, then today’s PMI gives some hope that domestic conditions are stabilizing. In contrast, the UK’s service PMI’s fell to 50.1 from 51.2, and the composite slumped to 50.3 from 51.4. The composite is the weakest since July 2016, a month after the referendum.

The EMU PMI country breakdown is what one might imagine. Spain remains a bright spot. The service PMI rise to 54.7 from 54.0 and the composite rose to 54.5 from 53.4. Both were above expectations. Germany services PMI was revised a little lower from the flash to 53.0. Recall that last week, the manufacturing PMI was also a touch lower than the flash reading. Nevertheless, the composite reading of 52.1 matched the flash report. France saw both its service and composite readings lifted from the flash report, but it is still contracting. The service PMI stands at 47.8 up from 47.5 (flash), and the composite is at 48.2, better than the 47.9 flash report. Italy disappointed. The service PMI fell to 49.7 from 50.5, and the composite fell to 48.8 from 50 (49.4 was the median forecast in the Bloomberg survey).

The euro fell to almost $1.1410 prior to the PMI releases and is confined to narrow ranges off the lows in the European morning. There are around 1.2 bln euros in options between $1.1385 and $1.1400 that expire today. Initial resistance is seen in the $1.1430-40 area. Sterling is making lower lows for the third session. After testing $1.32 a week ago, it is nearing $1.30 today. There are almost GBP750 in options at $1.3000-10 that expire today, and additional support is seen near $1.2980, where the 20-day moving average is also found. Sterling has not traded below $1.30 since January 23.

America

The economic calendar for the US, Canada, and Mexico is light today. The main feature comes from the US-PMI and ISM for the non-manufacturing sector. It typically is not a market mover. Nor are there Fed officials speaking today, ahead of Powell (and Quarles) tomorrow. The big issues for the market–trade and risk of a new government shutdown–are unresolved. President Trump delivers his belated State of the Union Address tonight in the US, but on Wednesday’s session in Asia.

The US sanctions on Venezuela make trading its bonds more difficult, and reports suggest that JP Morgan is considering dropping it from its main emerging market bond index. This would have a further cooling off effect and force may indexing asset managers to sell, which adds additional pressure on Maduro, as well as raising the cost of economic assistance from Russia and China.

Oil prices are flirting with an important upside break. The March WTI contract has been confined to $50-$55 a barrel for several weeks. It is firm with OPEC+ cuts coupled with disruption from Venezuela and Libya. US rig count has been falling. The $55 level marks an important technical area and a break above it would suggest potential toward $65-$67 a barrel. Such a rally in oil prices would likely weigh on bond prices and yield curves.

The US dollar continues to trade within last Friday’s trading range against the Canadian dollar (CAD1.3070-CAD1.3160). The exchange rate continues to be very sensitive to the equity market. Over the past 30 and 60 sessions, the Canadian dollar and S&P 500 move in the same direction around 85% of the time. It is not coincidental then that as equities tumbled in Q4 18 so did the Canadian dollar. As we have noted, the Canadian dollar rose only one week in Q4 18. The Mexican peso ended a nine-week advance last week, but it is really moving sideways as opposed to pulling back much. Mexico reports its leading economic indicator for December. It had fallen into negative territory in October and deeper in November. A MXN19.00-MXN19.15 range might suffice today.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD. $EUR,$JPY,EUR/CHF,Featured,FX Daily,MXN,newsletter,OIL,USD/CHF