A Korean delegation visited Switzerland’s Crypto Valley last autumn. Representatives from Switzerland’s growing cryptocurrency and blockchain sector say it has matured into a viable and respectable industry that demands to be taken seriously by banks. “The hype, nonsense and scams have gone away,” says Daniel Haudenschild, President of the Crypto Valley Associationexternal link (CVA), referring to a “wild west” phase...

Read More »Complaint filed against Federer and other Instagram influencers

The Swiss Foundation for Consumer Protection accuses Swiss influencers of not correctly labelling certain Instagram posts as advertising. A Swiss consumer protection organisation has filed a complaint against Swiss tennis star Roger Federer and several other celebrity “influencers”, accusing them of “stealth advertising” on Instagram and other social media sites. The Swiss Foundation for Consumer Protectionexternal link...

Read More »Local Government Is an Engine of Inflation

Insolvency isn’t restricted to private enterprise; governments go broke, too. One reason the economy is so much more precarious than advertised is inflation has pushed households and small businesses to the edge–and one engine of that inflation is local government. This is not to dump on local government, which is facing essentially unlimited demands from the public for more services while mandated cost increases in...

Read More »Keith Weiner – Basel III Is Not Good For Gold!

SBTV speaks with Keith Weiner, CEO of Monetary Metals, at The Safe House gold & silver vault in Singapore about the real impact of the Basel III reclassification of gold as a Tier 1 asset. Find out why it is not good for gold. Discussed in this interview: 02:58 Is gold an outdated asset for our modern times? 03:49 Gold is a 'risk free' asset. 04:41 Basel III and its impact on gold 10:49 You cannot inventory gold. 12:38 Crime of '33 - Roosevelt's expropriation of gold 20:11 Outlawing...

Read More »Keith Weiner – Basel III Is Not Good For Gold!

SBTV speaks with Keith Weiner, CEO of Monetary Metals, at The Safe House gold & silver vault in Singapore about the real impact of the Basel III reclassification of gold as a Tier 1 asset. Find out why it is not good for gold. Discussed in this interview: 02:58 Is gold an outdated asset for our modern times? 03:49 Gold is a 'risk free' asset. 04:41 Basel III and its impact on gold 10:49 You cannot inventory gold. 12:38 Crime of '33 - Roosevelt's expropriation of gold 20:11 Outlawing gold...

Read More »Gold Poised to Rise 20% as ‘Second Cold War’ Looms, Strategist Chandler Says

Jun.25 -- Marc Chandler, Bannockburn Global Forex chief market strategist, explains why he is bullish on gold. He speaks on "Bloomberg Markets: What'd You Miss?"

Read More »Gold Poised to Rise 20% as ‘Second Cold War’ Looms, Strategist Chandler Says

Jun.25 -- Marc Chandler, Bannockburn Global Forex chief market strategist, explains why he is bullish on gold. He speaks on "Bloomberg Markets: What'd You Miss?"

Read More »FX Daily, June 26: Biggest Drop in the S&P 500 in June Weighs on Global Equities

Swiss Franc The Euro has risen by 0.06% at 1.109 EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 fell nearly one percent yesterday, its steepest fall this month and this was a weight on Asia Pacific and European activity. Most markets have eased, though not as much as the US did. Hong Kong, India, and Singapore were...

Read More »In The Pit: Keith Weiner, Founder and CEO, Monetary Metals (June 2019)

Monetary Metals is one of the most interesting companies I've come across in a long time. The idea is to fix the long-standing objection to gold as a financial asset in that it "doesn't pay interest." I'm not ready to invest yet, but if they can consistently deliver on what they've started, it could be a game-changer--not just for their investors, but for the entire financial world. https://independentspeculator.com/

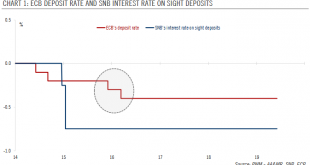

Read More »Swiss monetary policy – it’s (almost) all about the Swiss franc

With the ECB and the Fed both signalling their readiness to provide further stimulus, the Swiss National Bank is unlikely to have smooth sailing over the coming months. How the Swiss National Bank (SNB) reacts to further stimulus by its US and European counterparts will be the key focus of the coming months for investors. We believe that the Swiss central bank will be reluctant to cut rates in direct response to the...

Read More » SNB & CHF

SNB & CHF