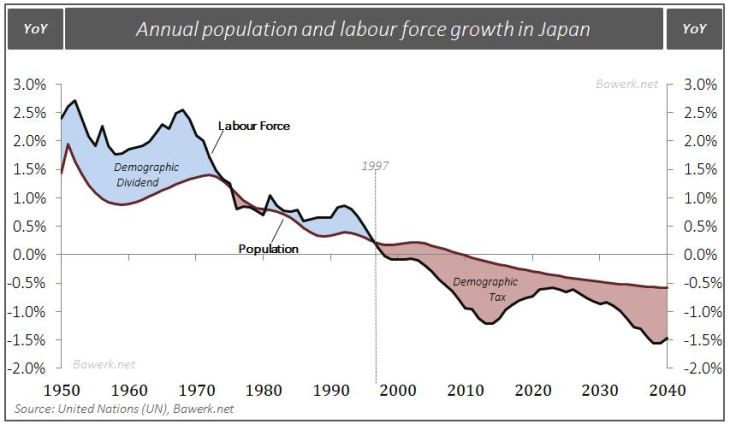

Annual population and labour force growth in Japan Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. As we all know, Japan has a rapidly ageing population whereby the workforce is getting smaller for every day. Japan has had a demographic growth tax ever since 1997 when population growth overtook potential labour force growth. Annual population and labour force growth in Japan – click to enlarge. Annual population and labour force growth in the US The United States on the other hand only started “paying” their demographic tax in 2010 and it was not until very recently it became severe enough to make a large dent in overall growth accounting. If we adjust for the demographic difference between the US and Japan, the Japanese economy has actually performed much better than the US. In other words, given the resources available, Japan has managed to eke out more real growth than the US.

Topics:

Eugen von Böhm Bawerk considers the following as important: Bank of Japan, Central Banks, Economics, Featured, Japan, Monetary Policy, newslettersent, secular stagnation, The United States, US

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Annual population and labour force growth in JapanWhich country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries. As we all know, Japan has a rapidly ageing population whereby the workforce is getting smaller for every day. Japan has had a demographic growth tax ever since 1997 when population growth overtook potential labour force growth. |

|

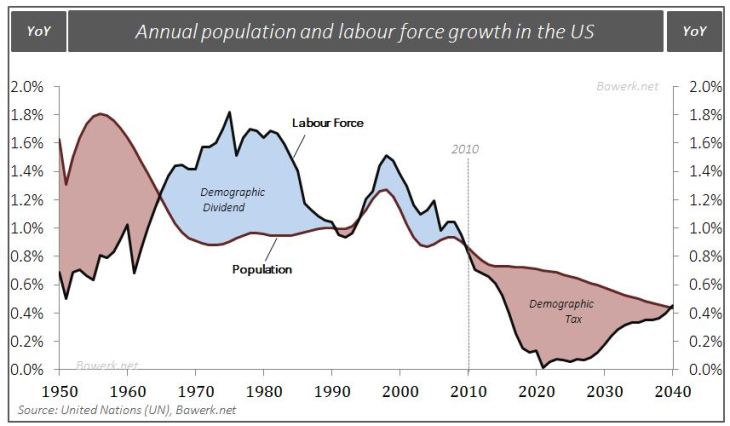

Annual population and labour force growth in the USThe United States on the other hand only started “paying” their demographic tax in 2010 and it was not until very recently it became severe enough to make a large dent in overall growth accounting. If we adjust for the demographic difference between the US and Japan, the Japanese economy has actually performed much better than the US. In other words, given the resources available, Japan has managed to eke out more real growth than the US. That is not to say Japan is growing on a healthy pace, only that they are able to grow faster (or fall less rapidly) than their potential workforce. The US economy have barely managed to keep up with is workforce; and the demographic tax facing the US from here on will only exacerbate the precarious situation. |

|

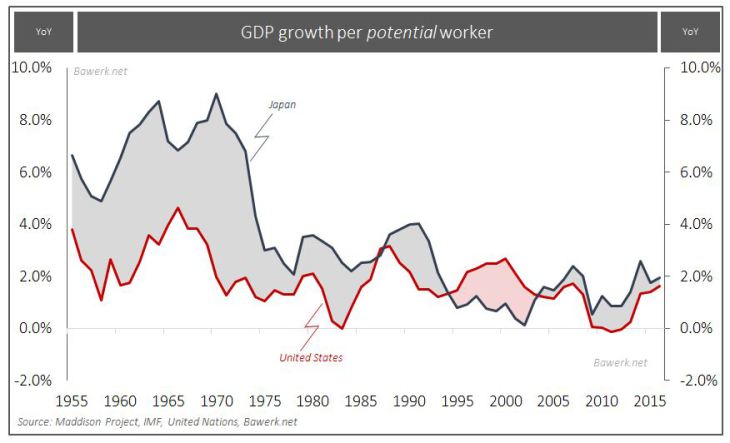

GDP growth per potential workerFacing headwinds like that it is safe to say US growth will remain subdued (not to mention the upcoming recession) in the years ahead. This will obviously wreak havoc with public budget projections as tax revenues fall well short of expectations and secular stagnationists crowding the upper echelons of economic policy circles insist on more fiscal spending. The resulting trillion dollar deficit will presumably be funded at negative interest rates with the strong approval of Keynesian hacks and power hungry policymakers. Needless to say, a structurally low growth environment will be blamed on under-consumption and foolish counter cyclical policies will continue to mend a non-existent problem. |

|

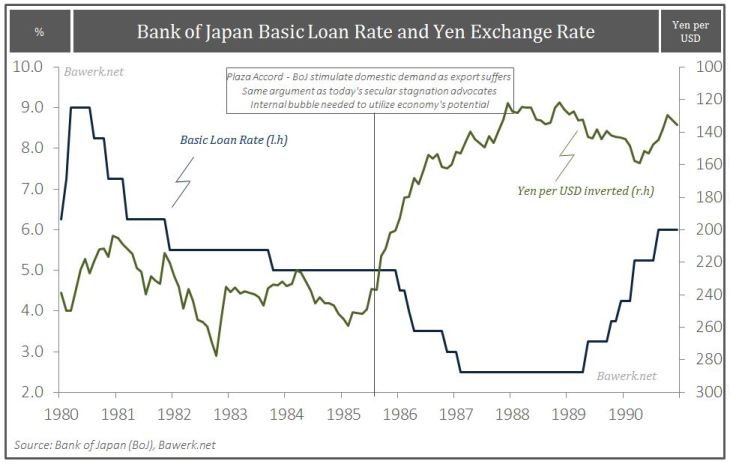

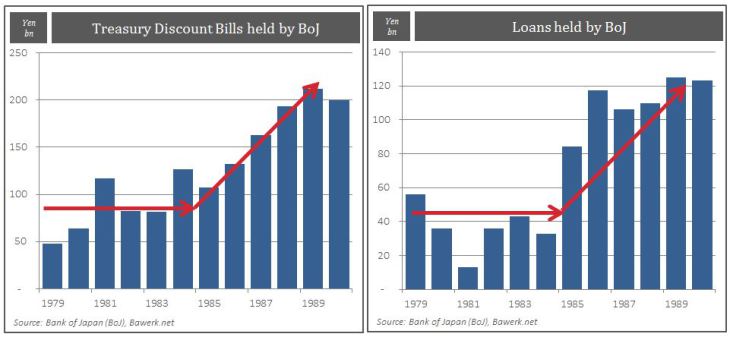

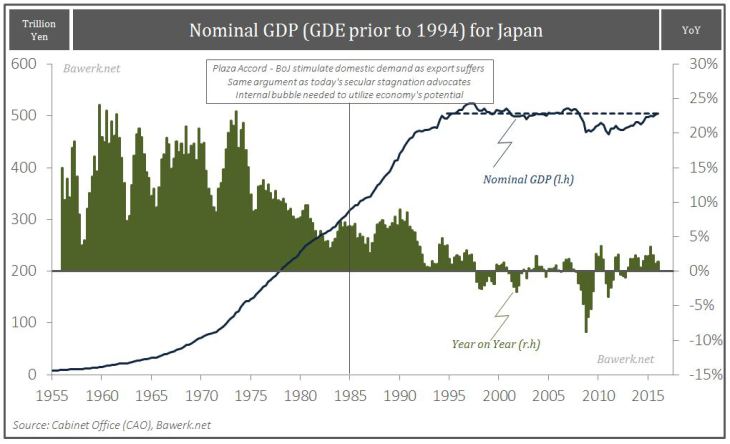

Bank of Japan Basic Loan Rate and Yen Exchange RateWe heard the story before and we know how that turned out for Japan; as the Plaza Accord of September 1985 strengthened the Yen, Japan’s boom was coming to an end. Reduced demand for their products on international markets led the Japanese leadership to conclude that they faced prospects of a secular stagnation (they didn’t call it that at the time) which could only be rectified by boosting internal demand. The Bank of Japan slashed the basic loan rate in half by expanding their purchases of treasury bills and doling out cheap loans. The ensuing bubble gave the impression that boom times would last as Japan transformed its economy from one dependent on manufacturing and exports to one self-propelled by its wn service sector (sounds familiar?).Initially the bubble policy appeared to be working as nominal growth rates held up, but the growing economy was built on the shaky foundation of an expanding balance sheet at lower interest rates engineered by the central bank. |

|

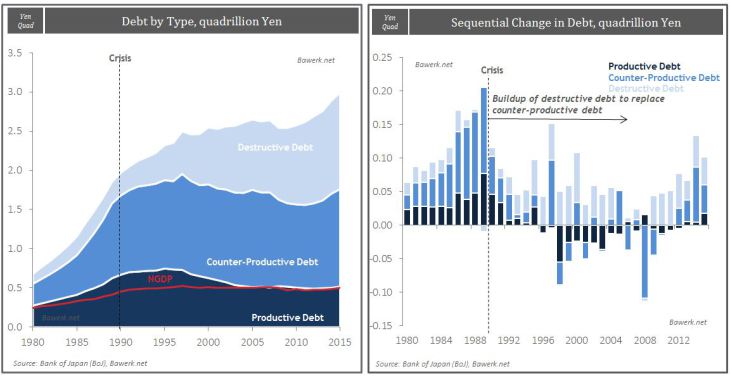

Treasury Discount Bills held by BOJ and Loans held by BOJWhat was really happening was essentially a substitution of productive debt with the intent of making a subsequent sale to counter-productive debt which is not self-liquidating, to maintain the illusion of prosperity. As soon as the Bank of Japan started to raise rates again, counter-productive debt came under pressure as it could not fund itself unless subsidised by the Bank of Japan. When the inevitable bust struck, new bouts of stimuli was applied, but this time counter-productive debt was substituted for pure consumptive, or destructive, debt. |

|

| As Keynesian focus on measured aggregates in the present, they could see nothing wrong with this policy. Lower domestic saving was a signal of a strong economy where little purchasing power would leak out of the circular spending stream whereby one man’s liability is another man’s asset. | |

Nominal GDP for JapanHowever, in the dis-aggregates something was terribly wrong. Old industries were kept alive by cheap credit, consuming the capital that should bring life to new ones, cementing the pre-Plaza Accord system that were ill fit for the new reality. Believing the post-Plaza Accord policy of bubble blowing was working, the Japanese continued with ZIRP (now NIRP) and QE in order to re-establish Japan’s glory days. Unsurprisingly, it did not work. Income, as measured by nominal GDP stagnated while outlays kept growing alongside the gargantuan public debt burden. |

It is within this environment of utter incompetence by the Japanese leadership the economy of Japan, adjusted for its dire demographic situation, manage to beat the US! Think about that for a second and what it means for the prospects of the US economy. The United States is doing the exact same mistakes as Japan did and the lesson will be the same; stagnation.

Instead of changing course, economists justify their ineptitude with made-up concepts such as a permanently reduced r* to prove the secular stagnation thesis. Fiscal spending funded by debt issuance at negative rates is next stop on this journey of madness, secured in central banks with nominal GDP targets.