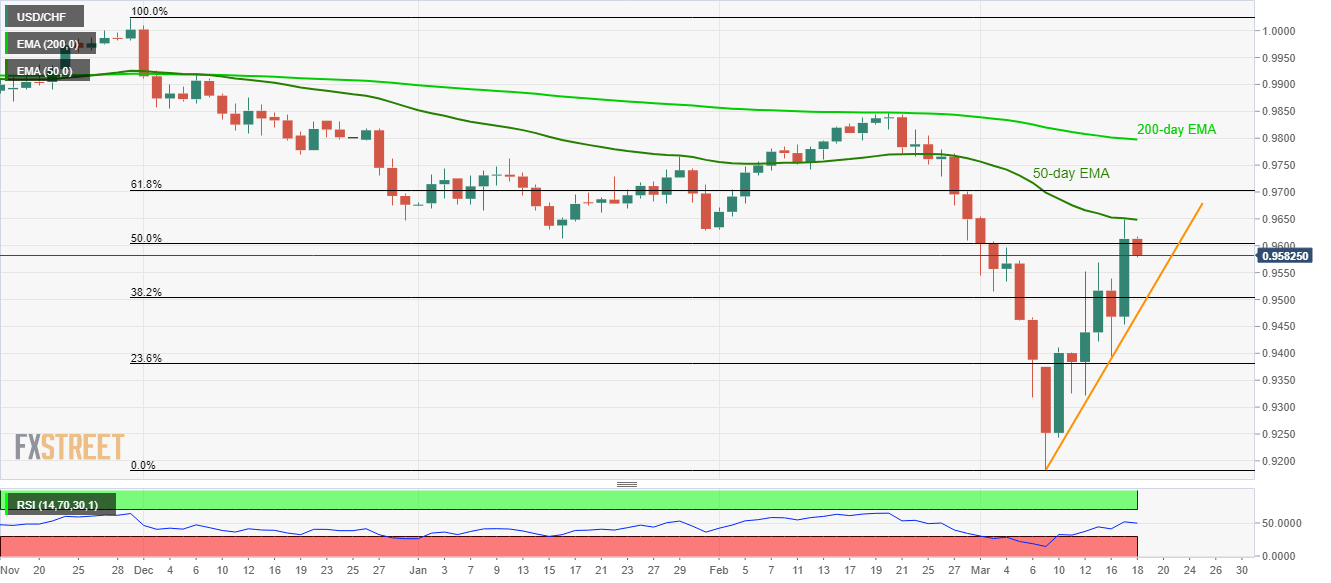

USD/CHF slips from a two-week high. 61.8% Fibonacci retracement, 200-day EMA add to the resistances. While extending its U-turn from 50-day EMA, USD/CHF drops 0.30% to 0.9583 ahead of the European session on Wednesday. The pair currently declines towards 38.2% Fibonacci retracement of its fall from November 2019, at 0.9500. However, an upward sloping trend line since March 09, near 0.9470 now, could restrict further downside. In a case where the bears dominate past-0.9470, 0.9400 and 0.9320 will offer intermediate halts to the pair’s southward trajectory towards the monthly low around 0.9180. Meanwhile, a daily closing beyond 50-day EMA level of 0.9650 needs to overcome 61.8% of Fibonacci retracement, close to 0.9700, ahead of confronting 200-day EMA figures

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

While extending its U-turn from 50-day EMA, USD/CHF drops 0.30% to 0.9583 ahead of the European session on Wednesday. The pair currently declines towards 38.2% Fibonacci retracement of its fall from November 2019, at 0.9500. However, an upward sloping trend line since March 09, near 0.9470 now, could restrict further downside. In a case where the bears dominate past-0.9470, 0.9400 and 0.9320 will offer intermediate halts to the pair’s southward trajectory towards the monthly low around 0.9180. Meanwhile, a daily closing beyond 50-day EMA level of 0.9650 needs to overcome 61.8% of Fibonacci retracement, close to 0.9700, ahead of confronting 200-day EMA figures surrounding 0.9800. Should there be a clear run-up past-0.9800, November month highs close to 1.0023 may lure the bulls. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Pullback expected

Tags: Featured,newsletter,USD/CHF