Swiss National Bank leaves expansionary monetary policy unchanged and adjusts basis for calculating negative interest on sight deposits at SNB The Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Furthermore, the National Bank is adjusting the basis for calculating negative interest on sight deposits at the SNB. The expansionary monetary policy continues to be necessary given the latest international developments and the inflation outlook in Switzerland. The situation on the foreign exchange market is still fragile, and the Swiss franc has appreciated in trade-weighted

Topics:

Swiss National Bank considers the following as important: 1.) SNB Press Releases, 1) SNB and CHF, Featured, newsletter, Switzerland inflation

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss National Bank leaves expansionary monetary policy unchanged and adjusts basis for calculating negative interest on sight deposits at SNBThe Swiss National Bank is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. It remains willing to intervene in the foreign exchange market as necessary, while taking the overall currency situation into consideration. Furthermore, the National Bank is adjusting the basis for calculating negative interest on sight deposits at the SNB. The expansionary monetary policy continues to be necessary given the latest international developments and the inflation outlook in Switzerland. The situation on the foreign exchange market is still fragile, and the Swiss franc has appreciated in trade-weighted terms. It remains highly valued. Negative interest and the willingness to intervene are important in order to counteract the attractiveness of Swiss franc investments and thus ease pressure on the currency. In this way, the SNB stabilises price developments and supports economic activity. The SNB is adjusting the basis for calculating negative interest as follows. Negative interest will continue to be charged on the portion of banks’ sight deposits which exceeds a certain exemption threshold. However, this exemption threshold will now be updated monthly and thereby reflect developments in banks’ balance sheets over time. This adjustment to the calculation basis takes account of the fact that the low interest rate environment around the world has recently become more entrenched and could persist for some time yet. The adjustment raises the exemption threshold for the banking system and reduces negative interest income for the SNB. The new exemption threshold calculation comes into effect on 1 November 2019. |

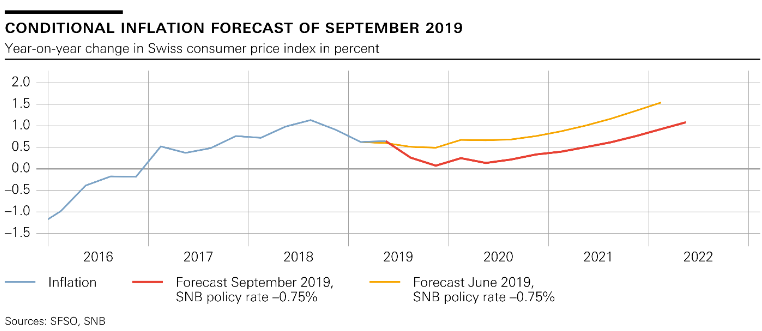

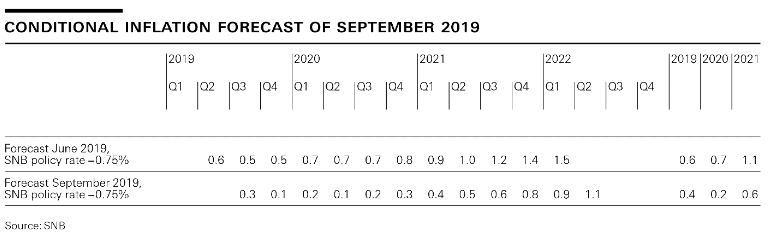

SNB Switzerland Conditional Inflation Forecast, September 2019(see more posts on Switzerland inflation, ) |

| The SNB regularly reviews the basis for calculating negative interest and adjusts it as necessary, in order to ensure room for manoeuvre in monetary policy going forward. The negative interest charge is to be limited to what is necessary, however. More information on the calculation of the exemption threshold can be found in the attached instruction sheet.

The new conditional inflation forecast is lower than in June. This is primarily due to weaker growth and inflation prospects abroad and the stronger Swiss franc. The forecast for the current year has been reduced slightly to 0.4%, from 0.6% in the previous quarter. For 2020, the SNB now expects an inflation rate of 0.2%, compared to 0.7% last quarter. The inflation rate increases to 0.6% in 2021; in the previous quarter, a rise to 1.1% had been forecast. The conditional inflation forecast is based on the assumption that the SNB policy rate remains at –0.75% over the entire forecast horizon. Global economic signals have deteriorated in recent months due to heightened trade tensions and political uncertainty. Economic growth around the world slowed in the second quarter, and manufacturing output has since been showing signs of weakening. The economic slowdown is being accompanied by subdued capital spending and a decline in the global trade in goods. Employment growth in the advanced economies was also slower than in previous quarters. In light of the heightened economic risks and modest inflation dynamics, various central banks have adjusted their monetary policy stance and lowered their key rates. In its new baseline scenario for the global economy, the SNB is revising down its growth forecast for the coming quarters. Over the short term, international momentum is likely to be modest. However, in the medium term the SNB expects the global economy to pick up again, not least due to monetary policy easing measures. Inflation is then expected to rise again gradually. Risks to the global economy remain tilted to the downside. Chief amo ng them are st ill political uncertainty and trade tensions, which could lead to renewed turbulence on the financial markets and a further dampening of economic sentiment. The Swiss economy continued to grow at a moderate rate in the second quarter. Developments on the labour market also remained positive. Employment figures continued to rise, and the unemployment rate remained stable at a low level. The deterioration of the international economic environment will likely cause growth to weaken temporarily. The SNB expects growth of between 0.5% and 1% for 2019 as a whole, compared to around 1.5% in June. The forecast adjustment is largely attributable to the fact that GDP growth rates for the second half of 2018 and the first quarter of 2019 were revised downwards. Imbalances persist on the mortgage and real estate markets. Both mortgage lending and prices for single-family homes and privately owned apartments continued to rise slightly in recent quarters, while prices in the residential investment property segment declined somewhat. Nevertheless, due to the strong price increases in recent years and growing vacancy rates there is the risk of a correction in this segment in particular. The SNB therefore welcomes the latest revision of the self-r egulation guidelines for banks in the area of investment properties. It will continue to monitor developments on the mortgage and real estate markets closely, and will regularly reassess the need for an adjustment of the countercyclical capital buffer. |

Conditonal Inflation Forecast of September 2019 |

Tags: Featured,newsletter,Switzerland inflation