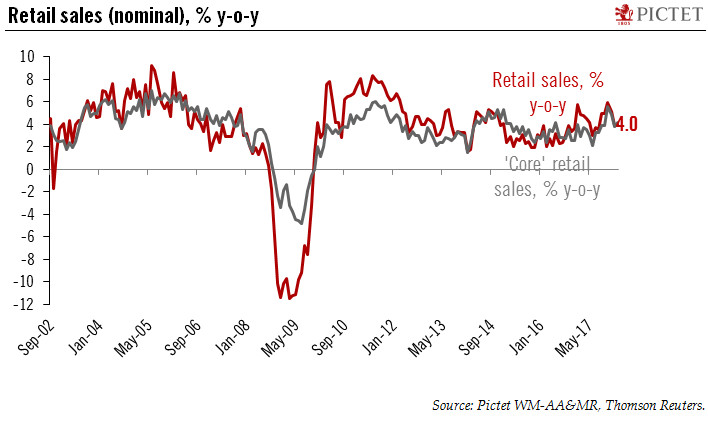

Retail sales posted their third consecutive monthly decline in February, but there is no need to worry, for now.The US consumer has shown surprising stinginess lately. Soft February retail sales data continue the uneven pattern of consumption data since the beginning of the year. On a y-o-y basis (and nominal terms) they were up only 4.0% in February, below the 1-year average of 4.4%.This soft consumption data is even more surprising as all consumption signals are flashing green for the US consumer.For now there is probably no need to worry about the US consumer. Fundamentals remain in good shape, the labour market remains very solid, consumers are feeling great, and credit card debt (a major driver of US consumption) continues to flow freely. At the same time, it is also possible we

Topics:

Thomas Costerg considers the following as important: Macroview, US consumer spending

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Retail sales posted their third consecutive monthly decline in February, but there is no need to worry, for now.

The US consumer has shown surprising stinginess lately. Soft February retail sales data continue the uneven pattern of consumption data since the beginning of the year. On a y-o-y basis (and nominal terms) they were up only 4.0% in February, below the 1-year average of 4.4%.

This soft consumption data is even more surprising as all consumption signals are flashing green for the US consumer.

For now there is probably no need to worry about the US consumer. Fundamentals remain in good shape, the labour market remains very solid, consumers are feeling great, and credit card debt (a major driver of US consumption) continues to flow freely. At the same time, it is also possible we might start to see the first negative side-effects of a strong economy – namely the stepped-up pricing power of corporates at the expense of the consumer. In other words: inflation, at the expense of consumption volumes.

In the near term, this consumption softness may dent Q1 GDP growth – 3.0% quarterly growth seems now out of reach. But we keep our annual forecast of 3.0% GDP growth unchanged for now – especially as we still bet on a catch-up in consumption in Q2-2018 based on still-solid fundamentals.

This recent data is unlikely to affect the Federal Reserve’s view – the Fed is as much focused on hard data as it is on forward looking surveys, which remain very solid. Q1 consumption softness is likely to be seen as a temporary hiccup.