History of Gold - How the gold industry has changed over 50 years Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years. Topics covered and interesting historical facts to note include: - Gold market size- Gold mine production "peaked in 2015"- South African production collapse from 1,000 tonnes- South African gold was flown to London and Zurich and an airliner had its own designated landing areas at Heathrow where gold moved directly from the place to secure vaults- It may still do – that is shrouded in secrecy!- Political concerns in France in 1968 saw massive demand- Strong demand in Japan in late 1980s when insurance companies were investing up to 3% of portfolios in gold- Record demand in the wake of the financial crisis- Investment in gold - Coin and bar demand rising globally- Massive uptake of bullion in the Far East, especially China- History of gold shows gold's continuing importance as safe haven asset Demand for physical gold investment. Source: GFMS Gold Survey GFMS Gold Survey is recognized as an important source of information on developments in the gold market and have celebrated the Gold Survey’s 50th anniversary, by conducting a high-level look at the history of the gold market in the past half century.

Topics:

GoldCore considers the following as important: Bitcoin, Bullion, Business, China, Crude, Far East, Finance, France, GFMS, Gold, Gold as an investment, Hedge, Hong Kong, Housing Market, India, Insurance Companies, Japan, London bullion market, Matter, Money, Precious Metals, Reuters, Silver as an investment, Silver Institute, Sovereigns, Zurich

This could be interesting, too:

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Claudio Grass writes Year in review: A tectonic shift has only just begun

investrends.ch writes Bitcoin – Rekord liegt jetzt bei mehr als 106’000 Dollar

History of Gold - How the gold industry has changed over 50 years

Thomson Reuters GFMS have compiled an interesting high level history of the gold industry in the last fifty years.

Topics covered and interesting historical facts to note include:

- Gold market size

- Gold mine production "peaked in 2015"

- South African production collapse from 1,000 tonnes

- South African gold was flown to London and Zurich and an airliner had its own designated landing areas at Heathrow where gold moved directly from the place to secure vaults

- It may still do – that is shrouded in secrecy!

- Political concerns in France in 1968 saw massive demand

- Strong demand in Japan in late 1980s when insurance companies were investing up to 3% of portfolios in gold

- Record demand in the wake of the financial crisis

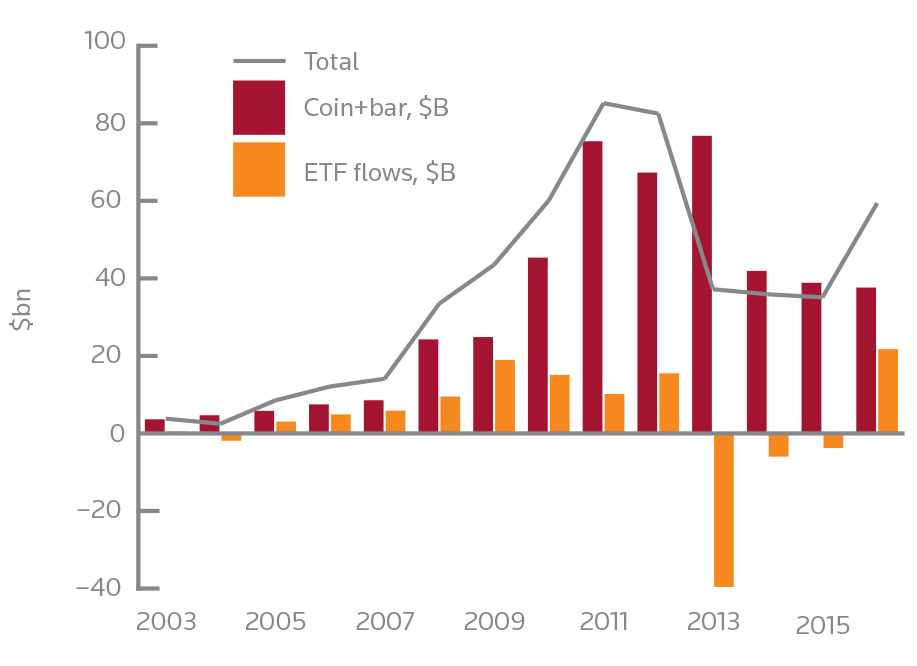

- Investment in gold - Coin and bar demand rising globally

- Massive uptake of bullion in the Far East, especially China

- History of gold shows gold's continuing importance as safe haven asset

Demand for physical gold investment. Source: GFMS Gold Survey

Demand for physical gold investment. Source: GFMS Gold Survey

GFMS Gold Survey is recognized as an important source of information on developments in the gold market and have celebrated the Gold Survey’s 50th anniversary, by conducting a high-level look at the history of the gold market in the past half century.

Access How the gold industry has changed over 50 years here

News and Commentary

Gold steady as US political concerns pressure dollar; stocks drop (Reyters)

Gold scores first back-to-back gains in nearly 2 weeks as dollar steadies (Marketwatch)

U.S. Stocks Drop as Treasuries Rise, Crude Rallies (Bloomberg)

Bitcoin crosses $1,800 for first time - Adds $3 billion in market cap in four days (CNBC)

Rebound in U.S. Wholesale Prices Signals Inflation Pressures (Bloomberg)

Global Silver Mine Production Drops in 2016 for First Time in 14 Years (Silver Institute)

Golden review: How the gold industry has changed over 50 years (Thomson Reuters)

China’s private investor gold surge seen as strong signal (Mining Weekly)

Bill Blain: "Something Is Happening In Europe And We Don’t Know What It Is…" (Zerohedge)

Hurricane Bearing Down on the Casino - Stockman (Daily Reckoning)

Gold Prices (LBMA AM)

12 May: USD 1,227.90, GBP 955.06 & EUR 1,129.55 per ounce

11 May: USD 1,221.00, GBP 945.66 & EUR 1,122.95 per ounce

10 May: USD 1,222.95, GBP 944.61 & EUR 1,124.99 per ounce

09 May: USD 1,225.15, GBP 948.51 & EUR 1,124.20 per ounce

08 May: USD 1,229.70, GBP 948.71 & EUR 1,123.45 per ounce

05 May: USD 1,239.40, GBP 958.06 & EUR 1,130.33 per ounce

04 May: USD 1,235.85, GBP 958.15 & EUR 1,131.05 per ounce

Silver Prices (LBMA)

12 May: USD 16.30, GBP 12.68 & EUR 14.99 per ounce

11 May: USD 16.37, GBP 12.70 & EUR 15.06 per ounce

10 May: USD 16.29, GBP 12.59 & EUR 14.99 per ounce

09 May: USD 16.22, GBP 12.55 & EUR 14.88 per ounce

08 May: USD 16.38, GBP 12.64 & EUR 14.96 per ounce

05 May: USD 16.27, GBP 12.58 & EUR 14.85 per ounce

04 May: USD 16.50, GBP 12.80 & EUR 15.09 per ounce

Recent Market Updates

- U.S. Gold Exports To China and India Surge In 2017

- The Dream of the Central Banker

- Silver Investment Case Remains Extremely Compelling

- Gold Coins, Bars In Demand – +9% In Q1, 2017

- Irish Property Bubble – 38pc Believe Housing Market Will Crash

- Silver Bullion On Sale After 10.6% Fall In Two Weeks

- London Property Bubble Vulnerable To Crash

- Silver price manipulation, is regulation putting a stop to it?

- Trump 100, Margin Debt Stock Bubble and Gold

- Gold Bullion Imports Into China via Hong Kong More Than Doubles in March

- LePen Euro Frexit Panic Over – “For Now”

- Gold Sovereigns – ‘Treasure’ Trove Found In UK – Don’t Be The Piano Owner

- Silver, Platinum and Palladium as Investments – Research Shows Diversification Benefits