It looks like BoJ Governor, Haruhiko Kuroda’s, minions are getting out and about to brief the financial news services that the biggest stimulator of all the central banks might reduce stimulus earlier than expected. The recipient of the unofficial briefings by BoJ officials is Reuters, which has this to say. The Bank of Japan is dropping subtle, yet intentional, hints that it could edge away from crisis-mode stimulus earlier than expected, through a future hike in its yield target,...

Read More »Bi-Weekly Economic Review: A Whirlwind of Data

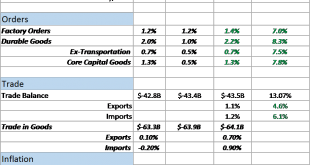

The economic data of the last two weeks was generally better than expected, the Citigroup Economic Surprise index near the highs of the year. Still, as I’ve warned repeatedly over the last few years, better than expected should not be confused with good. We go through mini-cycles all the time, the economy ebbing and flowing through the course of a business cycle. This being a particularly long half cycle, it has had...

Read More »Bi-Weekly Economic Review: Gridlock & The Status Quo

The good news is that the economy just printed its second consecutive quarter of 3% growth, a feat not accomplished since Q2 and Q3 2014. The bad news is that the growth spurt in 2014 was better, quantitatively and qualitatively. Those two quarters produced gains of 4.6% and 5.2% (annualized) in GDP, much better than the most recent 3.1% and 3% prints of Q2 and Q3 2017. And it took a hurricane to get the most recent...

Read More »Global Asset Allocation Update

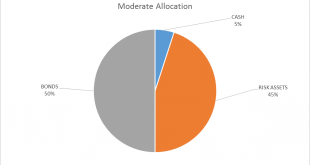

The risk budget this month shifts slightly as we add cash to the portfolio. For the moderate risk investor the allocation to bonds is unchanged at 50%, risk assets are reduced to 45% and cash is raised to 5%. The changes this month are modest and may prove temporary but I felt a move to reduce risk was prudent given signs of exuberance – rational, irrational or otherwise. Moderate Allocation - Click to enlarge No...

Read More »Bonds And Soft Chinese Data

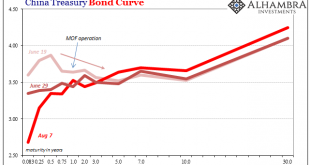

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year. China Treasury Bonds(see more posts on china...

Read More »Bi-Weekly Economic Review: Yawn

When I wrote the update two weeks ago I said that we might be nearing the point of maximum optimism. Apparently, there is another gear for optimism in this market as stocks have just continued to slowly but surely reach for the sky. Which is fine I suppose since we own the devils (although not much in the way of the US variety) but I can’t help but wonder what happens when the spell breaks. Goldilocks may be in the...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

Read More »Bi-Weekly Economic Review: Maximum Optimism?

The economic reports of the last two weeks were generally of a more positive tone. The majority of reports were better than expected although it must be noted that many of those reports were of the sentiment variety, reflecting optimism about the future that may or may not prove warranted. Markets have certainly responded to the dreams of tax reform dancing in investors’ heads with US stock markets providing a steady...

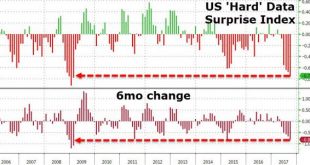

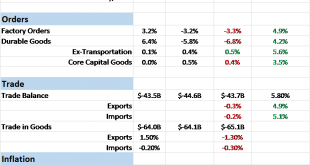

Read More »Dollar & Stocks Jump; Bonds & Bullion Dump In Lowest Volatility September Ever

It has now been 318 trading days since the S&P 500 suffered a 5% drawdown – the 4th-longest streak since 1928… So everything is awesome… [embedded content] BUT…US ‘hard’ economic data has not been this weak (and seen the biggest drop) since Feb 2009… US Data Surprise Index, 2006 - 2017 - Click to enlarge Q3 Was a Roller-Coaster… Q3 was the 8th straight quarterly gain in a row for The Dow – the longest streak...

Read More »Bi-Weekly Economic Review: As Good As It Gets

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org