The yield on the 10 year Treasury note briefly surpassed the supposedly important 3% barrier and then….nothing. So, maybe, contrary to all the commentary that placed such importance on that level, it was just another line on a chart and the bond bear market fear mongering told us a lot about the commentators and not a lot about the market or the economy. As I said last month, despite the recent run up in rates, the...

Read More »Bi-Weekly Economic Review: Interest Rates Make Their Move

How quickly things change in these markets. In the report two weeks ago, the markets reflected a pretty obvious slowing in the global economy. In the course of two weeks, what seemed obvious has been quickly reversed. The 10-year yield moved up a quick 20 basis points in just a week, a rise in nominal growth expectations that was mostly about inflation fears. The economic news over the last two weeks does not appear to...

Read More »Bi-Weekly Economic Review: Investing Is Not A Game of Perfect

The market volatility this year has been blamed on a lot of factors. The initial selloff was blamed on a hotter than expected wage number in the January employment report that supposedly sparked concerns about inflation – although a similar number this month wasn’t mentioned as a cause of last Friday’s selling. The unwinding of the short volatility trade exacerbated the situation and voila, 12% came off the market in a...

Read More »Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s...

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

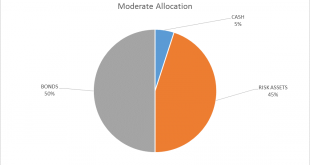

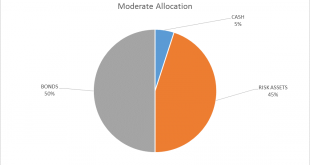

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

Read More »Bi-Weekly Economic Review: One Down, Three To Go

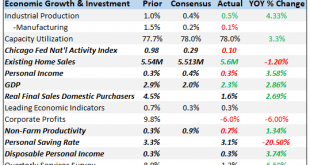

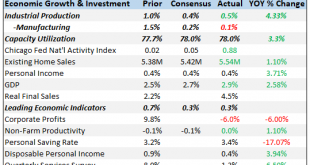

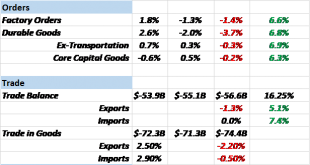

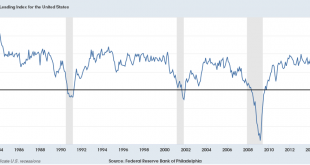

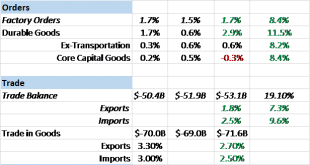

Economic Reports Economic Growth & Investment We pay particular attention to broad based indicators of growth. The Chicago Fed National Activity Index and the Conference Board’s Leading Economic Indicators are examples. We watch them because we are mostly interested in identifying inflection points in the broad economy and aren’t as interested in the details. Why? Because, while bear markets do happen outside of...

Read More »Bi-Weekly Economic Review

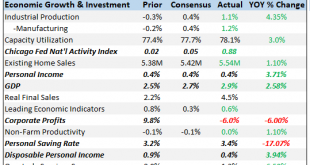

Economic Reports Economic Growth & Income Personal income for December was better than expected at up 0.4% on the month and 4.11% year over year. Wages and salaries were up 0.5%. Unfortunately, that rate of rise is not even up to the lower end of the range we’ve seen in past expansions when 5% income growth was a precursor to recession. Still, it is, sadly, about average for this expansion. Two items in this...

Read More »Global Asset Allocation Update:

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. Despite the selloff of the last week I don’t believe any portfolio action is warranted. While the overbought condition has largely been corrected now, the S&P 500 is far from the opposite condition, oversold. At the lows this morning, the S&P 500 was officially in...

Read More »Cool Video: Bloomberg Double Feature–BOE Meeting and the Yield Curve

- Click to enlarge The Bank of England meets tomorrow. Although no one expects a move, it has little to do with the recent market volatility. The FTSE 100 is poised to snap a six-day 7%+ slide. The FTSE 250 fell for seven consecutive sessions through yesterday, shedding 5.75% in the process. The UK’s 2-year yield slipped about seven basis points from last week’s close to58 bp before recovering to 63 bp today,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org