Three years after we first identified the former head of UBS's gold desk in Zurich as someone directly implicated in the rigging of precious metals prices, Bloomberg reports that Andre Flotron, a Swiss resident, was arrested while visiting the U.S., according to people familiar with the matter. Having been "on leave" since 2014, it appears Andre's hope that he was gone but "keen to return in due time" are now up in smoke. As Bloomberg reports, Flotron was...

Read More »Hard times continue for Swiss private banks

Numbers of banks in Switzerland have shrunk since the financial crisis. Over half of private banks in Switzerland analysed by KPMG last year experienced net outflows of client cash. In a difficult period for finance, many could be forced to shut down or be bought out. “Implement truly radical change, or continue to see performance deteriorate.” This was the message of a study released Thursday by audit group KPMG with...

Read More »Auf Schweizer Qualität setzen, aber richtig

Schweizer Aktien sind eine ausgezeichnete Anlagemöglichkeit für Investoren auf der Suche nach hoher Qualität und geringem Risiko. Die Experten von UBS Asset Management wissen, wonach man suchen muss. In einer oftmals turbulenten Welt war die Schweiz schon immer eine Insel der Stabilität. Und so ist es auch heute noch. Kein Wunder also, dass Schweizer Aktien bei einheimischen und internationalen...

Read More »Six Banks Join UBS’s “Utility Coin” Blockchain Project

Here’s a piece of news that the remaining human members of Wall Street’s FX sales and trading desks probably don’t want to hear. According to the Financial Times, six of the world’s largest banks have decided to join a blockchain project called “utility coin” that will allow banks to settle trades in securities denominated in different currencies without a money transfer. What’s worse, the banks expect to begin...

Read More »So können Anleger den passenden Smart Beta Index wählen

Ein passender Basisindex und das richtige Produkt sind die Grundlage für indexierte Investments. Insbesondere die Benchmark spielt dabei eine bedeutende Rolle und kann die Performance stark beeinflussen, so die Experten der UBS. Investoren treffen bei indexierten Anlagen zwei Entscheidungen: Zum einen müssen sie sich aus einer Vielzahl an Möglichkeiten für den richtigen Index entscheiden, der...

Read More »Swiss Asset Manager Settles US Tax Evasion Charges

Under the US Department of Justice’s 2013 ‘Swiss Bank Program’, 80 Swiss or Swiss-based banks paid $1.36 billion in fines for helping clients evade US taxes (Keystone) The Geneva asset management firm Prime Partners has agreed to pay $5 million (CHF4.8 million) to the United States to settle charges for tax evasion and assisting US taxpayers in opening and maintaining undeclared foreign bank accounts from 2001 to 2010....

Read More »Would you take a pilotless plane?

Commercial aircraft already take off and land using their on-board computers (Keystone) Pilotless cargo and passenger planes could be in use within eight years and save airlines billions, according to a report by Swiss bank UBS. But customers remain wary of the new technology despite potential fare reductions. “In the not-too-distant future, we would expect to see a situation where flights are pilotless or the number of...

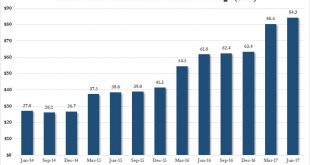

Read More »“Mystery” Central Bank Buyer Revealed: SNB Now Owns A Record $84 Billion In US Stocks

In the second quarter of the year, one in which unlike in Q1 fund flows showed a persistent and perplexing outflow from US stocks and into European and Emerging Markets, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: the Japanese...

Read More »Can Switzerland Survive Today’s Assault On Cash And Sound Money?

Authored by Marcia Christoff-Kurapovna via The Mises Institute, “Switzerland will have the last word,” wrote Victor Hugo in the late 19th century. “It possesses one of the most perfect forms of government in the world.” A contemporary of his, Frederick Kuenzli, a scholar of the Swiss Army, boasted: “No purer type of Republican ideals, no more fixed and devoted adherence to those ideals can be found in all the world...

Read More »Swiss Banks Paid Out €1 Billion In Negative Interest Rates In The First Half

Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below. There was one notable –...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org