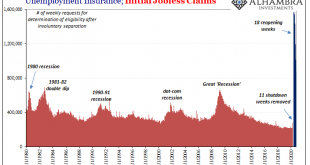

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state. Government officials have decided to pause their efforts for two weeks so as to try and sort out what “might” be widespread fraud. The state is also using this time to get after a substantial backlog of previous initial claims yet to be...

Read More »Who’s Negative? The Marginal American Worker

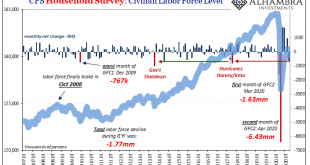

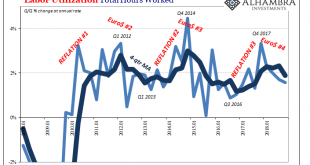

The BLS’s payroll report draws most of the mainstream attention, with the exception of the unemployment rate (especially these days). The government designates the former as the Current Employment Statistics (CES) series, and it intends to measure factors like payrolls (obviously), wages, and earnings from the perspective of the employers, or establishments. The Establishment Survey. Its cousin is called the Household Survey, or CPS, the Current Population Survey,...

Read More »Disposable (Employment) Figures

If last month’s payroll report was declared to be strong at +128k, then what would that make this month’s +266k? Epic? Heroic? The superlatives are flying around today, as you should expect. This Payroll Friday actually fits the times. It wasn’t great, they never really are nowadays (when you adjust for population and participation), but it was a good one nonetheless. November 2019, according to the BLS, was the first month since January to register better than...

Read More »For Labor And Recession, The Bad One

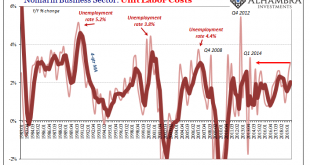

There’s a couple of different ways that Unit Labor Costs can rise. Or even surge. The first is the good way, the one we all want to see because it is consistent with the idea of an economy that is actually booming. If workers have become truly scarce as macro forces sustain actual growth such that all labor market slack is absorbed, then businesses have to compete for them bidding up the price of marginal labor. This is, of course, the exact scenario we’ve been...

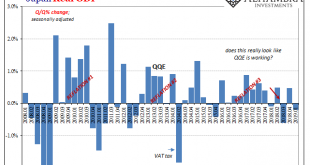

Read More »Why The Japanese Are Suddenly Messing With YCC

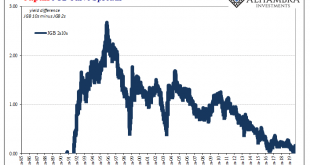

While the world’s attention was fixated on US$ repo for once, the Bank of Japan held a policy meeting and turned in an even more “dovish” performance. Likely the global central bank plan had been to combine the Fed’s second rate cut with what amounted to a simultaneous Japanese pledge for more “stimulus” in October. Both of those followed closely an ECB which got itself back in the QE business once more. But all that likely coordinated “accommodation” was spoiled...

Read More »Effective Recession First In Japan?

For a lot of people, a recession is two consecutive quarters of negative GDP. This is called the technical definition in the mainstream and financial media. While this specific pattern can indicate a change in the business cycle, it’s really only one narrow case. Recessions are not just tied to GDP. In the US, the Economists who make the determination (the NBER) will tell you recessions aren’t always so...

Read More »No Surprise, Hysteria Wasn’t a Sound Basis For Interpretation

What gets them into trouble is how they just can’t help themselves. Go back one year, to early 2018. Last February it was all-but-assured (in mainstream coverage) that the US economy was going to take off. The bond market, meaning UST’s, was about to be massacred because the overheating boom would force a double shot down its throat. Not only would safety instruments like UST’s have to contend with the unemployment...

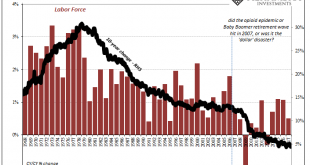

Read More »The Reluctant Labor Force Is Reluctant For A Reason (and it’s not booming growth)

In 2017, the BLS estimates that just 861k Americans were added to the official labor force, the denominator, of course, for the unemployment rate. That’s out of an increase of 1.4 million in the Civilian Non-Institutional Population, the overall prospective pool of workers. Both of those rises were about half the rate experienced in 2016. While population growth slowed last year, it produced, apparently, an almost...

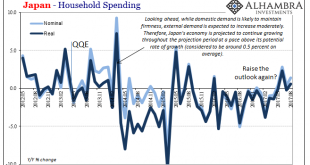

Read More »Japan Is Booming, Except It’s Not

Japan is hot, really hot. Stocks are up to level not seen since 1996 (Nikkei 225). Prime Minister Shinzo Abe called snap elections in Parliament to secure a supermajority and it worked. Things seem to be sparkling all over the place, with the arrow pointing up: “Hopes for a global economic recovery and US shares’ strength are making fund managers generous on Japanese stocks,” said Chihiro Ohta, general manager of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org