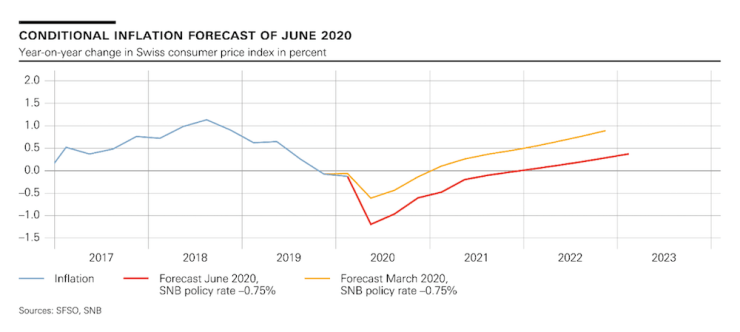

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market. © Marekusz | Dreamstime.comThe coronavirus pandemic has led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad. The bank presented a new lower inflation forecast than the one it issued in March 2020. The red line in the chart above shows deflation exceeding 1% this year, remaining in deflation in 2021. The yellow line is the bank’s forecast in March 2020. The forecast for the current year is negative (−0.7%). The inflation rate is likely to rise in 2021, but still be slightly negative (−0.2%), before returning to positive territory in 2022

Topics:

Investec considers the following as important: Business & Economy, Deflation Switzerland, Editor's Choice, Inflation Switzerland, Personal finance, SNB, Swiss National Bank

This could be interesting, too:

Investec writes The global brands artificially inflating their prices on Swiss versions of their websites

Investec writes Swiss car insurance premiums going up in 2025

Investec writes The Swiss houses that must be demolished

Investec writes Swiss rent cuts possible following fall in reference rate

On 18 June 2020, the Swiss National Bank (SNB) said it would maintain its negative rate of interest (-0.75%) and remains willing to intervene more strongly in the foreign exchange market.

The coronavirus pandemic has led to a severe downturn in economic activity and a decline in inflation both in Switzerland and abroad.

The bank presented a new lower inflation forecast than the one it issued in March 2020.

The red line in the chart above shows deflation exceeding 1% this year, remaining in deflation in 2021. The yellow line is the bank’s forecast in March 2020. The forecast for the current year is negative (−0.7%). The inflation rate is likely to rise in 2021, but still be slightly negative (−0.2%), before returning to positive territory in 2022 (0.2%).

The SNB expects GDP to contract by around 6% this year, the largest decline since the oil crisis in the 1970s. It forecasts an economic revival in the second half of the year that will continue to generate positive growth in 2021.

In its baseline scenario for the global economy, the SNB assumes further waves of infection will be successfully prevented. However, this scenario is subject to a high level of uncertainty on both the upside and downside.

Further waves of infection or trade tensions could derail economic recovery. On the other hand, the significant monetary and fiscal policy measures introduced in many countries could support the recovery more strongly than expected.

The SNB said people should be interpret these forecasts with caution. In the current situation, inflation and growth forecasts are subject to unusually high uncertainty, it said.

More on this:

SNB press release (in French) – Take a 5 minute French test now

For more stories like this on Switzerland follow us on Facebook and Twitter.