In the NZZ, Daniel Gerny and Simon Hehli report about potential conflicts of interest at Bern’s university hospital, the Inselspital. A cardiologist found evidence of negative health effects of in vitro fertilization, which the Inselspital offers. But unusually, the hospital’s PR department didn’t advertize the findings. The motivation to keep quiet, according to the PR department, was that the findings are of relevance also for other groups at the hospital, and that this would have to be...

Read More »Conflicts of Interest at Bern’s Inselspital?

In the NZZ, Daniel Gerny and Simon Hehli report about potential conflicts of interest at Bern’s university hospital, the Inselspital. A cardiologist found evidence of negative health effects of in vitro fertilization, which the Inselspital offers. But unusually, the hospital’s PR department didn’t advertize the findings. The motivation to keep quiet, according to the PR department, was that the findings are of relevance also for other groups at the hospital, and that this would have to be...

Read More »“Reserves For All? Central Bank Digital Currency, Deposits, and their (Non)-Equivalence,” CEPR, 2018

CEPR Discussion Paper 13065, July 2018. PDF. (Personal copy.) I offer a macroeconomic perspective on the “Reserves for All” (RFA) proposal to let the general public use electronic central bank money. After distinguishing RFA from cryptocurrencies and relating the proposal to discussions about narrow banking and the abolition of cash I propose an equivalence result according to which a marginal substitution of outside for inside money does not affect macroeconomic outcomes. I identify key...

Read More »“Reserves For All? Central Bank Digital Currency, Deposits, and their (Non)-Equivalence,” CEPR, 2018

CEPR Discussion Paper 13065, July 2018. PDF. (Personal copy.) I offer a macroeconomic perspective on the “Reserves for All” (RFA) proposal to let the general public use electronic central bank money. After distinguishing RFA from cryptocurrencies and relating the proposal to discussions about narrow banking and the abolition of cash I propose an equivalence result according to which a marginal substitution of outside for inside money does not affect macroeconomic outcomes. I identify key...

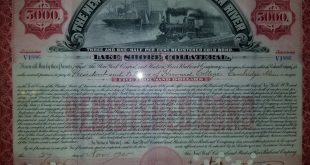

Read More »The Benefits of Issuing Gold Bonds

A gold bond is debt obligation that is denominated in gold, with interest and principal paid in gold. As I will explain below, it’s a way for the issuer to pay off its debt in full, and there are other advantages. Sometimes, I find that it’s helpful to show a picture of what I’m talking about. At the Harvard Club in New York, an old gold bond is hanging on the wall among other memorabilia. This is a gold bond bought by...

Read More »“Hack Your Way to Scientific Glory”

A reminder not to be overly impressed when presented with statistically significant coefficients, from FiveThirtyEight.com.

Read More »“Financial Policy,” CEPR, 2018

CEPR Discussion Paper 12755, February 2018. PDF. (Personal copy.) This paper reviews theoretical results on financial policy. We use basic accounting identities to illustrate relations between gross assets and liabilities, net debt positions and the appropriation of (primary) budget surplus funds. We then discuss Ramsey policies, answering the question how a committed government may use financial instruments to pursue its objectives. Finally, we discuss additional roles for financial...

Read More »“Fiscal Federalism, Grants, and the U.S. Fiscal Transformation in the 1930s” UoCH, 2017

University of Copenhagen, Department of Economics Discussion Paper 17-18, July 2017, with Martin Gonzalez-Eiras. PDF. We propose a theory of tax centralization and intergovernmental grants in politico-economic equilibrium. The cost of taxation differs across levels of government because voters internalize general equilibrium effects at the central but not at the local level. The equilibrium degree of tax centralization is determinate even if expenditure-related motives for centralization...

Read More »“Sovereign Bond Prices, Haircuts, and Maturity,” NBER, 2017

NBER Working Paper 23864, September 2017, with Tamon Asonuma and Romain Ranciere. PDF. (Local copy.) Rejecting a common assumption in the sovereign debt literature, we document that creditor losses (“haircuts”) during sovereign restructuring episodes are asymmetric across debt instruments. We code a comprehensive dataset on instrument-specific haircuts for 28 debt restructurings with private creditors in 1999–2015 and find that haircuts on shorter-term debt are larger than those on debt...

Read More »“Sovereign Bond Prices, Haircuts, and Maturity,” IMF, 2017

CEPR Discussion Paper 12252, August 2017, with Tamon Asonuma and Romain Ranciere. PDF. (ungated IMF WP.) Rejecting a common assumption in the sovereign debt literature, we document that creditor losses (“haircuts”) during sovereign restructuring episodes are asymmetric across debt instruments. We code a comprehensive dataset on instrument-specific haircuts for 28 debt restructurings with private creditors in 1999–2015 and find that haircuts on shorter-term debt are larger than those on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org