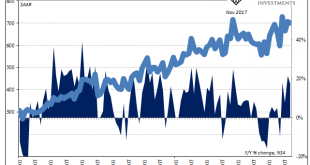

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again. About the only exception on the equity side was China, which outperformed for much the same reason as US growth – technology stocks. Generally, we expect foreign stocks to outperform in a weak dollar environment but so far any outperformance has...

Read More »The Complete Guide to Mortgages in Switzerland

(Disclosure: Some of the links below may be affiliate links) Since we have been looking at buying a house, I had to do a lot of research on mortgages. In Switzerland, mortgages are not as simple as they should be!So, in this post, I will share all there is to know about mortgages in Switzerland and how they work.Before you buy a real estate property, you must know this. You do not want to go to the bank without knowing first a few things. Otherwise, it could be easy for them to give you a bad...

Read More »Should you buy or rent a house in Switzerland?

(Disclosure: Some of the links below may be affiliate links) We are currently in the process of buying a house. Since I shared this fact on the blog, I have been asked several times whether people should buy or rent in Switzerland.So, I wanted to share my thoughts on the buy or rent subject. I am going to go over the different considerations about buying and renting houses in Switzerland.While I am going to speak specifically about houses, most of it also applies to apartments. But since we...

Read More »Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not Changed A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime. The rest of Asia responded to the initial outbreak better than the Chinese (and most everywhere else we now know) and generally mitigated...

Read More »Monthly Macro Monitor – June 2020

The stock market has recovered most of its losses from the March COVID-19 induced sell-off and the enthusiasm with which stocks are being bought – and sold but mostly bought – could lead one to believe that the crisis is over, that the economy has completely or nearly completely recovered. Unfortunately, other markets do not support that notion nor does the available economic data. Of course, markets look forward and there is the possibility that stock market...

Read More »We Have Reached The Silly Phase of the Bull Market

Have we entered a new bull market? Was the 35% pullback in the S&P 500 in March the fastest bear market in history? Or is this just a continuation of the bull market that started in 2009, interrupted by a rather large correction? Bull markets and bear markets are about behavior, about the human emotions of fear and greed. While we got a brief bout of fear in March, greed has since overwhelmed all sense, common and otherwise. What we’re seeing in the casino…er,...

Read More »How to invest in foreign property from Switzerland – The Story of Iain

(Disclosure: Some of the links below may be affiliate links) Recently, I had the chance to discuss Real Estate investments with Iain. Iain came from the United Kingdom to Switzerland 14 years ago. He is now a Swiss citizen.He has been investing heavily in several properties, especially in the United Kingdom. I thought it would make a very interesting story for this blog.We are currently considering buying a house to live in, but not yet investing in property. But diversification being very...

Read More »Regime Change

Stocks took another beating last week as the scope of the coronavirus shutdown started to sink in. The S&P 500 was down 15% last week with most of that coming on Monday after the Fed’s emergency rate cuts. Our accounts performed much better than that, but were still down on the week as corporate and municipal bonds continued to get marked down. Municipals recovered slightly at the end of the week as the Fed announced they would be buying highly-rated bonds with...

Read More »Is this the Beginning of a Recession?

As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn. The case of recession does seem to be one of those open...

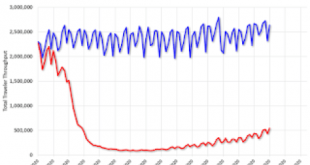

Read More »Downward Home Prices In The Downturn, Too

The Census Bureau reported today New Home Sales remained at a better than 700k SAAR in September following the big jump over the previous few months. Though the number was slightly lower last month than the month before, it wasn’t meaningfully less. As discussed yesterday, while that might seem the Fed’s rate cut psychology combined with the bond market’s pessimism (reducing the mortgage rate) is having a positive effect, I don’t see it that way. From yesterday:...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org