I don’t think Milton Friedman would have made much of chess player. For all I know he might have been a grand master or something close to that rank, but as much as his work is admirable it invites too the whole range of opposite emotion. He was the champion libertarian of the free market who rescued economics from the ravages of New Deal socialism, but in doing so he simply created the avenue for where Economics of...

Read More »Noose Or Ratchet

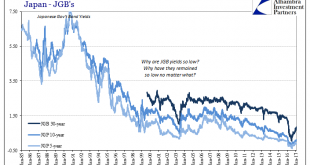

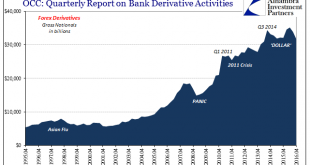

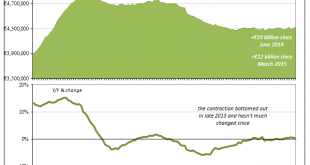

Closing the book on Q4 2016 balance sheet capacity is to review essentially forex volumes. The eurodollar system over the last ten years has turned far more in this direction in addition to it becoming more Asian/Japanese. In fact, the two really go hand in hand given the native situation of Japanese banks. As expected, data compiled by the Office of Comptroller of the Currency (OCC) shows the same negative tendencies...

Read More »Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it. In an interview with Charles Schwab, the former Fed Chairman says not to worry: Dr. Bernanke noted that corporate earnings have risen at the same...

Read More »Now You Tell Us

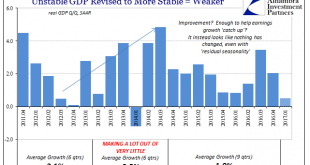

As we move further into 2017, economic statistics will be subject to their annual benchmark revisions. High frequency data such as any accounts published on or about a single month is estimated using incomplete data. It’s just the nature of the process. Over time, more comprehensive survey results as well as upgrades to statistical processes make it necessary for these kinds of revisions. There is, obviously, great...

Read More »The Global Burden

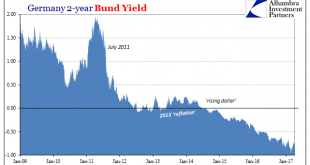

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it. On September 17, 2014, almost exactly fourteen years...

Read More »It Was And Still Is The Wrong Horse To Bet

The payroll report disappointed again, though it was deficient in ways other than are commonly described. The monthly change is never a solid indication, good or bad, as the BLS’ statistical processes can only get it down to a 90% confidence interval, and a wide one at that. It means that any particular month by itself specifies very little, except under certain circumstances. This month just happens to be one,...

Read More »Ultra-Loose Terminology, Not Policy

As world “leaders” gathered in Davos in January 2016, they did so among financial turmoil that was creating more economic havoc than at any time since the Great “Recession.” Having seen especially US QE as the equivalent of money printing, their focus was drawn elsewhere to at least attempt an explanation for the contradiction. They initially settled on the Fed’s rate hike, where terminating “ultra-loose” policies was...

Read More »Systemic Depression Is A Clear Choice

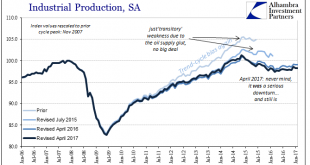

Looking back on late 2015, it is perfectly clear that policymakers had no idea what was going on. It’s always easy, of course, to reflect on such things with the benefit of hindsight, but even contemporarily it was somewhat shocking how complacent they had become as a global group. In the US, the Federal Reserve “raised rates” for the first time in a decade on the same day they released industrial production figures...

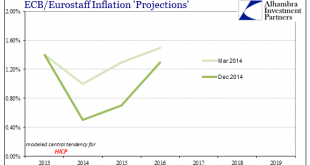

Read More »Consensus Inflation (Again)

Why did Mario Draghi appeal to NIRP in June 2014? After all, expectations at the time were for a strengthening recovery not just in Europe but all over the world. There were some concerns lingering over currency “irregularities” in 2013 but primarily related to EM’s and not the EU which had emerged from re-recession. The consensus at that time was full recovery not additional “stimulus.” From Bloomberg in January...

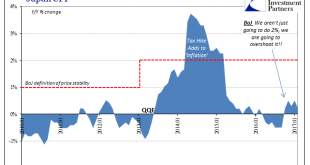

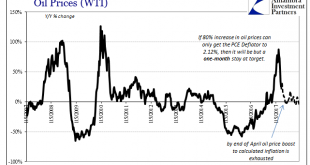

Read More »The Power of Oil

For the first time in 57 months, a span of nearly five years, the Fed’s preferred metric for US consumer price inflation reached the central bank’s explicit 2% target level. The PCE Deflator index was 2.12% higher in February 2017 than February 2016. Though rhetoric surrounding this result is often heated, the actual indicated inflation is decidedly not despite breaking above for once. In many ways 2.12% is hugely...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org