See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Regulated to Death The price of gold fell $13, and that of silver $0.23. Perspective: if you’re waiting for the right moment to buy, the market now offers you a better than it did last week. If you wanted to sell, this wasn’t a good week to wait. Which is your intention, and why? Obviously, last week the sellers were more...

Read More »US Money Supply and Fed Credit – the Liquidity Drain Becomes Serious

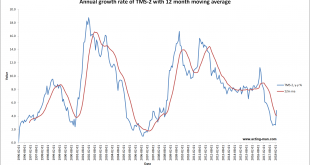

US Money Supply Growth Stalls Our good friend Michael Pollaro, who keeps a close eye on global “Austrian” money supply measures and their components, has recently provided us with a very interesting update concerning two particular drivers of money supply growth. But first, here is a chart of our latest update of the y/y growth rate of the US broad true money supply aggregate TMS-2 until the end of June 2018 with a...

Read More »Merger Mania and the Kings of Debt

Another Early Warning Siren Goes Off Our friend Jonathan Tepper of research house Variant Perception (check out their blog to see some of their excellent work) recently pointed out to us that the volume of mergers and acquisitions has increased rather noticeably lately. Some color on this was provided in an article published by Reuters in late May, “Global M&A hits record $2 trillion in the year to date”, which...

Read More »How to Get Ahead in Today’s Economy

“Literally On Fire” This week brought forward more evidence that we are living in a fabricated world. The popular story-line presents a world of pure awesomeness. The common experience, however, falls grossly short. There are many degrees of awesomeness, up to total awesomeness – which is where we are these days, in the age of total awesomeness, just a short skip away from the Nirvana era. - Click to enlarge What is...

Read More »US Money Supply Growth Jumps in March , Bank Credit Growth Stalls

A Movie We Have Seen Before – Repatriation Effect? There was a sizable increase in the year-on-year growth rate of the true US money supply TMS-2 between February and March. Note that you would not notice this when looking at the official broad monetary aggregate M2, because the component of TMS-2 responsible for the jump is not included in M2. Let us begin by looking at a chart of the TMS-2 growth rate and its...

Read More »The Capital Structure as a Mirror of the Bubble Era

Effects of Monetary Pumping on the Real World As long time readers know, we are looking at the economy through the lens of Austrian capital and monetary theory (see here for a backgrounder on capital theory and the production structure). In a nutshell: Monetary pumping falsifies interest rate signals by pushing gross market rates below the rate that reflects society-wide time preferences; this distorts relative prices...

Read More »From Fake Boom to Real Bust

Paradise in LA LA Land More is revealed with each passing day. You can count on it. But what exactly the ‘more is of’ requires careful discrimination. Is the ‘more’ merely more noise? Or is it something of actual substance? Today we endeavor to pass judgment, on your behalf. Normally, judgment would be passed on a Thursday, but we are making an exception. - Click to enlarge For example, here in the land of...

Read More »Getting High on Bubbles

Turn on, Tune in, Drop out Back in the drug-soaked, if not halcyon, days known at the sexual and drug revolution—the 1960’s—many people were on a quest for the “perfect trip”, and the “perfect hit of acid” (the drug lysergic acid diethylamide, LSD). Dr. Albert Hoffman and his famous bicycle ride through Basel after he ingested a few drops of LSD-25 by mistake. The photograph in the middle was taken at the Woodstock...

Read More »Trade War Game On!

Interesting Times Arrive “Things sure are getting exciting again, ain’t they?” The remark was made by a colleague on Tuesday morning, as we stepped off the elevator to grab a cup of coffee. Ancient Chinese curse alert… - Click to enlarge “One moment markets are gorging on financial slop like fat pigs in mud. The next they’re collectively vomiting on themselves. I’ll tell you one thing. President Trump’s trade war...

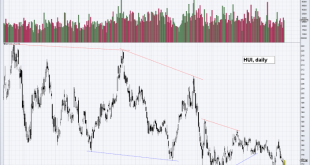

Read More »US Equities – Mixed Signals Battling it Out

A Warning Signal from Market Internals Readers may recall that we looked at various market internals after the sudden sell-offs in August 2015 and January 2016 in order to find out if any of them had provided clear advance warning. One that did so was the SPX new highs/new lows percent index (HLP). Below is the latest update of this indicator. S&P 500 New High Lows Percent, Feb 2015 - Apr 2018(see more posts on...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org