Planning on Your Behalf Watch out! At this very moment, professional economists of all stripes are making plans on your behalf. They are dreaming and scheming new and innovative ways to spend your money long before you have earned it. While you are busy at the gristmill, grinding away for clients and customers, claims are being laid upon your life. Your future earnings are being directed to boondoggles galore. Yet these claims are in addition to everything...

Read More »US Money Supply Growth – Bouncing From a 12-Year Low

True Money Supply Growth Rebounds in September In August 2019 year-on-year growth of the broad true US money supply (TMS-2) fell to a fresh 12-year low of 1.87%. The 12-month moving average of the growth rate hit a new low for the move as well. The main driver of the slowdown in money supply growth over the past year was the Fed’s decision to decrease its holdings of MBS and treasuries purchased in previous “QE” operations. This was partly offset by bank credit...

Read More »Fed Chair Powell’s Inescapable Contradiction

Under the Influence “This feels very sustainable.” – Federal Reserve Chairman Jerome Powell, October 8, 2019 Conflict and contradiction. These were two of the main themes reverberating around the world of centralized monetary planning this week. On Tuesday, for instance, a novel and contradictory central banker parlance – “reserve management purposes” – was birthed into existence by Fed Chair Jay Powell. We will have more on this later on. But first, to best...

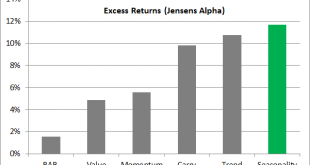

Read More »Scientific Long-Term Study Confirms: Seasonality is the Best Investment Strategy!

A Pleasant Surprise You can probably imagine that I am convinced of the merits of seasonality. However, even I was surprised that an investment strategy based on seasonality is apparently leaving numerous far more popular strategies in the dust. And yet, this is exactly what a recent comprehensive scientific study asserts – a study that probably considers a longer time span than most: it examines up to 217 years of...

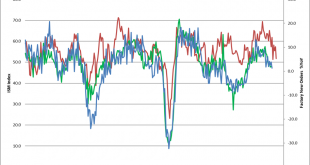

Read More »US Money Supply Growth and the Production Structure – Signs of an Aging Boom

Money Supply Growth Continues to Decelerate Here is a brief update of recent developments in US true money supply growth as well as the trend in the ratio of industrial production of capital goods versus consumer goods (we use the latter as a proxy for the effects of credit expansion on the economy’s production structure). First, a chart of the y/y growth rate of the broad US money supply TMS-2 vs. y/y growth in...

Read More »Two Junior Miners Offering Arbitrage Opportunities – an Interview with Jayant Bhandari

Maurice Jackson of Proven and Probable Interviews Jayant Bhandari Maurice Jackson of Proven & Probable has just conducted another interview with Jayant Bhandari, who is known to long-time readers as a frequent guest author on this site. Jayant Bhandari Below is a video of the interview as well as a link for downloading the transcript of the interview in PDF form. But first here is a list of the topics discussed:...

Read More »Is Inflation Beginning? Are You Ready?

Extrapolating The Recent Past Can Be Hazardous To Your Wealth “Those who cannot remember the past are condemned to repeat it,” remarked George Santayana over 100 years ago. These words, as strung together in this sequence, certainly sound good. But how to render them to actionable advice is less certain. Aren’t some facets of the past – like the floppy disk – not worth remembering? And aren’t others – like a first...

Read More »Monetary U-Turn: When Will the Fed Start Easing Again? Incrementum Advisory Board Meeting Q1 2019

Special Guest Trey Reik and Board Member Jim Rickards Discuss Fed Policy On occasion of its Q1 meeting in late January, the Incrementum Advisory Board was joined by special guest Trey Reik, the lead portfolio manager of the Sprott Institutional Gold & Precious Metal Strategy at Sprott USA since 2015 [ed note: as always, a PDF of the complete transcript can be downloaded further below]. Trey Reik of Sprott USA. -...

Read More »The Recline and Flail of Western Civilization and Other 2019 Predictions

The Recline and Flail of Western Civilization and Other 2019 Predictions “I think it’s a tremendous opportunity to buy. Really a great opportunity to buy.” – President Donald Trump, Christmas Day 2018 Darts in a Blizzard Today, as we prepare to close out the old, we offer a vast array of tidings. We bring words of doom and despair. We bring words of contemplation and reflection. And we also bring words of hope...

Read More »How Faux Capitalism Works in America

Stars in the Night Sky The U.S. stock market’s recent zigs and zags have provoked much squawking and screeching. Wall Street pros, private money managers, and Millennial index fund enthusiasts all find themselves on the wrong side of the market’s swift movements. Even the best and brightest can’t escape President Trump’s tweet precipitated short squeezes. The short-term significance of the DJIA’s 8 percent decline...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org