Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing. The bane of the logistical supply-side snafu-ing, it has been container redistribution mucking the goods economy up.The recent and sharp decline in container rates, according to Freightos, is because China’s been closed down by Xi’s pursuit of...

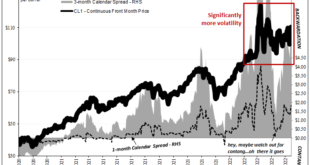

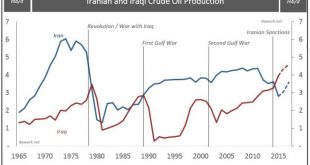

Read More »Crude Contradictions Therefore Uncertainty And Big Volatility

This one took some real, well, talent. It was late morning on April 11, the crude oil market was in some distress. The price was falling faster, already down sharply over just the preceding two weeks. Going from $115 per barrel to suddenly less than $95, there was some real fear there. But what really caught my attention was the flattening WTI futures curve. Up in the liquid front, it was closing in on contango and had it achieved that reshaping it would have been,...

Read More »I Told You It *Wasn’t* Money Printing; How The Fed Helped Cause, But Can’t Solve, Our Current ‘Inflation’

Trust the Fed. Ha! It’s one thing for money dealers to look upon Jay Powell’s stash of bank reserves with remarkable disdain, more immediately damning when effects of the same liquidity premiums in the real economy create serious frictions leaving the entire world exposed to the consequences. When all is said and done, the Federal Reserve has created its own doom-loop from which it won’t likely escape. The 2022 FOMC has made itself plain, incredibly hawkish to an...

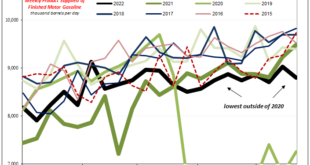

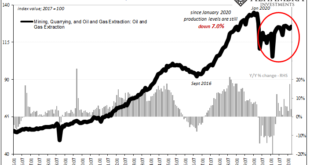

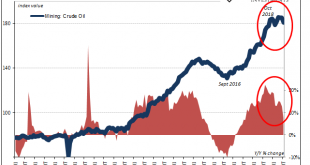

Read More »US Industrial Downturn: What If Oil and Inventory Join It?

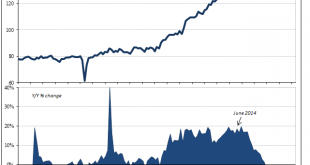

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one. The only place where there was a truly robust trend was the oil patch. Since the last crash a few years ago,...

Read More »The World Economy’s Industrial Downswing

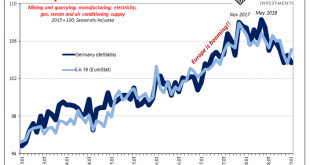

As economic data for 2019 comes in, the numbers continue to suggest more slowing especially in the goods economy. Perhaps what happened during that October-December window was a soft patch. Even if that was the case, we should still expect second and third order effects to follow along from it. Starting with Europe first, Germany’s deStatis had earlier reported factory orders and production levels in January 2019 while...

Read More »Industrial Fading

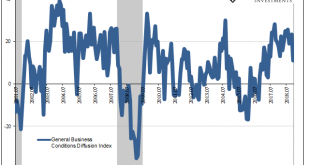

It is time to start paying attention to PMI’s again, some of them. There are those like the ISM’s Manufacturing Index which remains off in a world of its own. The version of the goods economy suggested by this one index is very different than almost every other. It skyrocketed in late summer last year way out of line (highest in more than a decade) with any other economic account. For that reason alone, it has been...

Read More »Staying Stuck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their...

Read More »Industrial Symmetry

There has always been something like Newton’s third law observed in the business cycles of the US and other developed economies. In what is, or was, essentially symmetry, there had been until 2008 considerable correlation between the size, scope, and speed of any recovery and its antecedent downturn, or even slowdown. The relationship was so striking that it moved Milton Friedman to finally publish in 1993 his plucking...

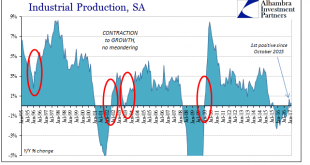

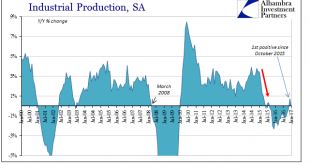

Read More »No Acceleration In Industry, Either

Industrial Production in the United States was flat in January 2017, following in December the first positive growth rate in over a year. The monthly estimates for IP are often subject to greater revisions than in other data series, so the figures for the latest month might change in the months ahead. Still, even with that in mind, there is no acceleration indicated for US industry. After suffering through a more than...

Read More »The ‘Strange’ Death of Mr. Abadi

As expected, Iranian Prime Minister Abadi was always going to come off worse in his last ditch attempt to try and regain some kind of political initiative by appointing a new look ‘technocratic’ government in Baghdad. But the ailing Prime Minister has managed to back himself into a particularly tight corner after being outplayed by Muqtada al Sadr, Iyad Allawi and even Nouri Al Maliki. Rather than sticking to his ‘technocratic guns’ Abadi blinked first on cabinet changes, by allowing more...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org