SkyWork currently serves some 17 destinations from the Swiss capital (Keystone) - Click to enlarge SkyWork Airlines, which flies to various European destinations from Bern Airport, may be forced to cease operations by the end of October due to its unstable financial situation. The Federal Office of Civil Aviation (FOCA) has limited SkyWork’s operating permit to the end of this month because the company is...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

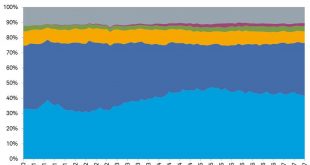

Read More »Migration of the Tax Donkeys

Dear local leadership: here’s the formula for long-term success. A Great Migration of the Tax Donkeys is underway, still very much under the radar of the mainstream media and conventional economists. If you are confident no such migration of those who pay the bulk of the taxes could ever occur, please consider the long-term ramifications of these two articles: Stanford Says Soaring Public Pension Costs Devastating...

Read More »FX Daily, October 12: Discipline Argues Against Consensus Narrative

Swiss Franc The Euro has risen by 0.09% to 1.155 CHF. EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Following the release of the FOMC minutes from last month’s meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This...

Read More »The new 10 Swiss franc note hand mystery

The third in a series of gorgeous new Swiss franc bank notes will be released by the Swiss National Bank (SNB) on October 18th. The 10-franc note keeps its yellow colour, but most everything else in the design and construction is different. What’s most remarkable about the new bank note? Not the 40 centimes or so it takes to make each note, nor that each note is projected to last only about a year. Not the sophisticated...

Read More »Young Guns of Gold Podcast – ‘The Everything Bubble’

– Young Guns of Gold Podcast – ‘The Everything Bubble’– Precious Metal Roundtable discuss gold in 2017 and outlook– Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets – “People are expecting too much from gold”– Economy: Inflation indicators, recession on the horizon, global debt issues– Global demand: ETF inflows, Russia central bank purchases, Germany...

Read More »Young Guns of Gold Podcast – ‘The Everything Bubble’

– Young Guns of Gold Podcast – ‘The Everything Bubble’– Precious Metal Roundtable discuss gold in 2017 and outlook– Gold +9.1% year to date; Performing well given Fed raising rates, lack of volatility and surge in stock markets – “People are expecting too much from gold”– Economy: Inflation indicators, recession on the horizon, global debt issues– Global demand: ETF inflows, Russia central bank purchases, Germany...

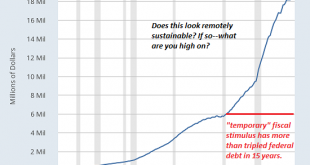

Read More »The Consent of the Conned

Every single line item in our entire Bernie Madoff scam of a system is cooked. My theme this week is The Great Unraveling, by which I mean the unraveling of our social-political-economic system of hierarchical, centralized power. Let’s start by looking at how the basis of governance has transmogrified from consent of the governed to consent of the conned. In effect, our leadership leads by lying. As we know, when it...

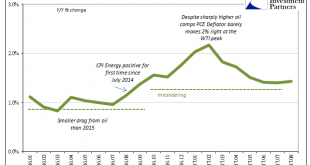

Read More »Non-Transitory Meandering

Monetary officials continue to maintain that inflation will eventually meet their 2% target on a sustained basis. They have no other choice, really, because in a monetary regime of rational expectations for it not to happen would require a radical overhaul of several core theories. Outside of just the two months earlier this year, the PCE Deflator has missed in 62 of the past 64 months. The FOMC is simply running out of...

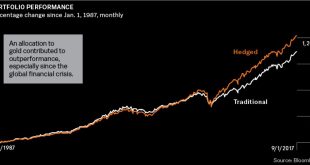

Read More »1987, 1997, 2007… Just How Crash-Prone are Years Ending in 7?

Bad Reputation Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org