Bad Reputation Years ending in 7, such as the current year 2017, have a bad reputation among stock market participants. Large price declines tend to occur quite frequently in these years. Just think of 1987, the year in which the largest one-day decline in the US stock market in history took place: the Dow Jones Industrial Average plunged by 22.61 percent in a single trading day. Or recall the year 2007, which marked...

Read More »Swiss National Bank Releases New 10-franc note

Third banknote in latest series showcases Switzerland’s organisational talent - Click to enlarge The Swiss National Bank (SNB) will begin issuing the new 10-franc note on 18 October 2017. Following the 50-franc and 20-franc notes, it is the third of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice. The inspiration behind...

Read More »FX Daily, October 11: Markets Looking for a New Focus

Swiss Franc The Euro has risen by 0.04% to 1.1515 CHF. EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday’s ranges against the major currencies, the euro has made a...

Read More »3 million francs of gold and silver found in Swiss sewers

© Iurii Konoval | Dreamstime Call it “dirty money” if you wish, because there’s about CHF 3 million in gold and silver found each year in Swiss sewage. But no one is going to get rich, according to a just-published report by the Swiss Federal Institute of Aquatic Science and Technology (Eawag). Recovering the estimated CHF 1.5 million in gold, and the same in silver, that passes through Swiss wastewater each year,...

Read More »London House Prices Are Falling – Time to Buckle Up

– London house prices fall in September: first time in eight years– High-end London property fell by 3.2% in year– House sales down by over a very large one-third – Global Real Estate Bubble Index – see table– Brexit, rising inflation and political uncertainty causing many buyers to back away from market– U.K. housing stock worth record £6.8 trillion, almost 1.5 times value of LSE and more than the value of all the gold...

Read More »The Damage Started Months Before Harvey And Irma

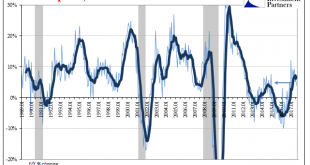

Ahead of tomorrow’s payroll report the narrative is being set that it will be weak because of Harvey and Irma. Historically, major storms have had a negative effect on the labor market. Just as auto sales were up sharply in September very likely because of the hurricane(s) and could remain that way for several months, payrolls could be weak for the same reasons and the same timeframe. That said, we can’t pretend as if...

Read More »Donald Trump: Warmonger-in-Chief

Cryptic Pronouncements If a world conflagration, God forbid, should break out during the Trump Administration, its genesis will not be too hard to discover: the thin-skinned, immature, shallow, doofus who currently resides in the Oval Office! The commander-in-chief – a potential source of radiation? - Click to enlarge This past week, the Donald has continued his bellicose talk with both veiled and explicit threats...

Read More »FX Daily, October 10: Dollar Pullback Extended

Swiss Franc The Euro has risen by 0.06% to 1.1507 CHF. EUR/CHF and USD/CHF, October 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though...

Read More »Why Small States Are Better

Andreas Marquart and Philipp Bagus (see their mises.org author pages here and here) were recently interviewed about their new book by the Austrian Economics Center. Unfortunately for English-language readers, the book is only available in German. Nevertheless, the interview offers some valuable insights. Mr. Marquart, Mr. Bagus, you have released your new book „Wir schaffen das – alleine!” (“We can do it – alone!”)...

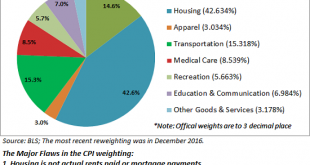

Read More »Be Careful What You Wish For: Inflation Is Much Higher Than Advertised

What the Federal Reserve is actually whining about is not low inflation–it’s that high inflation isn’t pushing wages higher like it’s supposed to. It’s not exactly a secret that real-world inflation is a lot higher than the official rates–the Consumer Price Index (CPI) and Personal Consumption Expenditures PCE). As many observers have pointed out, there are two primary flaws in the official measures of inflation: 1....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org