„Schuldfrei“ – so soll unser Geld zukünftig in Umlauf kommen. Das Wort „schuldfrei“ ist positiv besetzt. Wer möchte nicht schuldfrei sein? Jedermann. „Schuldfrei“ ist das zentrale Wort im Initiativtext der kommenden Vollgeld-Initiative, über die das Schweizervolk am 10. Juni 2018 abstimmen wird. Die Initiative kommt daher wie der Wolf im Schafspelz. Absatz 3 des Initiativtextes besagt: „Sie (die SNB) bringt im Rahmen...

Read More »Switzerland’s parliament rejects plan to cut health insurance discounts

Switzerland has a system of compulsory health insurance. Residents must choose an insurer and pay. Those who don’t are automatically signed up and sent a bill. © Auremar | Dreamstime.com - Click to enlarge Other than shopping around, choosing a policy with an excess, a sum that must be covered out of your own pocket before the insurance kicks in, is one of the few ways to reduce your premium. Like much insurance in...

Read More »Swiss accounts blocked over suspected Nigerian oil bribery case

The Shell Eni corporate bribery trial is billed as the biggest in history. (Keystone) - Click to enlarge The Office of the Attorney General of Switzerland (OAG) has blocked various bank accounts in Switzerland regarding an alleged oil bribery scheme linked to Nigeria. Executives from oil giants Shell and Eni are due to stand trial in Milan, Italy, in May. At the request of the Milan public prosecutor, the...

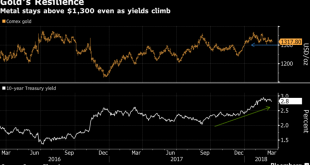

Read More »Four Charts: Debt, Defaults and Bankruptcies To See Higher Gold

– $8.8B Sprott Inc. sees higher gold on massive consumer debt, defaults & bankruptcies – Rising and record U.S. debt load may cause financial stress, weaken dollar and see gold go higher– Massive government and consumer debt eroding benefits of wage growth (see chart) by Bloomberg Rising U.S. interest rates, usually bad news for gold, are instead feeding signs of financial stress among debt-laden consumers and...

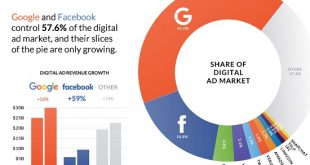

Read More »Is Profit-Maximizing Data-Mining Undermining Democracy?

If targeting political extremes generates the most profit, then that’s what these corporations will pursue. As many of you know, oftwominds.com was falsely labeled propaganda by the propaganda operation known as ProporNot back in 2016. The Washington Post saw fit to promote ProporNot’s propaganda operation because it aligned with the newspaper’s view that any site that wasn’t pro-status quo was propaganda; the...

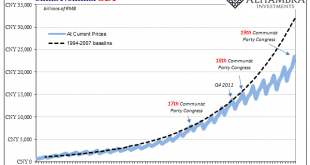

Read More »The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been...

Read More »BNS; les liquidités des banques suisses au service du QE de la communauté monétaire internationale

La BNS s’est arrimée à l’euro en 2011 sous le prétexte de soutenir les exportateurs suisses.Ce serait donc la raison de sa transformation en hedge fund… De notre côté, nous avons toujours soutenu depuis 2011 qu’elle n’avait fait que suivre ses collègues dans la pratique du quantitative easing, dans le but de soutenir les grandes banques et autres hedge funds, en les déchargeant de leurs créances publiques à haut...

Read More »Swiss Trade Balance February 2018: Foreign Trade at a High Level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM ended Friday under renewed selling pressures, and capped off a mostly softer week. COP, THB, and TWD were the best performers last week, while TRY, RUB, and ZAR were the worst. Despite a widely expected 25 bp hike, this week’s FOMC meeting still has potential to weigh on EM. Stock Markets Emerging Markets, March 14 Source: economist.com - Click to enlarge Poland Poland reports February...

Read More »Rolex ‘most reputable global brand’ for third straight year

Roger Federer's continued success plays a part in Rolex's image (Keystone) - Click to enlarge Swiss watch brand Rolex has topped a ranking of the world’s most reputable brands for a third year in a row. Rolex beat Danish toy firm Lego for the top spot, while Swiss food manufacturer Nestlé jumped 21 places to rank 33rd. The Reputation Institute compiled the list in its annual Global RepTrack 100external link,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org