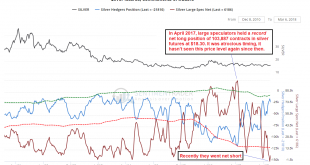

Speculators Throw the Towel Over the past several years we have seen a few amazing moves in futures positioning in a number of commodities, such as e.g. in crude oil, where the by far largest speculative long positions in history have been amassed. Over the past year it was silver’s turn. In April 2017, large speculators had built up a record net long position of more than 103,000 contracts in silver futures with the...

Read More »Great Graphic: Potential Topping Pattern for Euro

The euro appears to be potentially carving out a topping pattern. Recall that after correcting lower last September and October, the euro rallied for three months through January before weakening 1.75% in February. That was its biggest decline since February 2017. The euro’s high print was actually on February 16 near $1.2555, when it posted a key reversal, which is when it makes a new high for the move and then closes...

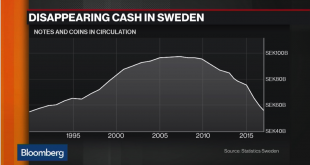

Read More »Gold Protects As Cashless Society Threatens Vulnerable

Gold Protects As Cashless Society Threatens Vulnerable – Swedish authorities concerned cashless society is happening ‘too quickly’ and heading into ‘negative spiral’– Only 25% of Swedes paid in cash at least once a week in 2017, 36% never use cash– Cash usage in Sweden falling both as share of GDP and in nominal terms– Sweden may be world’s first economy to introduce a cryptocurrency, the e-krona– Cashless is not a...

Read More »Switzerland – a definition of middle class

A recent survey calculates 60.1% of Switzerland’s population was middle class in 2015, a figure that has remained broadly stable since 1998, reaching its highest in 2009 (61.3%) and lowest in 2013 (56.8%). © Iakov Filimonov | Dreamstime.com - Click to enlarge But what is middle class in Switzerland? According to Switzerland’s Federal Statistical Office, it is anyone living in a household with a gross income between 70%...

Read More »Raiffeisen chair resigns over scandal-tainted former CEO

(Keystone) - Click to enlarge Johannes Rüegg-Stürm, the chairman of the board of directors of Switzerland’s third-largest bank has resigned from his position with immediate effect. The bank hopes turn a new page following the arrest and criminal proceedings against former CEO Pierin Vincenz. A statementexternal link released by the bank on Thursday, said the move was intended to “preserve the long-term credibility of...

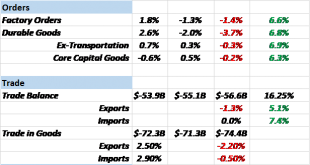

Read More »Bi-Weekly Economic Review: The New Normal Continues

There has been a lot of talk about the economic impact of the recent tax reform. All of it, including the analyses that include lots of fancy math, amounts to nothing more than speculation, usually informed by little more than the political bias of the analyst. I am guilty of that too to some degree but I don’t let my personal political views dictate how I view the economy for purposes of investing. I am, to put it...

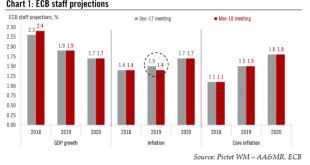

Read More »ECB begins to rotate forward guidance

The ECB made one small change to its communication in March consistent with a normalisation process that is likely to remain very gradual. In line with our expectations, today the Governing Council (unanimously) decided to drop its commitment to increase asset purchases “in terms of size and/or duration” if needed, which had steadily become more difficult to justify and less credible anyway. In effect, the ECB has...

Read More »Drive for women in top jobs suffers setback

For the first time since 2009 the percentage of women in top management positions has decreased (Keystone) - Click to enlarge The percentage of women in top executive positions dropped slightly in Switzerland last year, a report has found. The annual survey by the Schilling human resource consultancyexternal link shows a 1% drop to 7% in 2017 compared with the previous year. In 2016, the share of women in...

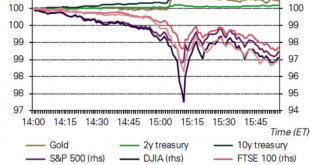

Read More »Stock Market Selloff Showed Gold Can Reduce Portfolio Risk

Stock Market Selloff Showed Gold Can Reduce Portfolio Risk – Recent stock market selloff showed gold can deliver returns and reduce portfolio risk– Gold’s performance during stock market selloff was consistent with historical behaviour– Gold up nearly 10% in last year but performance during recent selloff was short-lived– The stronger the market pullback, the stronger gold’s rally– WGC: ‘a good time for investors to...

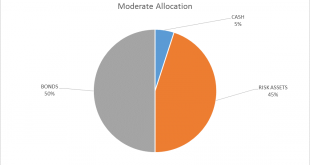

Read More »Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet

There is no change to the risk budget this month. For the moderate risk investor the allocation to bonds is 50%, risk assets 45% and cash 5%. We have had continued volatility since the last update but the market action so far is pretty mundane. The initial selloff halted at the 200 day moving average and the rebound carried to just over the 50 day moving average. That is about “as expected” as you can get for a stock...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org