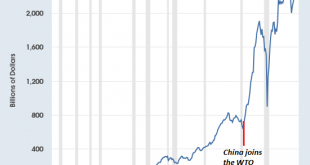

Central banks are looking beyond the dollar to grow their foreign exchange reserves for the first time in a decade. Rising trade tensions, and a recovering European economy bode well for the euro making a stronger case for central banks to diversify into the monetary union’s currency. Approximately 64% of fx reserves are held in dollars, followed by euros at 20%, and the yen and pound sterling each commanding 4.5%. The...

Read More »Credit Suisse boss earned less last year

Tidjane Thiam, CEO of Credit Suisse, as seen in February (Keystone) - Click to enlarge Credit Suisse Chief Executive Tidjane Thiam earned slightly less in 2017 during his third year on the job, the bank said on Friday. The news comes at a time of scrutiny over executive pay and bonuses. Thiam earned CHF9.7 million ($10.26 million) last year, a 5.3% drop on 2016, Switzerland’s second-biggest bank said. “The...

Read More »Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here...

Read More »15 Years of War: To Whose Benefit?

As for Iraq, the implicit gain was supposed to be access to Iraqi oil. Setting aside the 12 years of "no fly zone" air combat operations above Iraq from 1991 to 2003, the U.S. has been at war for almost 17 years in Afghanistan and 15 years in Iraq. (If the word "war" is too upsetting, then substitute "continuing combat operations".) Since the burdens and costs of these combat operations are borne solely by the...

Read More »Trendline Broken: Similarities to 1929, 1987 and the Nikkei in 1990 Continue

Anatomy of Waterfall Declines In an article published in these pages in early March, I have discussed the similarities between the current chart pattern in the S&P 500 Index compared to the patterns that formed ahead of the crashes of 1929 and 1987, as well as the crash-like plunge in the Nikkei 225 Index in 1990. The following five similarities were decisive features of these crash patterns: – a rally along a...

Read More »KOF Economic Barometer is Falling

In March 2018, the KOF Economic Barometer fell by 2.4 points to a new reading of 106.0. Notwithstanding this decline, the present position is still on a level clearly above its long-term average. This indicates that in the near future the Swiss economy should continue to grow at rates above average. In March 2018, the KOF Economic Barometer fell from 108.4 in the previous month (revised up from 108.0) by 2.4 points...

Read More »FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

Swiss Franc The Euro has fallen by 0.11% to 1.1758 CHF. EUR/CHF and USD/CHF, March 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after...

Read More »IMF forecasts 2.25 percent Swiss GDP growth in 2018 while pointing to risks

A boost to investment and net exports from the tailwind of strong external demand, together with faster expansion of household spending owing to rising employment, are forecast to lift GDP growth to around 2¼ percent in 2018, said the IMF in a statement referring to Switzerland issued on 26 March 2018. © Tibor Ritter | Dreamstime.com - Click to enlarge On the downside the IMF said: rising international trade tensions...

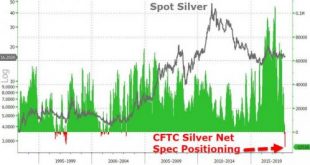

Read More »Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

– Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish– JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart)– Silver Speculators Go Short – Which Is Extremely Bullish– Stunning Silver COT Report: One For the Ages (see chart) The silver futures Commitment of Traders (COT) report released last Friday was extremely positive and has most silver analysts calling for higher...

Read More »Slaves to Government Debt Paper

Seeing Things for What They Are Picture, if you will, a group of slaves owned by a cruel man. Most of them are content, but one says to the others, “I will defy the Master”. While his statement would superficially appear to yearn towards freedom, it does not. It betrays that this slave, just like the others, thinks of the man who beats them as their “Master” (note the capital M). This slave does not seek freedom, but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org