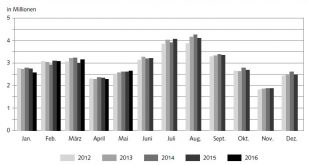

05.07.2016 09:15 – FSO, Tourism (0353-1606-80) Tourism accommodation statistics in May 2016 Increase in overnight stays during May 2016 Neuchâtel, 05.07.2016 (FSO) – The Swiss hotel industry registered 2.7 million overnight stays in May 2016, which corresponds to a growth of 1.3% (+35,000 overnight stays) compared with May 2015. Domestic visitors recorded 1.1 million overnight stays, representing an increase of 1.9%...

Read More »Silver – OMG!

A hi-ho silver moment… Photo credit: Pat Corkery, United Launch Alliance Going Parabolic From Wednesday through Friday, the price of silver spiked massively. It ended the week about $2 higher than the previous week. The last time we recall silver price action like this was about 3 years ago, in August 2013. That one week, the price rose about $2.50. Before that was a week in August 2012, with a price gain of about...

Read More »Housing Affordability – A Dose of Reality

Restless Peasants First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. Brexit is a clear illustration of how politicians, policy makers and the establishment have lost touch with the...

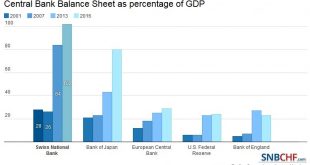

Read More »SNB intervenes for 6.3 billion francs in one week, total 10bn Brexit intervention

Interventions:The SNB intervenes for 6.3 bn francs in the week ending last Friday, the week one after Brexit. Already on Day One , the SNB intervened for an estimated 3-4 bn francs This is once again the a new weekly high since the end of the EUR/CHF peg in January 2015. Seven billion sight deposits come from Swiss banks, when fearful investors moved their money on Swiss bank accounts. FX: Unexpectedly for us, the SNB...

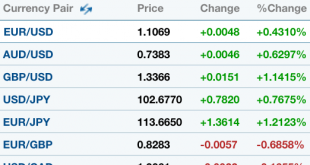

Read More »(1.3.) Let’s improve the way we report FX rates

This post is motivated by recent headlines suggesting that the Chinese yuan has depreciated in recent days. Here’s an example: China’s yuan weakens to 5-1/2 low as c.bank tolerates depreciation This headline is completely inaccurate – the Chinese yuan has been appreciating in recent days. So that’s one problem I’d like to fix. I’d like to see the media start reporting accurate data on exchange rates, so that we know...

Read More »Brexit: BoE Governor Not Optimistic

Monday July 4: Five things the markets are talking about Happy 4th of July! Stateside, this is a holiday shortened trading week, one that will be dominated by two fundamental events – Wednesday’s FOMC minutes and Friday’s non-farm payroll (NFP) report for June. With no surprises expected in the minutes, both dealers and investors have very much priced out any possibility of a U.S rate hike occurring within the next...

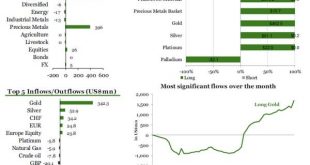

Read More »ETF Securities Reports Biggest One-Day Gold Inflow Since Financial Crisis

It never ceases to amaze how vastly different the investment styles of gold paper vs physical traders are: while we have documented previously how the latter tend to buy progressively more the lower the price (as traditional “buy low, buy more lower” investing would suggest), “investors” in gold paper-derivatives such as ETFs and ETPs are quite the opposite: in fact, they rarely buy until someone else is buying and...

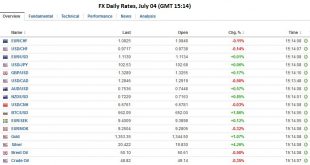

Read More »FX Daily, July 04: Four Things that Happened on the Anniversary of the Original Brexit

Summary Inflation expectations fall in Japan. UK construction PMI fell sharply before Brexit. The Australian dollar recovers from the dip as investors await more results. It is not clear that Brexit has sparked a wave of nationalism or anti-EU sentiment. FX Rates Monday, while Americans were celebrating the original Brexit, the US dollar drifted lower. The Australian dollar fully recovered from electoral...

Read More »Emerging Markets: Preview for the Week Ahead

EM and risk recovered nicely from the Brexit turmoil last week. Yet we think markets are getting too carried away with the “low rates forever” theme and are likely underestimating the capability of the Fed to tighten before 2018. This Friday, the June jobs data could spark a shift in sentiment with a strong reading. Consensus is currently 175k jobs created, up from 38k in May. We don’t think individual EM...

Read More »FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Summary Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act. There have been two developments that are shaping investment climate. The first was the dramatic rally in equity markets last week, with many recovering nearly all that was lost on the Brexit...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org