Brexit Volatility remained high with markets rebounding from last week’s heavy losses as tensions began to ease following the UK referendum. Bargain hunters took advantage of badly beaten up sectors on bets that central banks would ride to the rescue of investors by providing additional stimulus to avert disaster. Mark Carney, governor of the Bank of England, reassured markets that a rate cut could come as early as...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

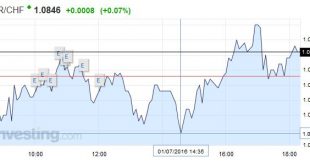

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

Read More »FX Daily, June 30: Calm Continues, but Rot Below the Surface

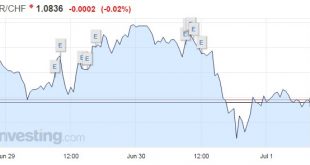

Swiss Franc During the weak the Swiss Franc lost momentum. It could regain speed only on June 30. The stronger Franc was initiated by remarks by BoE governor Carney. Sterling stayed on the defensive on Friday after unambiguously dovish comments from the Bank of England abruptly ended a tentative recovery in the currency, while the euro wobbled on speculation of more stimulus in Europe. Still trying to get over...

Read More »Great Graphic: What are UK Equities Doing?

Summary Domestic-oriented UK companies have been marked down. The outperformance by UK’s global companies is a negative view of sterling. The drop in interest rates is in anticipation of a recession and easier BOE policy. Some observers argue the media and some economists are exaggerating the impact of the UK vote a week ago. They talk about the petition for a second referendum. They about Scotland vetoing the...

Read More »Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized. Why? Because politics is about power and distribution of real wealth. And since money affect almost every single transaction,...

Read More »The Coming End of the “Third Way” System

The Best Thing About the EU is J.C. Juncker’s Alcoholism We recently discussed the post-Brexit landscape with a friend (in fact, our editor), who bemoaned that “the EU is led by a drunkard”. Our immediate reaction to this was to exclaim: “That’s the best thing about the EU!” Why do we think so? It makes this overpaid, useless bureaucrat human. Not only that, it clearly raises his entertainment value. As our regular...

Read More »Natural population change 2015: Swiss population increases not only thanks to immigration

30.06.2016 09:15 – FSO, Demography and Migration (0353-1606-50) More paternity acknowledgements and divorces Neuchâtel, 30.06.2016 (FSO) – Births outside marriage, paternity acknowledgements and divorces increased in 2015. There was also a rise in births in general and in deaths. Marriages and registered partnerships declined. These are the definitive findings of the Vital Statistics from the Federal Statistical...

Read More »Is it Time to Buy Real Estate? Yes and No

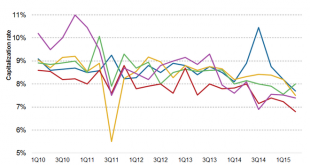

Is it Time to Buy Income-Producing Real Estate? No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of rent increases, the answer is no. Capitalization Rates REIT cap rates (as of mid 2015, they have declined further since then) Capitalization Rates Valuation is one big red...

Read More »FX Weekly Preview

The US dollar bottomed against nearly all the major currencies on May 3. The hawkish April FOMC minutes that began swaying opinion about the prospects for a summer rate hike were not published until two weeks later, and the confirmation by NY Fed President Dudley was not until May 19. Nevertheless, the shift in expectations for a resumption of the Fed’s gradual normalization of monetary policy is a potent force that has fueled the greenback’s recovery. The place to look for investors’...

Read More »A Trump Landslide in November?

Objective Reality After spending three weeks with objective truth at the ranch, we are now forced to return to the world of myths, delusions, and claptrap. Yes, we are in Buenos Aires looking at a TV! And there they are… talking about the world of politics, money, culture… the world of Facebook and CNBC… of Trump and Clinton… of ZIRP and NIRP… and of Game of Thrones. Photo credit: HBO The royal seating accommodation fought over in “Game of Thrones”. It looks decidedly uninviting – a...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org