Tracks at La Plaine in canton Geneva buckled due to recent hot weather, preventing TGV trains from running between Geneva and France. The international TGV rail link between Geneva and France, which had been affected by the hot weather, has been repaired. Trains have been running since 5am on Sunday. Hot weather had buckled the tracks at La Plaine in canton Geneva, requiring repair work on Saturday, the Swiss Federal...

Read More »FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

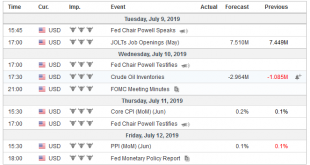

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing. United States The jobs report trumps the PMI/ISM data and suggests...

Read More »Switzerland number one for expat pay and stability

Geneva – © Hai Huy Ton That | Dreamstime.com In 2019, Switzerland came top overall in a ranking of destinations for expatriates to live and work, moving up from eighth last year. Singapore, which had held the top spot for four years in the HSBC’s list of the best countries for expatriates, dropped to second place. Switzerland scored highly on salaries (1st), stability (1st), education (2nd) and quality of life. 82% of...

Read More »Quantum says Swiss prosecutors close Angola-related case

Quantum Global founder Jean-Claude Bastos was released from an Angolan jail last March after reaching a confidential settlement with the Angolan sovereign fund. The Angolan authorities dropped all charges against him. The Office of the Attorney General has closed an investigation into events surrounding the Zug-based asset manager Quantum Global and its founder Jean-Claude Bastos, the firm says. Bastos has been in the...

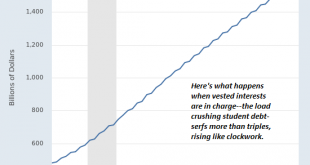

Read More »Vested Interests in Charge = Guaranteed Failure

It boils down to two very simple principles: accredit the student, not the institution and teach every student how to rigorously learn on their own. Vested interests have every incentive to maintain the status quo: specifically, those who currently own the assets, income streams and power will continue to own the assets, income streams and power. To accomplish this, vested interests must suppress, undermine or co-opt...

Read More »Swiss car importers fined over higher CO2 emissions

For the third year running, newly registered cars in Switzerland have failed to meet the national CO2 emissions target, largely due to the growth in the number of 4x4s and fall in diesel cars, the Federal Office of Energy has warned. Car importers had to pay CHF30 million ($30.4 million) in fines into a national road fund after failing to meet vehicle CO2 emission objectives in 2018, the federal office said in a...

Read More »Planned pension reform sees women working a year longer

Workers will have the option of playing different cards to determine their retirement age and pension return. The Swiss government plans to incrementally increase the retirement age of women to 65 while offering incentives for all people to work longer. The CHF2.8 billion ($2.84 billion) savings measures would be accompanied by a sales tax hike and extra pension payments for hardship cases. On Wednesday, Swiss interior...

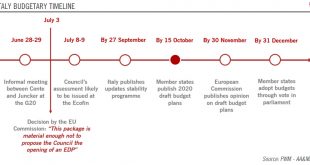

Read More »A truce between Rome and Brussels

For now, Italy has avoided Brussels’ Excessive Deficit Procedure. But tensions are set to rise again in the autumn when Italy presents its 2020 budget package. In its mid-year budget revision, the Italian government lowered its 2019 deficit target. The government pointed to better-than-expected revenues for this revision, including tax revenues that were EUR3.5bn higher than expected and an additional EUR2.7bn in other...

Read More »FX Daily, July 05: Dollar is Bid Ahead of Jobs Report

Swiss Franc The Euro has risen by 0.10% at 1.1126 EUR/CHF and USD/CHF, July 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the...

Read More »What’s Left to Monetize?

What’s left to monetize? It appears the answer is “very little.” Advertising has always monetized consumers’ time and attention, what we call engagement today. Newspapers and periodicals publish advertisements, radio/TV networks and stations air adverts, movie theaters run trailers/ads, billboards occupy our mental space while driving and websites and apps post adverts. The more media you consume, the more adverts you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org