◆ Why central banks including China and Russia will keep buying gold due to concerns about the outlook for currencies, including the dollar and the euro, Mark O’Byrne, Research Director of GoldCore told Marketwatch ◆ While the gold tonnage demand from central banks in recent months has been significant and near records, gold remains a tiny fraction of most central banks’ massive foreign-exchange reserves,” O’Byrne says, adding that the trend is “sustainable and...

Read More »Some Thoughts on the Fed and Oil Shocks

Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken. RECENT DEVELOPMENTS The weekend bombing of Saudi oil facilities continues to reverberate. The drone strike removed about 5% of global supplies from the market, leading Brent oil to spike to $72 per barrel Monday before falling...

Read More »Focus Is On The Pre-recession Condition

Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession. Any economy which might slow down into a weakened state for whatever reasons becomes susceptible. What might be a minor,...

Read More »FX Daily, September 17: Markets Calm(er)

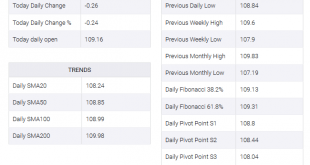

Swiss Franc The Euro has risen by 0.60% to 1.0984 EUR/CHF and USD/CHF, September 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Oil prices have stabilized after yesterday’s surge. Both Brent and WTI are holding on to around $7-$8 a barrel gain. Equity markets are mixed. Some are attributing the losses in Asia Pacific outside of Japan (Nikkei rose its highest level since late April), Korea and Australia to...

Read More »Morgan Stanley forecasts a surprise 25 basis point cut from the SNB

The SNB meeting is on Thursday The Swiss National Bank needs to respond to the strong currency and lower rates from the ECB, according to Morgan Stanley. The consensus for Thursday’s meeting is no change from -0.75% but Morgan Stanley and UBS are two firms that are forecasting a surprise 25 bps cut. “What’s motivating the SNB to ease policy is inflation,” economists write in a note today. “It’s low and uncomfortably close to zero, despite loose monetary policy and a...

Read More »Why Are People Now Selling Their Silver? Report 15 Sep

This week, the prices of the metals fell further, with gold -$18 and silver -$0.73. On May 28, the price of silver hit its nadir, of $14.30. From the last three days of May through Sep 4, the price rose to $19.65. This was a gain of $5.35, or +37%. Congratulations to everyone who bought silver on May 28 and who sold it on Sep 4. To those who believe gold and silver are money (as we do) the rising price of silver may seem right as rain. Why shouldn’t the dollar go...

Read More »CHF/JPY: Eyes on central banks and geopolitics

This week the BoJ will hold its regular policy meeting. Global uncertainty, linked to the trade war and Brexit, has strengthened the value of the Swiss franc and Yen. CHF/JPY is struggling to maintain the upside as the Yen picks up a safe haven bid, anchored on geopolitical developments following a textbook risk-off response in global financial markets following the strike on Saudi Arabia’s oil facilities over the weekend. Both the CHF and Yen picked up a bid as...

Read More »Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances. It was reported last week that Maersk and MPC would “temporarily suspend” their sailings on one of the biggest routes between Europe and Asia. Weakening...

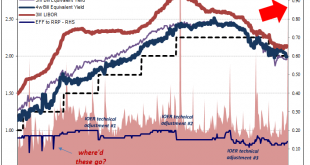

Read More »Stuck at A: Repo Chaos Isn’t Something New, It’s The Same Baseline

Finally, finally the global bond market stopped going in a straight line. I write often how nothing ever does, but for almost three-quarters of a year the guts of the financial system seemed highly motivated to prove me wrong. Yields plummeted and eurodollar futures prices soared. It is only over the past few weeks that rates have backed up in what has been the first real selloff since last year. Is this a meaningful change? It may seem that way in certain places....

Read More »Dollar Mixed, Oil Spikes as Markets Digest Saudi Attack

The weekend bombing of Saudi oil facilities continue to reverberate across global markets The currencies of the oil producing nations are likely to outperform near-term US rates continue to adjust ahead of the FOMC UK Prime Minister Johnson is in Luxembourg today to meet with EC President Juncker China reported weak August IP and retail sales . The dollar is mixed against the majors as markets continue to digest the attack on Saudi oil facilities. Yen and Loonie are...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org