Those with teenagers wishing for the greater travel freedom likely to come with proof of vaccination may have cause for hope. On 7 May 2021, Pfizer submitted an authorisation application to Swissmedic, Switzerland’s drug approval agency, for use of its vaccine against Covid-19 on those aged 12 to 15 years old. © Jovanmandic | Dreamstime.com - Click to enlarge The application asks for the authorisation of the vaccine, which is currently being used on adults in...

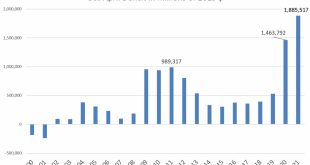

Read More »The US Government Is On Track to Top Last Year’s Record-Breaking Deficits

The Treasury department has issued its spending and revenue report for April 2021, and it’s clear the US government is headed toward another record-breaking year for deficits. According to the report, the US federal government collected $439.2 billion in revenue during April 2021, which was a sizable improvement over April 2020 and over March 2021. Indeed, April 2021’s revenue total was the largest since July of last year when the federal government collected 563.5...

Read More »FX Daily, May 13: Long Lost Bond Vigilantes Sighted, Gives Dollar Fillip

Swiss Franc The Euro has fallen by 0.15% to 1.0957 EUR/CHF and USD/CHF, May 13(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is as if the bond vigilantes were pushed too far. US inflation is accelerating more than expected, and it cannot all be attributed to the base effect, and the Federal Reserve, to many investors, is tone-deaf. With powerful fiscal stimulus, nominal growth above 10%, and the...

Read More »Overtourism could give way to Sustainable Travel

Let me state from the outset, you won’t get a discount if you mention to your travel agent that you read this article when you book your trip to Switzerland this summer. But it will be nice to have you back; Switzerland – in line with much of Europe – is planning to open up to overseas visitors in a few short weeks. And since we haven’t seen you in a while, I expect you’ll be welcomed with open arms! I can assure you, the place hasn’t changed much. Of course, we have...

Read More »The ‘Take This Job and Shove It’ Recession

So hey there Corporate America, the Fed and your neofeudal cronies: take this job and shove it. This time it really is different, but not in the way the Wall Street shucksters are claiming. Conventional economists, politicos and pundits are completely clueless about the unraveling that’s gathering momentum beneath the superficial surface of “reflation” because they don’t yet grasp we’re entering an unprecedented new type of recession: a ‘Take This Job and Shove...

Read More »Tax Deductions in Switzerland for 2021

(Disclosure: Some of the links below may be affiliate links) We all want to pay lower taxes! When you fill your tax declaration in Switzerland, it is important to take advantage of all possible tax deductions. Tax deductions allow you to reduce your taxable income. Since your taxable income will directly drive the amount of taxes you are going to pay, it is essential to reduce it when possible. So, in this article, I want to go into detail about all the possible tax...

Read More »Excess Mortality in The US Has Plummeted to Pre-Covid Levels

In any given year during the past decade in the United States, more than 2.5 million Americans have died—from all causes. The number has grown in recent years, climbing from 2.59 million in 2013 to 2.85 million in 2019. This has been due partially to the US’s aging population, and also due to rising obesity levels and drug overdoses. In fact, since 2010, growth rates in total deaths has exceeded population growth in every year. In 2020, preliminary numbers suggest a...

Read More »FX Daily, May 12: The Dollar Stabilizes but Stocks, Not So Much

Swiss Franc The Euro has fallen by 0.07% to 1.0966 EUR/CHF and USD/CHF, May 12(see more posts on Business, EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets remain on edge. Asia Pacific and US equities have yet to find stable footing, and inflation fears are elevated. The foreign exchange market has turned quiet as the dollar consolidates its recent losses. China and Hong Kong escaped the sell-off equities that saw...

Read More »UBS Reportedly Re-Starts Layoffs After “Doubling” One Time Bonuses To Some Associates

On one hand, UBS seems hell bent on keep its new Gen Z employees who have recently been promoted to associate positions. After all, it was just hours ago that we wrote about how the bank was showering some newly promoted employees with one-time $40,000 bonuses. Yet on the other hand, UBS apparently isn’t as determined to hang on to certain other employees. The bank has reportedly re-started its “Reduction in Force” job cut plan this week, according to Bloomberg, who...

Read More »A Woke CIA … or a Free, Peaceful, and Prosperous Society?

There is a battle currently going on over whether the CIA should be woke or not. The battle was apparently incited by a recent segment of a social media series issued by the CIA entitled “Humans of CIA.” According to an article in yesterday’s Washington Post, Susan Gordon, deputy director of national intelligence from 2017-2019, says that the aim of the series is to “connect to America, and if they’re lucky, attract new talent.” Former CIA Director Mike Pompeo went...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org