Against the backdrop of the war in Ukraine, the Swiss ambassador to NATO, Philippe Brandt, explains the importance of Switzerland’s partnership with the alliance, which he views as perfectly compatible with Swiss neutrality. SWI swissinfo.ch: Has your role as head of the Swiss mission to NATO changed since the outbreak of the war in Ukraine? Philippe Brandt: We are living through a very intense time. Our role as a mission hasn’t fundamentally changed. We are closely...

Read More »Baby Boomer Retirement at Risk

The seven deadliest words in the English language—We’ve never done it this way before. And that certainly applies to Baby Boomers whose prospects for retirement are different than any preceding generation. Many Boomers, those born between 1946 and 1964, have made their retirement plans based on their parent’s generation. The World War II crowd retired with income from Social Security and, in most cases, a generous pension, providing non-stop income that lasted the...

Read More »Binance in Ontario nicht mehr verfügbar

Allerdings hat es nichts mit dem Freedom Convoy zu tun, der Kanada zuletzt auf die Titelseiten brachte. Die kanadische Provinz Ontario hatte schon letztes Jahr neue Regulierungen angekündigt, die auch Crypto-Börsen betreffen. Nun hat Binance veröffentlicht, diese Regulierungen nicht erfüllen zu können; stattdessen zieht man sich komplett aus der Provinz zurück. Crypto News: Binance in Ontario nicht mehr verfügbarNachdem der Staat mehrfach daran scheiterte Cryptocoins...

Read More »Governments “Sanction” Their Own Citizens Every Day. The Russia Sanctions Are Just a Natural Evolution.

Russian president Vladimir Putin’s invasion of Ukraine in the last week of February 2022 was the culmination of decades of transnational statist expansion. The North Atlantic Treaty Organization (NATO), which managers of the postwar Washington-centered imperium set up to counter Communist imperialism coordinated from Moscow, was rendered obsolete when the Soviet Union collapsed at Christmastide in 1991. But instead of rejoicing in the fall of an adversarial empire...

Read More »Swiss Institute in New York appoints new director

German-born Stefanie Hessler, 35, will head the Swiss art space starting in May. Her appointment is part of several rearrangements in institutions run by the pharma billionaire Maja Hoffmann. Last October, the Swiss Institute, a non-profit contemporary art space in New York, announced that board chair Maja Hoffmann, one of the heiresses of the Roche pharmaceutical company, had been elected president of the board of trustees. Soon afterwards, in November, the former...

Read More »Stell dir vor, Russland führt Krieg gegen die Ukraine und Ludwig von Mises lebte noch in Lemberg/Lwiw

Stell dir vor, Ludwig von Mises wäre nicht Jahrgang 1881, sondern Jahrgang 1981. Er wäre dann nicht vor 140 Jahren am 29. September 1881, sondern erst vor 40 Jahren am 29. September 1981 geboren worden – zehn Jahre vor dem Ende der Sowjetunion. Seine Geburtsstadt hieße dann nicht Lemberg, sondern Lwiw, und sein Geburtsland hieße dann nicht Österreichisch-Ungarische Monarchie, sondern Ukrainische Sozialistische Sowjetrepublik. Und nun stell dir vor, die Familie von...

Read More »Trading with the Enemy: An American Tradition

During the French and Indian War (1754–1763), Americans continued the great tradition of trading with the enemy, and even more readily than before. As in King George’s War, Newport took the lead; other vital centers were New York and Philadelphia. The individualistic Rhode Islanders angrily turned Governor Stephen Hopkins out of office for embroiling Rhode Island in a “foreign” war between England and France. Rhode Island blithely disregarded the embargo against...

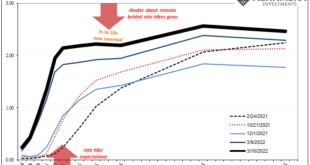

Read More »Media Attention All Over FOMC, Market Attention Totally Elsewhere

The Federal Reserve did something today, or actually announced today that it will do something as of tomorrow. And since we’re all conditioned to believe this is the biggest thing ever, I’ll have to add my own $0.02 (in eurodollars, of course, can’t be bank reserves) frustratingly contributing to the very ritual I’m committed to seeing end. We shouldn’t care much about the Fed. Live look at Jay Powell’s press conference.#ratehikeshttps://t.co/leCyV8Wak4...

Read More »Patents, Legal Monopolies, and the High Prices for Drugs

Currently, 63 percent of American adults are on prescription drugs, according to a 2021 survey. Of this 63 percent of Americans, 26 percent say they have difficulty affording their prescriptions. Despite the prices of prescription drugs falling in recent years, an increasing number of Americans are concerned about high drug costs and demanding action be taken, 88 percent saying they want it to be easier for generic drugs to enter the market. The same percentage...

Read More »Swiss companies’ balancing act with Russia

Big consumer brands are leaving Russia in droves but for many Swiss companies untangling ties isn’t that easy. Last week Swiss chocolate maker Lindt & Sprüngli joined a chorus of brands like McDonald’s closing shops and suspending deliveries to Russia after its invasion of Ukraine. The decision by Lindt & Sprüngli took some by surprise. The company’s CEO, Dieter Weisskopf, had said during its annual results call a day before, that it was planning to keep...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org